Fillable Online State of Rhode Island Division of 2020

What is the fillable online State of Rhode Island Division Of

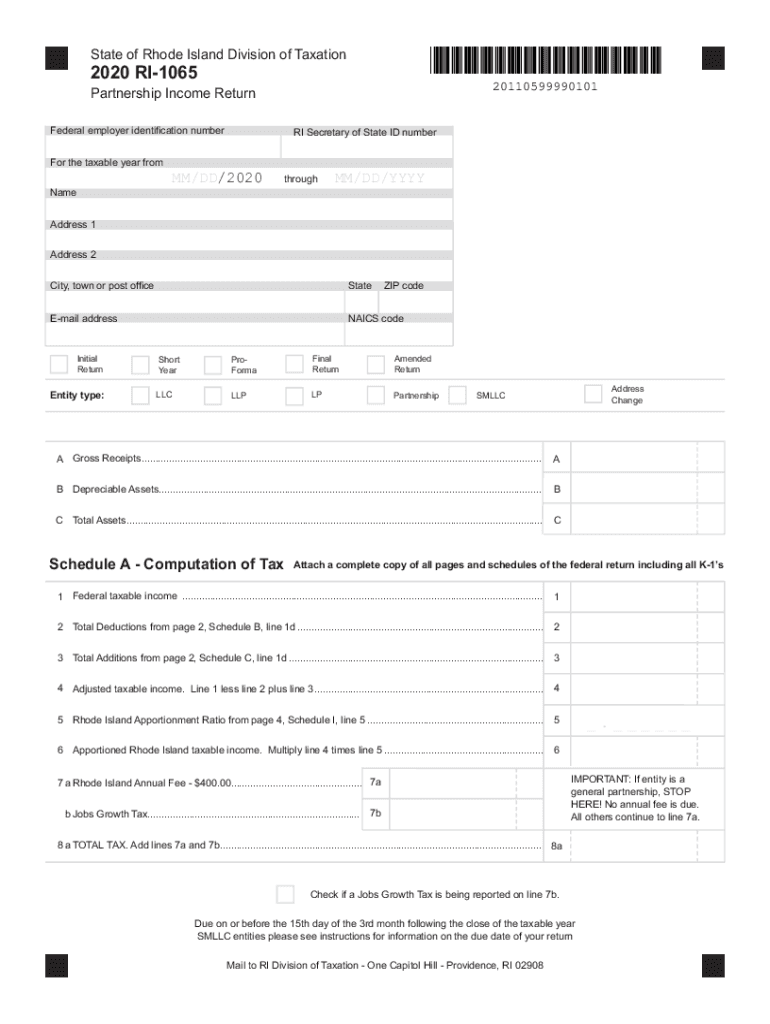

The 2019 RI 1065 form, also known as the RI Partnership Return, is a crucial document for partnerships operating in Rhode Island. This form is used to report the income, deductions, gains, and losses of partnerships. It is essential for ensuring compliance with state tax regulations and for accurate reporting to the RI Division of Taxation. The fillable online version of this form simplifies the process, allowing users to complete and submit it electronically, which can save time and reduce errors.

Steps to complete the fillable online State of Rhode Island Division Of

Completing the 2019 RI 1065 form online involves several key steps:

- Access the fillable form through the Rhode Island Division of Taxation website.

- Enter the partnership's identifying information, including the name, address, and Federal Employer Identification Number (FEIN).

- Report the income and deductions for the partnership, ensuring all figures are accurate and supported by documentation.

- Review the form for completeness and accuracy, checking for any missing information or errors.

- Submit the completed form electronically or print it for mailing, depending on your preference.

Legal use of the fillable online State of Rhode Island Division Of

The 2019 RI 1065 form is legally binding when completed and submitted according to state regulations. Electronic submissions via a trusted platform like signNow are recognized as valid under the ESIGN Act and UETA, ensuring that the eSignature holds the same legal weight as a handwritten signature. It is important to follow all guidelines set forth by the RI Division of Taxation to ensure compliance and avoid penalties.

