Utah Partnership Return 2018

What is the Utah Partnership Return

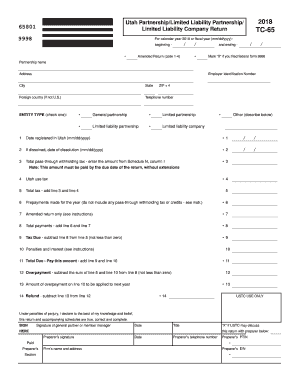

The Utah Partnership Return, commonly referred to as the Utah TC-65, is a tax form used by partnerships operating within the state of Utah. This form is essential for reporting the income, deductions, and credits of the partnership to the state tax authority. Partnerships are unique entities where income is passed through to individual partners, who then report it on their personal tax returns. Understanding the Utah TC-65 is crucial for ensuring compliance with state tax laws and regulations.

Steps to complete the Utah Partnership Return

Completing the Utah TC-65 involves several key steps:

- Gather necessary documentation, including financial statements and partner information.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified filing deadline, either electronically or by mail.

Each step is vital to ensure that the return is processed smoothly and that the partnership remains compliant with state regulations.

Legal use of the Utah Partnership Return

The Utah TC-65 must be used in accordance with state tax laws. This includes accurately reporting all income and deductions associated with the partnership. Legal compliance is essential to avoid penalties and ensure that the partnership is recognized as a legitimate entity by the state. Utilizing a reliable eSignature platform can help streamline the submission process while maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Utah TC-65 are critical to avoid late fees and penalties. Typically, the return is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships that operate on a calendar year, this means the return is due by April 15. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Required Documents

To complete the Utah TC-65, several documents are required:

- Financial statements detailing income and expenses.

- Partner information, including Social Security numbers or EINs.

- Any supporting documentation for deductions and credits claimed.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Utah TC-65 can be submitted through various methods:

- Online submission through the Utah State Tax Commission's e-filing system.

- Mailing a paper copy of the form to the appropriate tax authority address.

- In-person submission at designated tax offices, if applicable.

Choosing the appropriate submission method can help expedite processing and ensure timely compliance with filing requirements.

Quick guide on how to complete utah tc 65 2018 2019 form

Accomplish Utah Partnership Return effortlessly on any device

Digital document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Manage Utah Partnership Return on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related procedure today.

The easiest way to edit and eSign Utah Partnership Return seamlessly

- Obtain Utah Partnership Return and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about losing or disorganized documents, exhausting form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Utah Partnership Return and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utah tc 65 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the utah tc 65 2018 2019 form

How to make an electronic signature for the Utah Tc 65 2018 2019 Form online

How to create an eSignature for the Utah Tc 65 2018 2019 Form in Chrome

How to make an eSignature for signing the Utah Tc 65 2018 2019 Form in Gmail

How to make an eSignature for the Utah Tc 65 2018 2019 Form straight from your smart phone

How to generate an electronic signature for the Utah Tc 65 2018 2019 Form on iOS devices

How to make an eSignature for the Utah Tc 65 2018 2019 Form on Android

People also ask

-

What is airSlate SignNow and how does it relate to Utah 65?

airSlate SignNow is an intuitive eSignature platform that enables businesses to send and sign documents electronically. Specifically, under the Utah 65 legislation, airSlate SignNow provides a compliant solution for businesses in Utah looking to streamline their document signing processes while ensuring legal compliance.

-

How much does airSlate SignNow cost for users in Utah 65?

Pricing for airSlate SignNow varies based on the subscription plan you choose. For users in Utah 65, our plans are cost-effective and designed to fit the needs of businesses looking for efficient document management solutions without breaking the bank.

-

What features does airSlate SignNow offer to comply with Utah 65 regulations?

airSlate SignNow offers features such as advanced eSignature capabilities, audit trails, and secure document storage, which are essential for compliance with Utah 65 regulations. These features ensure that your electronic signatures are legally binding and that your documents are securely managed.

-

Can I integrate airSlate SignNow with other software for my Utah 65 business needs?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications that businesses in Utah 65 commonly use, such as CRM and document management systems. This connectivity makes it easier to manage your workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for companies operating under Utah 65?

Using airSlate SignNow allows companies operating under Utah 65 to save time and reduce costs by streamlining the signing process. The platform's user-friendly interface enhances the user experience, enabling quick adoption and immediate benefits for all stakeholders involved.

-

Is airSlate SignNow secure for sensitive documents under Utah 65 standards?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and secure storage, to ensure that all sensitive documents comply with Utah 65 standards. You can trust that your data is protected and handled with the utmost care.

-

How can businesses in Utah 65 benefit from using airSlate SignNow's mobile app?

The airSlate SignNow mobile app provides businesses in Utah 65 with the flexibility to manage document signing on the go. This convenience allows users to send, sign, and track documents anytime, anywhere, enhancing productivity and responsiveness.

Get more for Utah Partnership Return

- Rcb form

- Rimhc after name form

- Monthly vehicle inspection checklist form

- Aoc e 432 the north carolina court system nccourts form

- Aoc cr 330a the north carolina court system nccourts form

- Guardian of estate form north carolina

- Safe deposit box inventory sheet form

- Aoc sp 906m the north carolina court system nccourts form

Find out other Utah Partnership Return

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now