Ri 1065 Tax Form 2018

What is the RI 1065 Tax Form

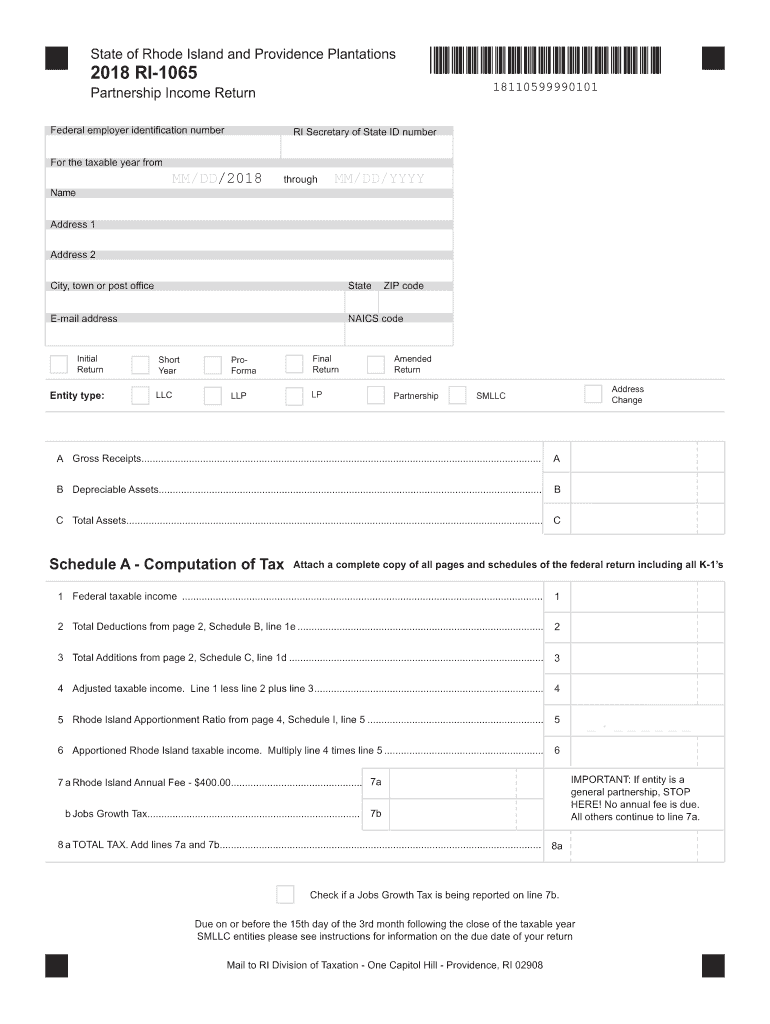

The RI 1065 tax form is a state-specific document used for reporting income, deductions, and credits for partnerships operating in Rhode Island. This form is essential for partnerships to fulfill their tax obligations and provide necessary information to the Rhode Island Division of Taxation. It allows partnerships to report their income and distribute it among partners, who will then report their share on their individual tax returns. Understanding the purpose of the RI 1065 is crucial for compliance with state tax laws.

Steps to Complete the RI 1065 Tax Form

Filling out the RI 1065 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and prior tax returns. Follow these steps:

- Enter the partnership's identifying information, including name, address, and federal employer identification number (EIN).

- Report total income, including all sources of revenue generated by the partnership.

- Detail allowable deductions, such as operating expenses and other business-related costs.

- Calculate the net income or loss of the partnership.

- Distribute income to partners based on their ownership percentages, ensuring each partner's share is accurately reflected.

- Review the form for completeness and accuracy before signing and submitting it.

How to Obtain the RI 1065 Tax Form

The RI 1065 tax form can be obtained through the Rhode Island Division of Taxation's official website. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, taxpayers may request a physical copy by contacting the Division of Taxation directly. Ensuring you have the correct version of the form for the relevant tax year is important for compliance.

Legal Use of the RI 1065 Tax Form

The RI 1065 tax form is legally required for partnerships operating in Rhode Island to report their income and expenses. It must be completed accurately and submitted by the designated filing deadline to avoid penalties. This form serves as a formal declaration of the partnership's financial activities and is subject to review by the Rhode Island Division of Taxation. Compliance with legal requirements ensures that partnerships maintain good standing with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the RI 1065 tax form are crucial for partnerships to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this typically means the form is due by April 15. It is essential to stay informed about any changes to deadlines or extensions that may be applicable, especially in light of circumstances such as natural disasters or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The RI 1065 tax form can be submitted through various methods to accommodate different preferences. Partnerships can file the form electronically through the Rhode Island Division of Taxation's online portal, which offers a secure and efficient way to meet filing requirements. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines and requirements, so it is advisable to review these before proceeding.

