TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications 2020

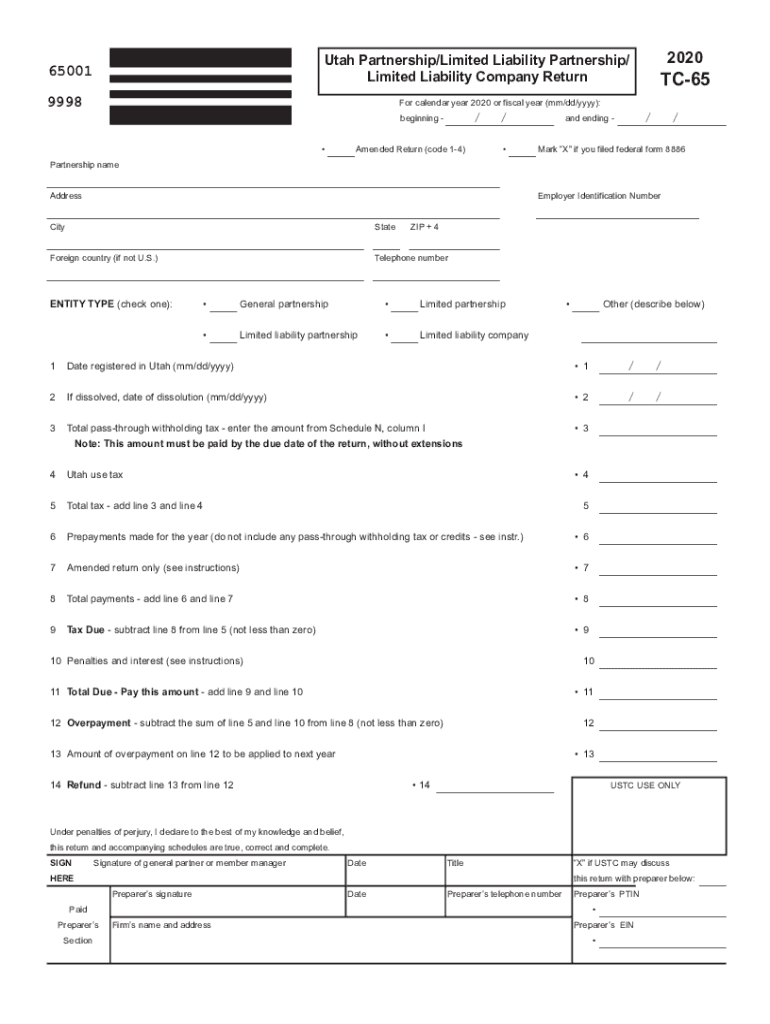

What is the TC 65 Form?

The TC 65 form is a tax document used by partnerships in Utah to report income, deductions, and credits. It is specifically designed for Limited Liability Companies (LLCs) and partnerships operating within the state. The form facilitates the reporting of financial information to the Utah State Tax Commission, ensuring compliance with state tax laws. By accurately completing the TC 65, partnerships can effectively communicate their financial status and fulfill their tax obligations.

Steps to Complete the TC 65 Form

Completing the TC 65 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records. Next, fill out the identification section with the partnership's name, address, and federal employer identification number (EIN). Then, report the income and deductions on the appropriate lines, ensuring that all figures are accurate and supported by documentation. Finally, review the completed form for any errors before submitting it to the Utah State Tax Commission.

Filing Deadlines / Important Dates

It is crucial for partnerships to be aware of the filing deadlines associated with the TC 65 form. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing helps avoid penalties and interest on unpaid taxes.

Legal Use of the TC 65 Form

The TC 65 form is legally binding and must be completed in accordance with Utah state tax laws. It serves as an official record of the partnership's income and expenses, making it essential for compliance with tax regulations. Failure to accurately complete and submit the form can result in penalties, including fines and interest on unpaid taxes. Partnerships should ensure that all information reported is truthful and supported by appropriate documentation to maintain legal compliance.

Key Elements of the TC 65 Form

Several key elements must be included when completing the TC 65 form. These include the partnership's identification information, a detailed account of income sources, and a comprehensive list of deductions. Additionally, partnerships must report any credits claimed and provide a summary of the financial activities for the tax year. Understanding these elements is vital for accurately reflecting the partnership's financial position and ensuring compliance with state tax requirements.

Form Submission Methods

The TC 65 form can be submitted through various methods, including online filing, mailing, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for immediate processing and confirmation of receipt. Partnerships opting for mail submission should ensure that the form is postmarked by the filing deadline. In-person submissions can be made at local tax offices, where partnerships can receive assistance if needed.

Quick guide on how to complete 2020 tc 65 forms utah partnershipllpllc return forms ampamp publications

Effortlessly complete TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without complications. Manage TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications with ease

- Obtain TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require creating new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 tc 65 forms utah partnershipllpllc return forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the 2020 tc 65 forms utah partnershipllpllc return forms ampamp publications

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What are the key components of the Utah TC 65 instructions 2018?

The Utah TC 65 instructions 2018 provide specific guidelines for completing the TC-65 form, which is crucial for tax filings in Utah. These instructions cover essential information such as eligibility, required documentation, and important deadlines, ensuring taxpayers can navigate their filings smoothly.

-

How can airSlate SignNow help with the Utah TC 65 instructions 2018?

airSlate SignNow streamlines the signing and sending process for documents related to the Utah TC 65 instructions 2018. With its user-friendly interface, businesses can easily eSign necessary forms and track their submissions, ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Utah TC 65 instructions 2018?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Investing in this solution not only saves time in navigating the Utah TC 65 instructions 2018 but also enhances document security and management.

-

What features does airSlate SignNow provide to assist with the Utah TC 65 instructions 2018?

airSlate SignNow includes features such as customizable templates, in-app reminders, and secure cloud storage, which are instrumental in managing the requirements outlined in the Utah TC 65 instructions 2018. These functionalities enhance efficiency and ensure all paperwork is correctly handled.

-

Are there integration options available for airSlate SignNow regarding the Utah TC 65 instructions 2018?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to manage their documents related to the Utah TC 65 instructions 2018 all in one place. This integration enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow when following the Utah TC 65 instructions 2018?

Using airSlate SignNow simplifies the eSigning process for documents required by the Utah TC 65 instructions 2018, ultimately saving time and reducing errors. Its commitment to security ensures that sensitive information is well-protected during the filing process.

-

Who can benefit from the Utah TC 65 instructions 2018?

Individuals and businesses filing taxes in Utah will find the Utah TC 65 instructions 2018 particularly beneficial. Whether you’re a seasoned taxpayer or new to the process, having the right tool like airSlate SignNow can simplify your experience and ensure proper compliance.

Get more for TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications

Find out other TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast