Instructions for Form TC 65 "Utah PartnershipLimited Liability 2022

Understanding the Utah TC 65 Instructions

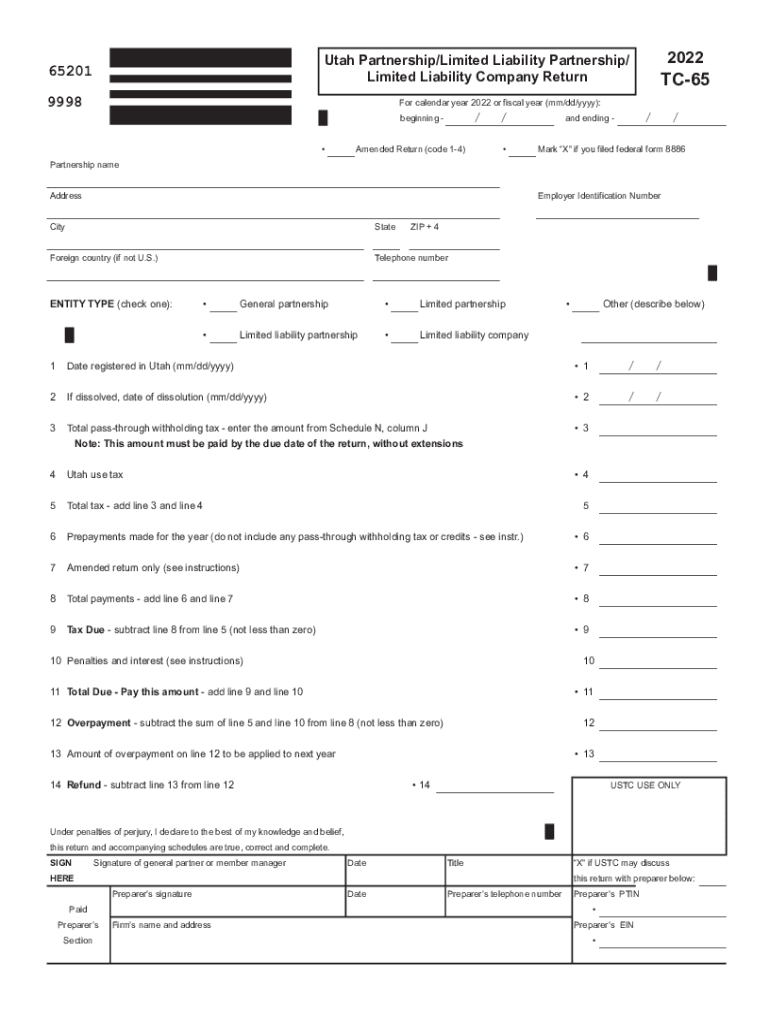

The Utah TC 65 instructions provide essential guidelines for completing the Utah Partnership Return, which is necessary for partnerships and limited liability companies (LLCs) operating within the state. This form is used to report income, deductions, and credits for partnerships, ensuring compliance with state tax regulations. Understanding the instructions is crucial for accurate reporting and to avoid potential penalties.

Steps to Complete the Utah TC 65 Instructions

Completing the Utah TC 65 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form with accurate information regarding the partnership's income, deductions, and credits.

- Ensure that all partners sign the form, as their signatures are required for submission.

- Review the completed form for any errors or omissions before submission.

Following these steps can help ensure that the form is filled out correctly and submitted on time.

Legal Use of the Utah TC 65 Instructions

The Utah TC 65 instructions are legally binding and must be adhered to when filing the partnership return. Compliance with these instructions ensures that the partnership meets its tax obligations under Utah law. Failure to follow these instructions can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Utah TC 65. Typically, the form must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties, so timely filing is essential.

Required Documents for the Utah TC 65

To complete the Utah TC 65, several documents are required:

- Financial statements, including profit and loss statements.

- Records of all income received and expenses incurred by the partnership.

- Details of any credits or deductions the partnership is claiming.