Quick guide on how to complete 2 total deductions from page 2 schedule b line 1e

Your assistance manual on how to ready your Ri 1065 Tax Form

If you’re curious about how to finalize and submit your Ri 1065 Tax Form, here are some brief guidelines to simplify tax submission.

Initially, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document management tool that enables you to modify, draft, and complete your tax forms seamlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and easily return to adjust details as necessary. Enhance your tax administration with advanced PDF modification, eSigning, and simple sharing.

Follow the instructions below to complete your Ri 1065 Tax Form in a few minutes:

- Create your account and begin editing PDFs almost immediately.

- Utilize our catalog to acquire any IRS tax form; navigate through variations and schedules.

- Click Get form to launch your Ri 1065 Tax Form in our editor.

- Populate the required fields with your details (textual content, figures, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and amend any mistakes.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that paper filing may increase errors in returns and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2 total deductions from page 2 schedule b line 1e

FAQs

-

Would an employer be able to figure out my salary from a W-2 form? The first box is well below my salary (likely due to the 401k and other non-tax deductions). How would they calculate my specific gross salary from this?

The prospective employer could look at W-2 form Box 5, Medicare wages and tips which is your salary. Certain benefits (such as your employer’s contribution to your 401-K) are not listed, but it’s much closer than your taxable wages.

Create this form in 5 minutes!

How to create an eSignature for the 2 total deductions from page 2 schedule b line 1e

How to generate an electronic signature for your 2 Total Deductions From Page 2 Schedule B Line 1e online

How to create an electronic signature for the 2 Total Deductions From Page 2 Schedule B Line 1e in Google Chrome

How to create an eSignature for putting it on the 2 Total Deductions From Page 2 Schedule B Line 1e in Gmail

How to generate an electronic signature for the 2 Total Deductions From Page 2 Schedule B Line 1e from your smartphone

How to create an eSignature for the 2 Total Deductions From Page 2 Schedule B Line 1e on iOS

How to create an electronic signature for the 2 Total Deductions From Page 2 Schedule B Line 1e on Android OS

People also ask

-

What is the 2017 RI 1065 form, and why is it important?

The 2017 RI 1065 form is crucial for partnerships in Rhode Island to report their income, deductions, and tax liabilities. It ensures compliance with state tax regulations and helps avoid penalties. Filing this form accurately can streamline your business operations and meetings tax obligations.

-

How can airSlate SignNow assist with filing the 2017 RI 1065?

airSlate SignNow simplifies the process of eSigning and sending necessary documents related to the 2017 RI 1065 form. By allowing multiple users to sign documents electronically, businesses can ensure quick and secure submission to tax authorities. This saves time and reduces the risk of errors in completing the form.

-

What features does airSlate SignNow offer for managing 2017 RI 1065 documents?

AirSlate SignNow provides features such as templates, document tracking, and automated reminders for the 2017 RI 1065 form. These tools help streamline the document preparation and signing process, ensuring that all necessary signatures are collected efficiently. Users can easily manage and organize their forms for quick access during tax season.

-

Is airSlate SignNow cost-effective for small businesses filing the 2017 RI 1065?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses dealing with the 2017 RI 1065 form. With various pricing plans available, users can choose one that fits their budget while benefiting from an array of features. This ensures businesses can efficiently manage their document needs without overspending.

-

Can airSlate SignNow integrate with other software for handling the 2017 RI 1065?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software that are beneficial for processing the 2017 RI 1065 form. These integrations allow users to import or export data with ease, making the workflow smoother and more productive.

-

What are the benefits of using airSlate SignNow for the 2017 RI 1065 form?

Using airSlate SignNow for the 2017 RI 1065 form ensures faster document turnaround times and enhances collaboration among partners. The platform's security features also protect sensitive tax information from unauthorized access. Overall, it optimizes the entire filing process while ensuring compliance.

-

How secure is airSlate SignNow when handling the 2017 RI 1065 form?

AirSlate SignNow employs advanced security protocols to protect documents, including those related to the 2017 RI 1065 form. With encrypted data transmission and secure cloud storage, users can trust that their information is safe while eSigning or transmitting sensitive documents.

Get more for Ri 1065 Tax Form

- Durable power of attorney form 65 dws investments

- La care authorization form 100835639

- Vtag application liberty university liberty form

- Neuromodulator consent form

- Rpc form pdf download

- Chronic fatigue syndrome chronic fatigue syndrome disability benefits questionnaire form

- Salary agreement template form

- Salary confidentiality agreement template form

Find out other Ri 1065 Tax Form

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template