RI 1065 Corp Forms Rhode Island Division of Taxation Tax State Ri 2013

What is the RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

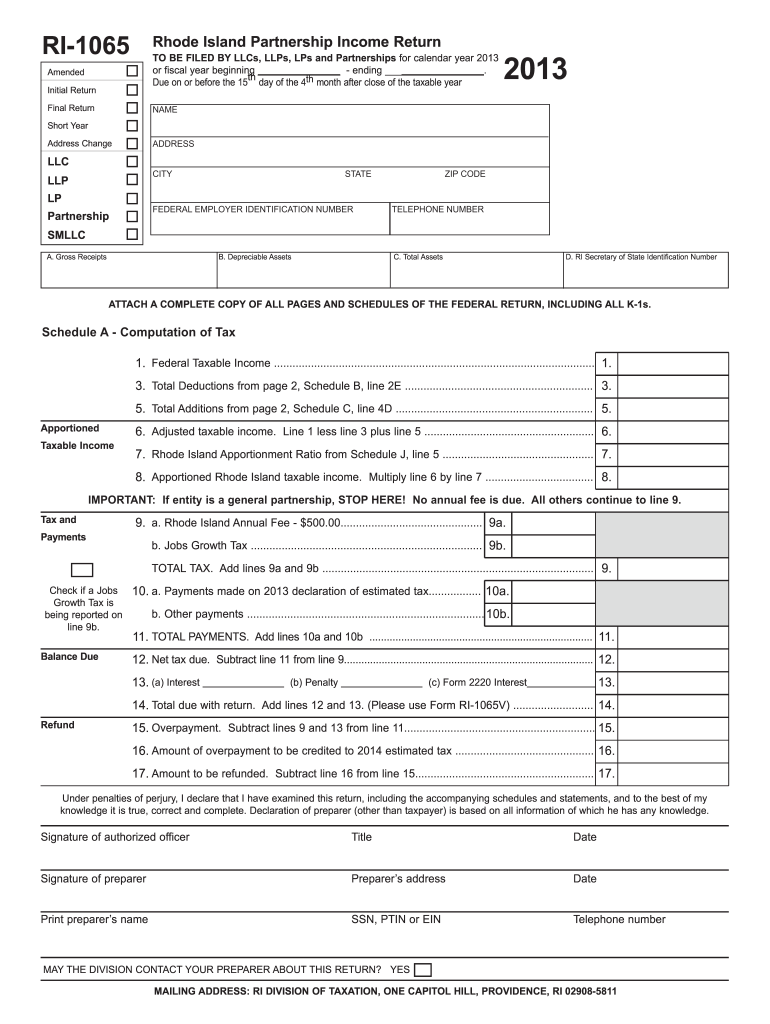

The RI 1065 Corp Forms are essential documents required by the Rhode Island Division of Taxation for reporting income generated by partnerships and certain corporations. This form is crucial for tax compliance within the state of Rhode Island, allowing businesses to accurately report their income, deductions, and credits. The RI 1065 form serves as a means for the state to assess the tax liabilities of partnerships, ensuring that all entities fulfill their obligations under state tax laws.

Steps to complete the RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

Completing the RI 1065 Corp Forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, expense reports, and any relevant tax documents. Next, accurately fill out each section of the form, ensuring that all figures are correct and correspond to your financial records. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form electronically through a secure platform or by mail, ensuring that you adhere to all filing deadlines set by the Rhode Island Division of Taxation.

Legal use of the RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

The RI 1065 Corp Forms are legally binding documents that must be filled out and submitted in accordance with Rhode Island state tax laws. The information provided on these forms is used by the state to determine tax liabilities, and inaccuracies or omissions can lead to penalties. It is essential for businesses to ensure that they comply with all legal requirements when completing and submitting the form, as this protects them from potential legal issues and ensures proper tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the RI 1065 Corp Forms are crucial for maintaining compliance with state tax regulations. Typically, the forms must be submitted by the 15th day of the third month following the close of the tax year. For partnerships operating on a calendar year, this means the deadline is generally March 15. It is important for businesses to be aware of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Form Submission Methods (Online / Mail / In-Person)

The RI 1065 Corp Forms can be submitted through various methods to accommodate different preferences and needs. Businesses have the option to file online using secure e-filing systems, which is often the fastest and most efficient method. Alternatively, forms can be mailed directly to the Rhode Island Division of Taxation. In some cases, businesses may also choose to deliver their forms in person. Each method has specific requirements and processing times, so it is advisable to select the option that best suits your business's needs.

Key elements of the RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

The key elements of the RI 1065 Corp Forms include sections for reporting income, deductions, and credits, as well as information about the partners and the business entity. Each section must be completed accurately to reflect the financial status of the partnership or corporation. Additionally, the form requires signatures from authorized representatives, which may be completed electronically, ensuring that the form is legally binding and compliant with state regulations.