- Identification information for all partners, including their Social Security numbers or Employer Identification Numbers (EIN).

Having these documents ready can streamline the completion process and help ensure accuracy.

Form Submission Methods for the Utah TC 65

The Utah TC 65 can be submitted through various methods:

- Electronically, using approved e-filing software.

- By mail, sending the completed form to the appropriate state tax office.

- In-person, if preferred, at designated tax offices.

Choosing the right submission method can depend on the partnership's preferences and available resources.

Quick guide on how to complete instructions for form tc 65 ampquotutah partnershiplimited liability

Complete Instructions For Form TC 65 "Utah PartnershipLimited Liability effortlessly on any device

Online document management has gained widespread popularity among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form TC 65 "Utah PartnershipLimited Liability on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Instructions For Form TC 65 "Utah PartnershipLimited Liability effortlessly

- Find Instructions For Form TC 65 "Utah PartnershipLimited Liability and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form TC 65 "Utah PartnershipLimited Liability and ensure smooth communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form tc 65 ampquotutah partnershiplimited liability

Create this form in 5 minutes!

People also ask

-

What are Utah TC 65 instructions?

Utah TC 65 instructions are guidelines provided by the Utah state government for completing tax credit forms. These instructions outline all necessary information required for individuals and businesses to accurately file their tax credits. Understanding the Utah TC 65 instructions is essential for ensuring compliance and maximizing your tax benefits.

-

How can airSlate SignNow help with Utah TC 65 instructions?

airSlate SignNow offers a seamless solution for signing and sending documents related to your Utah TC 65 instructions. With its intuitive interface, users can easily manage and eSign forms, ensuring that all required documents are completed accurately and submitted on time. Leveraging airSlate SignNow can simplify your process signNowly.

-

Is airSlate SignNow suitable for small businesses managing Utah TC 65 instructions?

Absolutely! airSlate SignNow provides a cost-effective solution tailored for small businesses handling their Utah TC 65 instructions. With features that allow for bulk signing and easy document tracking, small business owners can streamline their workflow and focus on what they do best—growing their business.

-

What features does airSlate SignNow offer for eSigning documents related to Utah TC 65 instructions?

airSlate SignNow includes robust features like multi-party signing, custom templates, and advanced security measures perfect for documents associated with Utah TC 65 instructions. Users can easily create and sign documents while ensuring compliance with state regulations. The platform also allows for real-time document tracking and reminders.

-

Are there any integrations available with airSlate SignNow that assist with Utah TC 65 instructions?

Yes, airSlate SignNow offers various integrations that complement the process of managing Utah TC 65 instructions. The platform seamlessly integrates with popular tools like Google Drive, Salesforce, and Microsoft Office, enabling users to manage their documents directly within their preferred applications. This enhances productivity and simplifies the filing process.

-

How does eSigning through airSlate SignNow benefit those filing Utah TC 65 instructions?

eSigning through airSlate SignNow provides signNow benefits for those filing their Utah TC 65 instructions. It speeds up the document signing process, reduces paper usage, and enhances workflow efficiency. Additionally, eSigned documents hold legal validity, ensuring that your submissions are recognized by the state.

-

What is the pricing structure for airSlate SignNow when dealing with Utah TC 65 instructions?

airSlate SignNow offers various pricing plans tailored to suit different business needs, including those required for handling Utah TC 65 instructions. With flexible subscription options, you can choose a plan that fits your budget and requirements, ensuring you get the best value for your document management needs.

Get more for Instructions For Form TC 65 "Utah PartnershipLimited Liability

- Oregon limited form

- Disclaimer property 497323538 form

- Oregon notice right lien form

- Quitclaim deed from individual to husband and wife oregon form

- Warranty deed from individual to husband and wife oregon form

- Transfer on death deed from an individual ownergrantor to an individual beneficiary oregon form

- Quitclaim deed from corporation to husband and wife oregon form

- Warranty deed from corporation to husband and wife oregon form

Find out other Instructions For Form TC 65 "Utah PartnershipLimited Liability

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF