Tab Key Moves Cursor to Some of My Labels, Instead of to the 2023-2026

IRS Guidelines

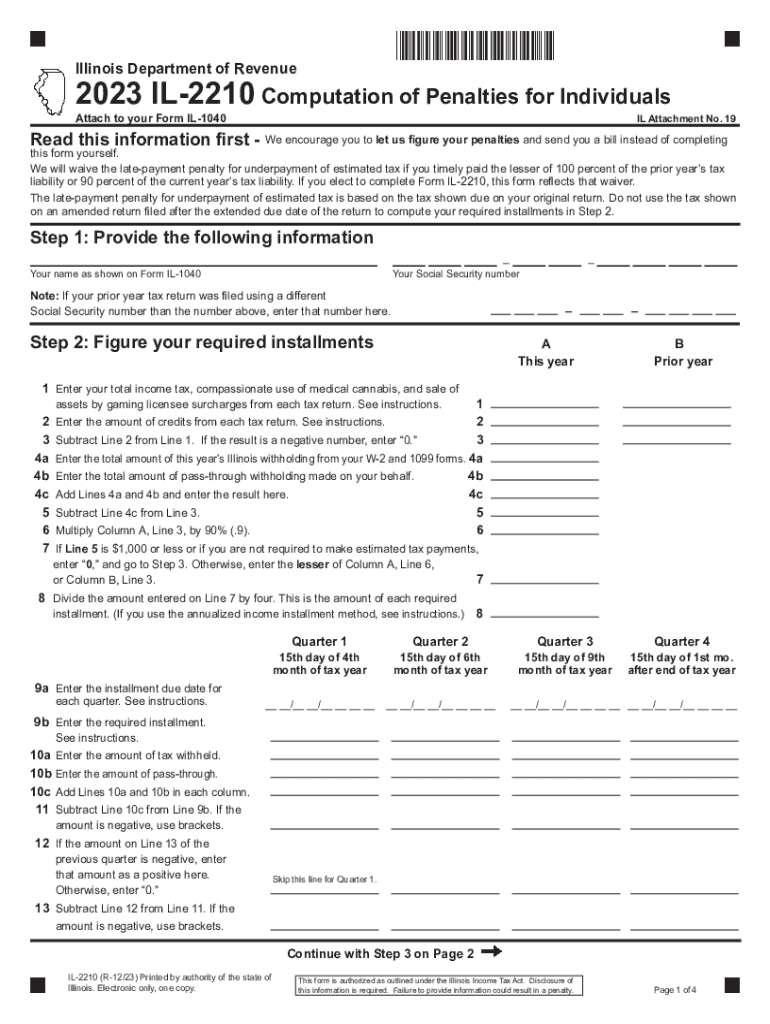

The 2023 IL 2210 form is essential for Illinois taxpayers who need to report underpayment of state income tax. The IRS provides guidelines that help taxpayers understand the requirements for filing this form. Taxpayers must determine if they owe additional tax due to underpayment and calculate the amount owed. The IRS stipulates that taxpayers should use the IL 2210 form if they did not pay enough tax throughout the year, either through withholding or estimated payments.

Filing Deadlines / Important Dates

For the 2023 IL 2210 form, it is crucial to adhere to specific filing deadlines to avoid penalties. Typically, the deadline for filing state income tax returns in Illinois is April 15. If you are required to file the IL 2210, ensure that it is submitted by this date. Additionally, if you are making estimated payments, be aware of quarterly deadlines to avoid underpayment penalties.

Penalties for Non-Compliance

Failure to file the 2023 IL 2210 form when required can result in penalties. The state of Illinois imposes penalties for underpayment of tax, which can accumulate over time. Taxpayers may face a penalty of one percent of the underpayment amount for each month the payment is late, up to a maximum of 12 months. Understanding these penalties can help taxpayers avoid unnecessary financial burdens.

Required Documents

To complete the 2023 IL 2210 form accurately, taxpayers need to gather specific documents. This includes prior year tax returns, records of income received throughout the year, and any documentation related to estimated tax payments made. Having these documents on hand can streamline the filing process and ensure that all required information is accurately reported.