Quick guide on how to complete 2013 ri 1065 corp forms rhode island division of taxation tax state ri

Your assistance manual for preparing your RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

If you’re looking to understand how to finalize and send your RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri, here are a few concise guidelines to simplify the tax submission process.

To begin, simply create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document tool that enables you to modify, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit any information that requires adjustments. Enhance your tax organization with advanced PDF editing, eSigning, and easy sharing options.

Complete the following steps to wrap up your RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri in just a few minutes:

- Create your account and begin working on PDFs almost instantly.

- Utilize our directory to locate any IRS tax form; browse various versions and schedules.

- Click Get form to access your RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri in our editor.

- Add the necessary information in the fillable fields (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-valid eSignature (if required).

- Examine your document and rectify any mistakes.

- Save your modifications, print a copy, send it to your recipient, and download it to your device.

Refer to this guide for filing your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper format can lead to errors in returns and delay reimbursements. Additionally, prior to e-filing your taxes, ensure you check the IRS website for filing regulations pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct 2013 ri 1065 corp forms rhode island division of taxation tax state ri

Create this form in 5 minutes!

How to create an eSignature for the 2013 ri 1065 corp forms rhode island division of taxation tax state ri

How to create an electronic signature for your 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri online

How to make an electronic signature for the 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri in Google Chrome

How to make an electronic signature for putting it on the 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri in Gmail

How to generate an electronic signature for the 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri straight from your mobile device

How to generate an electronic signature for the 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri on iOS

How to generate an eSignature for the 2013 Ri 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri on Android OS

People also ask

-

What are RI 1065 Corp Forms and why are they important for Rhode Island businesses?

RI 1065 Corp Forms are essential tax documents required by the Rhode Island Division of Taxation for corporate entities generating income. These forms ensure compliance with state tax obligations, helping businesses avoid penalties and maintain good standing. Properly handling RI 1065 Corp Forms is crucial for accurate tax reporting and financial transparency.

-

How can airSlate SignNow assist with completing RI 1065 Corp Forms?

airSlate SignNow offers an efficient platform for electronically signing and managing RI 1065 Corp Forms. With its user-friendly interface, businesses can easily fill out, sign, and send these forms, streamlining the process. This results in faster compliance with the Rhode Island Division of Taxation and reduced administrative workload.

-

What pricing options are available for using airSlate SignNow for RI 1065 Corp Forms?

airSlate SignNow provides flexible pricing plans tailored to fit both small and large businesses. Users can choose from monthly or annual subscriptions, with options that include features specifically designed for handling RI 1065 Corp Forms. This cost-effective solution ensures that businesses get the functionality they need without overspending.

-

Are there any integrations available for airSlate SignNow that assist with RI 1065 Corp Forms?

Yes, airSlate SignNow integrates seamlessly with various popular applications, enhancing your ability to manage RI 1065 Corp Forms. These integrations allow you to connect your accounting software or document management tools directly with the platform, streamlining the entire filing process. This ensures that you have all the necessary resources at your fingertips.

-

What are the benefits of using airSlate SignNow for RI 1065 Corp Forms?

Using airSlate SignNow for RI 1065 Corp Forms simplifies the signing and submission process, making it faster and more secure. The platform offers tracking features, real-time updates, and encrypted storage for sensitive documents. This enhances the overall efficiency of handling tax documents while ensuring compliance with the Rhode Island Division of Taxation.

-

Can I access airSlate SignNow on mobile devices for RI 1065 Corp Forms?

Absolutely! airSlate SignNow is designed to be fully functional on mobile devices, allowing users to manage RI 1065 Corp Forms on the go. This flexibility means you can complete and sign documents anytime, anywhere, ensuring that you never miss a deadline for the Rhode Island Division of Taxation.

-

Is it easy to learn how to use airSlate SignNow for RI 1065 Corp Forms?

Yes, airSlate SignNow is known for its intuitive and user-friendly design, making it easy for anyone to learn how to utilize it for RI 1065 Corp Forms. The platform provides helpful tutorials and customer support to guide users through the process. You'll be able to navigate through functions quickly and efficiently without any extensive training.

Get more for RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

- Mutual wills containing last will and testaments for unmarried persons living together with no children connecticut form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children connecticut form

- Mutual wills or last will and testaments for man and woman living together not married with minor children connecticut form

- Non marital cohabitation living together agreement connecticut form

- Paternity law and procedure handbook connecticut form

- Coverage selection form connecticut

- Bill of sale in connection with sale of business by individual or corporate seller connecticut form

- Coverage selection partnership connecticut form

Find out other RI 1065 Corp Forms Rhode Island Division Of Taxation Tax State Ri

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order