Filing deadlines / Important dates

For the 2019 RI 1065 form, the filing deadline typically aligns with the federal tax return deadline for partnerships, which is usually March 15 of the following year. If additional time is needed, partnerships may file for an extension, but it is crucial to submit the extension request before the original deadline to avoid penalties. Keeping track of these dates helps ensure timely compliance with state tax obligations.

Required documents

When completing the 2019 RI 1065 form, certain documents are essential for accurate reporting. These may include:

- Financial statements detailing income and expenses.

- Supporting documentation for deductions claimed.

- Partnership agreements that outline the terms and conditions of the partnership.

- Any prior year tax returns that may provide context for current filings.

Form submission methods (Online / Mail / In-Person)

The 2019 RI 1065 form can be submitted through various methods, offering flexibility for partnerships. The preferred method is online submission via the Rhode Island Division of Taxation's website, which allows for immediate processing. Alternatively, partnerships can print the completed form and mail it to the appropriate address or submit it in person at the Division of Taxation office located at One Capitol Hill, Providence, RI. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Examples of using the fillable online State of Rhode Island Division Of

The fillable online 2019 RI 1065 form is beneficial for various types of partnerships, including:

- Limited Liability Companies (LLCs) that elect to be treated as partnerships for tax purposes.

- General partnerships formed for business purposes.

- Joint ventures that require reporting of income and expenses.

These examples illustrate the versatility of the form and its importance in ensuring accurate tax reporting for different partnership structures in Rhode Island.

Quick guide on how to complete fillable online state of rhode island division of

Effortlessly Prepare Fillable Online State Of Rhode Island Division Of on Any Device

Online document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without hindrances. Handle Fillable Online State Of Rhode Island Division Of on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign Fillable Online State Of Rhode Island Division Of with Ease

- Obtain Fillable Online State Of Rhode Island Division Of and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Online State Of Rhode Island Division Of and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online state of rhode island division of

Create this form in 5 minutes!

How to create an eSignature for the fillable online state of rhode island division of

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the 2019 RI 1065 form used for?

The 2019 RI 1065 form is used for partnerships operating in Rhode Island to report their income, deductions, and credits. It provides essential information to the state tax authority and is crucial for accurate tax filing. Completing this form correctly ensures compliance and helps in avoiding potential penalties.

-

How can I easily complete the 2019 RI 1065 form?

You can complete the 2019 RI 1065 form easily using airSlate SignNow. Our platform offers user-friendly tools for filling out and eSigning your documents. With the ability to integrate essential data and collaborate online, we streamline the entire process for you.

-

Is there a cost associated with using airSlate SignNow for the 2019 RI 1065 form?

Yes, there is a cost associated with using airSlate SignNow, but it remains cost-effective for businesses. Pricing varies based on the features you choose, but we ensure you get the best value for your eSigning and document management needs, including the 2019 RI 1065 form.

-

What features does airSlate SignNow offer for managing the 2019 RI 1065 form?

airSlate SignNow offers features like document templates, secure eSigning, and cloud storage that make managing the 2019 RI 1065 form hassle-free. You can track the status of your documents in real-time, making it easier to keep tabs on submissions and receiving confirmations.

-

Can I integrate airSlate SignNow with other software for the 2019 RI 1065 form?

Absolutely! airSlate SignNow integrates with various accounting and productivity tools to streamline the process of completing the 2019 RI 1065 form. This allows you to import data directly from compatible software, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for the 2019 RI 1065 form?

Using airSlate SignNow for the 2019 RI 1065 form ensures a smooth user experience with easy navigation and secure eSigning. You can also benefit from reduced operational costs and quicker turnaround times on important documents, enhancing overall efficiency.

-

Is it safe to store the 2019 RI 1065 form on airSlate SignNow?

Yes, it is safe to store your 2019 RI 1065 form on airSlate SignNow. Our platform employs advanced security measures, including data encryption and secure access, ensuring your sensitive information remains protected and confidential.

Get more for Fillable Online State Of Rhode Island Division Of

Find out other Fillable Online State Of Rhode Island Division Of

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online