Rhode Island Payroll Tax Registration and Information for 2024-2026

Understanding the RI 1065 Form

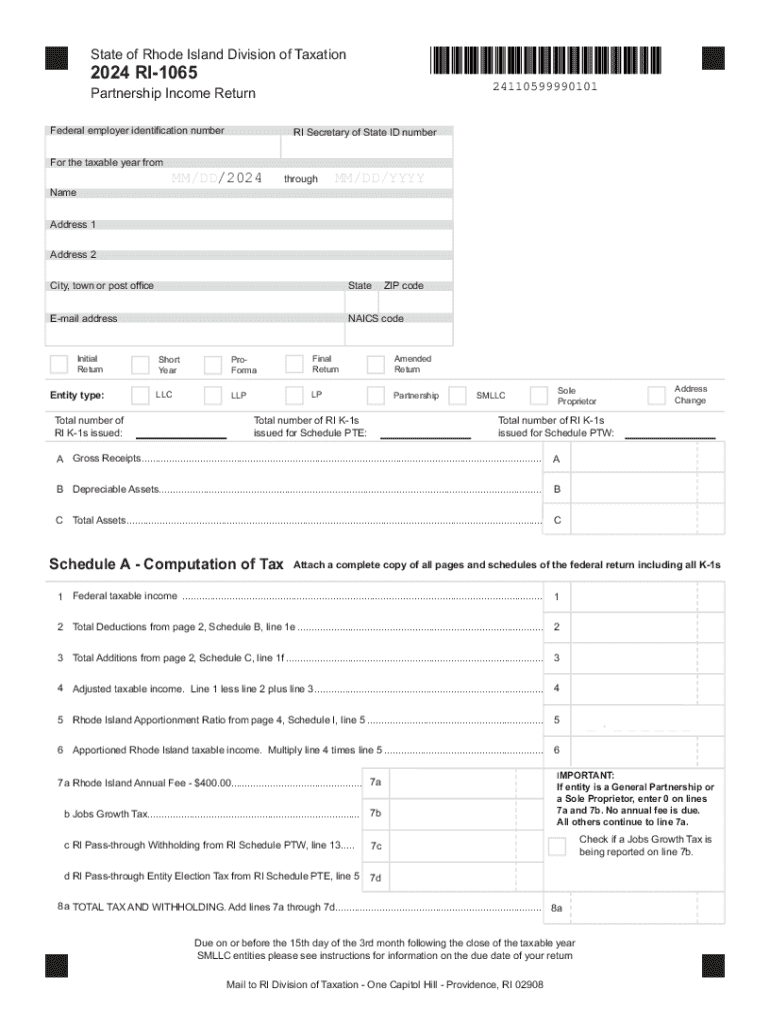

The RI 1065 form is a crucial document used by partnerships in Rhode Island to report income, deductions, gains, losses, and other pertinent financial information. This form is essential for partnerships to comply with state tax regulations. It allows the state to assess the tax liability of the partnership and ensures that partners report their share of income accurately on their personal tax returns.

Key Elements of the RI 1065 Form

When completing the RI 1065 form, several key elements must be included:

- Partnership Information: This section requires the partnership's name, address, and federal employer identification number (EIN).

- Income and Deductions: Partnerships must report total income, including ordinary business income, interest income, and other sources, along with allowable deductions.

- Partner Information: The form requires details about each partner, including their share of income, deductions, and credits.

- Signature: A designated partner must sign the form to certify its accuracy.

Steps to Complete the RI 1065 Form

Completing the RI 1065 form involves several steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the partnership information section accurately.

- Report total income and deductions on the form.

- Detail each partner's share of income and deductions.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by the due date to avoid penalties.

Filing Deadlines and Important Dates

Partnerships must be aware of the filing deadlines for the RI 1065 form. Typically, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is essential to file on time to avoid late fees and penalties.

Form Submission Methods

The RI 1065 form can be submitted through various methods:

- Online: Partnerships may have the option to file electronically through the Rhode Island Division of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate state tax office.

- In-Person: Partnerships may also choose to submit the form in person at designated tax offices.

Penalties for Non-Compliance

Failing to file the RI 1065 form on time or providing inaccurate information can result in penalties. The state may impose fines, and partners may face additional tax liabilities. It is important for partnerships to ensure compliance with all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct rhode island payroll tax registration and information for

Create this form in 5 minutes!

How to create an eSignature for the rhode island payroll tax registration and information for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1065 form?

The RI 1065 form is a tax return used by partnerships in Rhode Island to report income, deductions, and credits. It is essential for ensuring compliance with state tax regulations. Completing the RI 1065 form accurately can help avoid penalties and ensure proper tax treatment.

-

How can airSlate SignNow help with the RI 1065 form?

airSlate SignNow simplifies the process of completing and eSigning the RI 1065 form. With our user-friendly platform, you can easily fill out the form, gather necessary signatures, and securely send it to the relevant parties. This streamlines your workflow and ensures timely submission.

-

Is there a cost associated with using airSlate SignNow for the RI 1065 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to features that facilitate the completion and eSigning of the RI 1065 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the RI 1065 form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for managing the RI 1065 form. These tools enhance efficiency and ensure that your documents are organized and easily accessible. You can also track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for the RI 1065 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the RI 1065 form. Whether you use accounting software or document management systems, our platform can enhance your productivity.

-

What are the benefits of using airSlate SignNow for the RI 1065 form?

Using airSlate SignNow for the RI 1065 form offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, reducing the risk of errors. Additionally, your data is protected with advanced security measures.

-

How secure is airSlate SignNow when handling the RI 1065 form?

airSlate SignNow prioritizes security, employing encryption and secure access protocols to protect your data when handling the RI 1065 form. We comply with industry standards to ensure that your sensitive information remains confidential. You can trust us to keep your documents safe.

Get more for Rhode Island Payroll Tax Registration And Information For

Find out other Rhode Island Payroll Tax Registration And Information For

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online