Form Submission Methods

The 2023 IL 2210 form can be submitted through various methods. Taxpayers have the option to file online using the Illinois Department of Revenue's website, which provides a convenient digital submission process. Alternatively, forms can be mailed to the appropriate state office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Eligibility Criteria

Not all taxpayers are required to file the 2023 IL 2210 form. Eligibility typically includes individuals who owe additional tax due to underpayment. Taxpayers must assess their total tax liability and compare it to the amount paid throughout the year. If the payments fall short, filing the IL 2210 becomes necessary. Understanding these criteria can help taxpayers determine their obligations and avoid penalties.

Taxpayer Scenarios

Different taxpayer scenarios can influence the need for the 2023 IL 2210 form. For instance, self-employed individuals may find themselves needing to file this form more frequently due to fluctuating income. Similarly, retirees who have income from pensions or investments should evaluate their tax payments to ensure compliance. Recognizing these scenarios can aid taxpayers in making informed decisions about their tax filings.

Quick guide on how to complete tab key moves cursor to some of my labels instead of to the

Complete Tab Key Moves Cursor To Some Of My Labels, Instead Of To The effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Tab Key Moves Cursor To Some Of My Labels, Instead Of To The across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Tab Key Moves Cursor To Some Of My Labels, Instead Of To The without hassle

- Locate Tab Key Moves Cursor To Some Of My Labels, Instead Of To The and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or save it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device. Edit and electronically sign Tab Key Moves Cursor To Some Of My Labels, Instead Of To The and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tab key moves cursor to some of my labels instead of to the

Create this form in 5 minutes!

How to create an eSignature for the tab key moves cursor to some of my labels instead of to the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 IL 2210 and how does it affect my business?

The 2023 IL 2210 is the Illinois form for underpayment of estimated income tax. Businesses must be aware of this form to avoid penalties while ensuring they meet their tax obligations. With airSlate SignNow, you can easily eSign and send necessary documents related to the 2023 IL 2210, streamlining your compliance processes.

-

How can airSlate SignNow assist with filing the 2023 IL 2210?

airSlate SignNow simplifies the process of collecting signatures and approvals for your tax documents, including the 2023 IL 2210. Our platform allows you to create, send, and track your documents, ensuring you file on time without the hassles of traditional paperwork.

-

Is airSlate SignNow cost-effective for businesses managing the 2023 IL 2210?

Yes, airSlate SignNow offers a cost-effective solution for businesses dealing with the 2023 IL 2210. With various pricing plans, our service helps you save on time and resources while ensuring all your documents are securely eSigned and managed efficiently.

-

What features does airSlate SignNow offer for managing the 2023 IL 2210 documentation?

airSlate SignNow provides features such as customizable templates, real-time tracking, and seamless collaboration to simplify your management of the 2023 IL 2210. These tools ensure that all necessary signatures and approvals are obtained quickly and securely.

-

Can I integrate airSlate SignNow with other tools for handling the 2023 IL 2210?

Absolutely! airSlate SignNow integrates with various applications like Google Drive, Salesforce, and more, allowing you to manage the 2023 IL 2210 and other documents in one place. This enhances your productivity by streamlining workflows and document management across platforms.

-

What are the benefits of using airSlate SignNow for the 2023 IL 2210?

Using airSlate SignNow for the 2023 IL 2210 means enhanced efficiency, reduced paperwork, and quicker turnaround times. The platform not only simplifies the signing process but also ensures compliance with tax regulations, thus alleviating stress during tax season.

-

How does airSlate SignNow ensure the security of my 2023 IL 2210 documents?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your 2023 IL 2210 documents. Our commitment to security keeps your sensitive information safe while allowing for effortless eSigning and document sharing.

Get more for Tab Key Moves Cursor To Some Of My Labels, Instead Of To The

- Federal direct consolidation loan application and promissory note loanconsolidation ed form

- Bank information form

- Personal bank servicesthe citizens bank form

- Authorization justification form

- Why the uk must associate to horizon europe royal society form

- Credit application agreement amp personal guarantee form

- Tororebate form

- Form 1013

Find out other Tab Key Moves Cursor To Some Of My Labels, Instead Of To The

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU