Rhode Island Form 1065 Partnership Income Tax Return 2023

What is the Rhode Island Form 1065 Partnership Income Tax Return

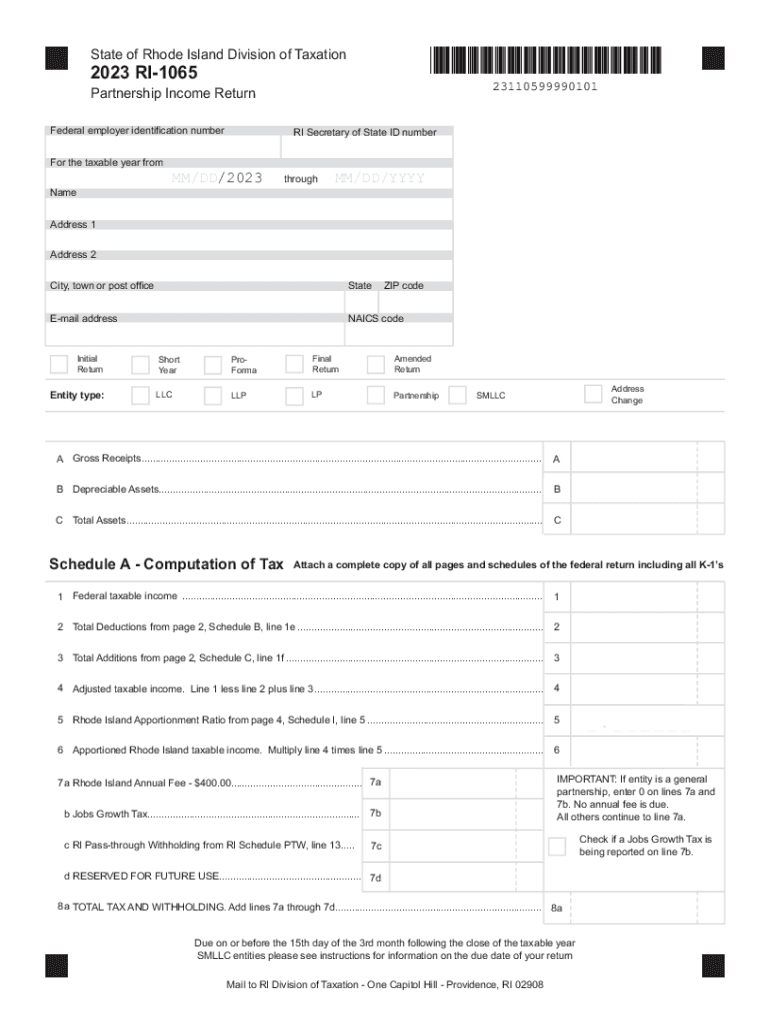

The Rhode Island Form 1065 is the Partnership Income Tax Return used by partnerships operating in the state. This form is essential for reporting income, deductions, gains, and losses from the partnership's operations. Partnerships are not taxed at the entity level; instead, the income is passed through to the individual partners, who report it on their personal tax returns. The form captures vital information about the partnership's financial activities and ensures compliance with state tax regulations.

Steps to complete the Rhode Island Form 1065 Partnership Income Tax Return

Completing the Rhode Island Form 1065 involves several key steps:

- Gather necessary financial records, including income statements, expense reports, and partner information.

- Fill out the basic partnership information, such as name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, including operating expenses, salaries, and other costs incurred during the tax year.

- Calculate the partnership's taxable income and any applicable credits or adjustments.

- Ensure all partners' information is correctly reported, including their share of income and deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Partnerships in Rhode Island must adhere to specific filing deadlines to avoid penalties. The Rhode Island Form 1065 is generally due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by March 15. It is crucial to be aware of any extensions that may apply and to file accordingly to maintain compliance.

Required Documents

When filing the Rhode Island Form 1065, several documents are typically required to support the information reported. These may include:

- Partnership agreements outlining the terms of the partnership.

- Financial statements, including income statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Information regarding each partner's capital contributions and share of profits.

Key elements of the Rhode Island Form 1065 Partnership Income Tax Return

The Rhode Island Form 1065 includes several key elements that must be accurately reported. These elements consist of:

- Identification of the partnership and partners.

- Income details, including total revenue and other income sources.

- Deductions for business expenses, including salaries and operational costs.

- Partner allocations, which detail how income and deductions are distributed among partners.

How to use the Rhode Island Form 1065 Partnership Income Tax Return

Using the Rhode Island Form 1065 effectively involves understanding its structure and purpose. The form serves as a reporting tool for partnerships to disclose their financial activities to the state. To use the form, partnerships must accurately fill in all required sections, ensuring that all income and deductions are reported in accordance with Rhode Island tax laws. Once completed, the form can be submitted either electronically or via mail, depending on the partnership's preference and compliance requirements.

Create this form in 5 minutes or less

Find and fill out the correct rhode island form 1065 partnership income tax return

Create this form in 5 minutes!

How to create an eSignature for the rhode island form 1065 partnership income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Rhode Island partnership return?

A Rhode Island partnership return is a tax document that partnerships must file to report income, deductions, and credits to the state. It is essential for ensuring compliance with state tax laws and accurately reflecting the partnership's financial activities. Filing this return helps avoid penalties and ensures that all partners are informed about the partnership's tax obligations.

-

How can airSlate SignNow help with filing a Rhode Island partnership return?

airSlate SignNow simplifies the process of preparing and submitting your Rhode Island partnership return by allowing you to eSign and send documents securely. Our platform streamlines document management, making it easy to collaborate with partners and ensure all necessary signatures are obtained. This efficiency can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for managing partnership returns?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your Rhode Island partnership return. These tools help ensure that all documents are completed accurately and submitted on time. Additionally, our platform integrates with various accounting software to enhance your workflow.

-

Is airSlate SignNow cost-effective for small businesses filing a Rhode Island partnership return?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to file a Rhode Island partnership return. Our pricing plans are flexible and cater to different business sizes, ensuring that you only pay for what you need. This affordability, combined with our robust features, makes it an ideal choice for managing your partnership tax filings.

-

Can I integrate airSlate SignNow with my existing accounting software for partnership returns?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your Rhode Island partnership return. This integration allows for automatic data transfer, reducing the risk of errors and saving you time. You can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for my partnership return?

Using airSlate SignNow for your Rhode Island partnership return provides numerous benefits, including enhanced security, ease of use, and improved collaboration. Our platform ensures that your documents are securely stored and easily accessible, while the user-friendly interface allows for quick navigation. Additionally, you can collaborate with partners in real-time, ensuring everyone is on the same page.

-

How does airSlate SignNow ensure the security of my partnership return documents?

airSlate SignNow prioritizes the security of your documents, including those related to your Rhode Island partnership return. We utilize advanced encryption methods and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your data remains confidential and secure throughout the signing process.

Get more for Rhode Island Form 1065 Partnership Income Tax Return

Find out other Rhode Island Form 1065 Partnership Income Tax Return

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile