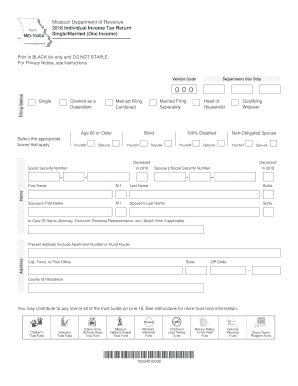

Form MO 1040A Individual Income Tax Return SingleMarried One Income 2018

What is the Form MO 1040A Individual Income Tax Return SingleMarried One Income

The Form MO 1040A is a simplified version of the Missouri Individual Income Tax Return designed for single or married taxpayers filing with one income source. This form allows eligible individuals to report their income, claim deductions, and calculate their tax liability efficiently. It is particularly useful for those who do not have complex tax situations, such as multiple income streams or extensive deductions. By using this form, taxpayers can ensure compliance with state tax laws while taking advantage of available credits and deductions.

How to use the Form MO 1040A Individual Income Tax Return SingleMarried One Income

Using the Form MO 1040A involves several straightforward steps. First, gather all necessary documentation, including W-2 forms, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all personal information, income details, and deductions are accurately reported. After completing the form, review it for any errors or omissions. Finally, submit the form either electronically or via mail, depending on your preference and the options available through the Missouri Department of Revenue.

Steps to complete the Form MO 1040A Individual Income Tax Return SingleMarried One Income

Completing the Form MO 1040A involves a series of methodical steps:

- Gather all income documentation, including W-2s and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Claim any applicable deductions, such as standard deductions or exemptions.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form to affirm its accuracy.

- Submit the completed form to the Missouri Department of Revenue.

Eligibility Criteria

To qualify for using the Form MO 1040A, taxpayers must meet specific eligibility criteria. This form is intended for individuals who are filing as single or married with one income source. Additionally, taxpayers must have a total income below a certain threshold, which may vary annually. It is essential to review the latest guidelines from the Missouri Department of Revenue to ensure compliance with current eligibility requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the Form MO 1040A. The form can be filed electronically through the Missouri Department of Revenue's online portal, which offers a convenient and efficient way to complete the filing process. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability. Each method has its own advantages, so individuals should select the one that best suits their needs.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Form MO 1040A. Typically, the deadline for submitting individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply and ensure they file their returns on time to avoid penalties.

Quick guide on how to complete form mo 1040a 2018 individual income tax return singlemarried one income

Complete Form MO 1040A Individual Income Tax Return SingleMarried One Income effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Form MO 1040A Individual Income Tax Return SingleMarried One Income on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form MO 1040A Individual Income Tax Return SingleMarried One Income with ease

- Acquire Form MO 1040A Individual Income Tax Return SingleMarried One Income and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form MO 1040A Individual Income Tax Return SingleMarried One Income and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040a 2018 individual income tax return singlemarried one income

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040a 2018 individual income tax return singlemarried one income

How to make an eSignature for the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income online

How to generate an electronic signature for the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income in Google Chrome

How to generate an electronic signature for signing the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income in Gmail

How to make an electronic signature for the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income right from your smartphone

How to create an eSignature for the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income on iOS devices

How to create an eSignature for the Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income on Android devices

People also ask

-

What is the Form MO 1040A Individual Income Tax Return SingleMarried One Income, and who should use it?

The Form MO 1040A Individual Income Tax Return SingleMarried One Income is designed for Missouri residents who are filing single or married status with one source of income. This simplified form allows qualifying taxpayers to report earnings efficiently while ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with completing the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

airSlate SignNow offers an intuitive platform to eSign and manage your Form MO 1040A Individual Income Tax Return SingleMarried One Income digitally. Our user-friendly tools streamline the process, making it easier for taxpayers to fill out their forms and submit them without delays.

-

Is there a cost to use airSlate SignNow for the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

Yes, airSlate SignNow provides various affordable pricing plans to access its features, including those needed for the Form MO 1040A Individual Income Tax Return SingleMarried One Income. By investing in our service, you gain access to an efficient way to manage your tax documents securely and conveniently.

-

What features does airSlate SignNow offer for the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

airSlate SignNow includes features such as secure eSigning, document storage, and real-time tracking for your Form MO 1040A Individual Income Tax Return SingleMarried One Income. These capabilities ensure that you can manage your tax return seamlessly from anywhere, anytime.

-

Are there any integration options available with airSlate SignNow for the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

Yes, airSlate SignNow integrates with various software applications to enhance your experience when managing the Form MO 1040A Individual Income Tax Return SingleMarried One Income. This allows you to combine your eSigning capabilities with other business tools, improving overall workflow efficiency.

-

How secure is my data when using airSlate SignNow for the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

Your data is highly secure with airSlate SignNow, as we utilize advanced encryption and security protocols for all documents, including the Form MO 1040A Individual Income Tax Return SingleMarried One Income. Our commitment to data protection ensures that your sensitive information remains confidential.

-

Can I use airSlate SignNow for my tax documents other than the Form MO 1040A Individual Income Tax Return SingleMarried One Income?

Absolutely! airSlate SignNow is versatile and supports a wide range of document types, allowing you to eSign and manage various tax documents beyond the Form MO 1040A Individual Income Tax Return SingleMarried One Income. This makes it a comprehensive solution for all your tax-related needs.

Get more for Form MO 1040A Individual Income Tax Return SingleMarried One Income

Find out other Form MO 1040A Individual Income Tax Return SingleMarried One Income

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure