Il 1040 Fill Out and Sign Printable PDF TemplatesignNow 2022

Understanding the 2210 computation form

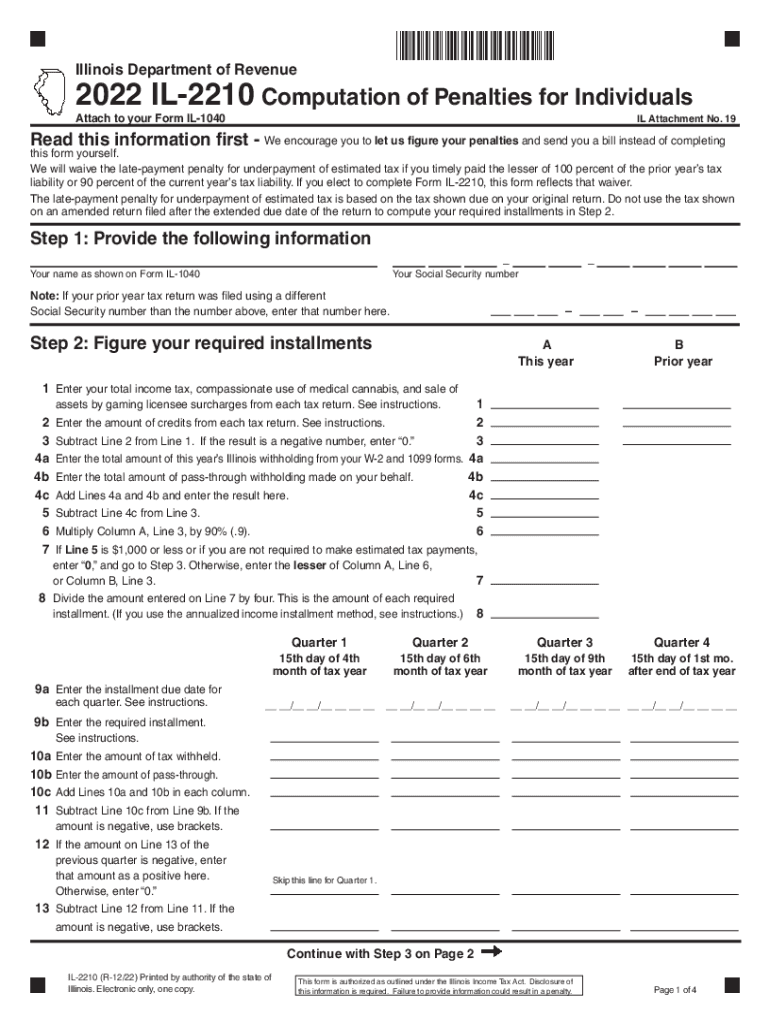

The 2210 computation form is essential for taxpayers who may face underpayment penalties. This form helps calculate whether you owe a penalty for not paying enough tax throughout the year. It is particularly relevant for individuals who have income that isn't subject to withholding, such as self-employment income, interest, dividends, or capital gains. By accurately completing the 2210 computation form, you can determine your tax liability and avoid potential penalties.

Steps to complete the 2210 computation form

Filling out the 2210 computation form involves several steps. First, gather all relevant financial documents, including your income statements and previous tax returns. Next, identify your total tax liability for the year. Then, calculate your total payments made throughout the year, including withholding and estimated tax payments. Compare these figures to determine if you owe any penalties. Finally, complete the form by providing the necessary calculations and any required signatures.

Key elements of the 2210 computation form

The 2210 computation form includes several critical sections. These sections typically cover your total tax liability, total payments, and any applicable credits. Additionally, the form requires you to indicate your filing status and income type. Understanding these elements is vital for accurately assessing your tax situation and ensuring compliance with IRS regulations.

Filing deadlines for the 2210 computation form

It is important to be aware of the filing deadlines associated with the 2210 computation form. Generally, the form must be submitted along with your annual tax return by April 15 of the following year. If you are unable to meet this deadline, you may request an extension. However, any taxes owed must still be paid by the original due date to avoid additional penalties and interest.

Penalties for non-compliance with the 2210 computation form

Failing to complete and submit the 2210 computation form when required can result in significant penalties. The IRS may impose an underpayment penalty if you do not pay enough tax throughout the year. This penalty is calculated based on the amount of underpayment and the length of time the payment is overdue. To avoid these penalties, it is crucial to understand your tax obligations and complete the form accurately.

Digital vs. paper version of the 2210 computation form

Taxpayers have the option to complete the 2210 computation form either digitally or on paper. The digital version offers the convenience of electronic filing, which can expedite processing times and reduce the risk of errors. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensure that all information is accurate and submitted on time to avoid penalties.

Quick guide on how to complete il 1040 fill out and sign printable pdf templatesignnow

Effortlessly prepare Il 1040 Fill Out And Sign Printable PDF TemplatesignNow on any device

Managing documents online has gained traction among both companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Il 1040 Fill Out And Sign Printable PDF TemplatesignNow on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign Il 1040 Fill Out And Sign Printable PDF TemplatesignNow effortlessly

- Locate Il 1040 Fill Out And Sign Printable PDF TemplatesignNow and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Il 1040 Fill Out And Sign Printable PDF TemplatesignNow and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1040 fill out and sign printable pdf templatesignnow

Create this form in 5 minutes!

How to create an eSignature for the il 1040 fill out and sign printable pdf templatesignnow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2210 computation form?

The 2210 computation form is a tax form used by individuals to calculate their underpayment of estimated taxes owed to the IRS. It helps taxpayers determine if they owe a penalty for not paying enough tax throughout the year. By using the 2210 computation form, taxpayers can ensure they meet their obligations and avoid unnecessary penalties.

-

How can airSlate SignNow help with the 2210 computation form?

airSlate SignNow allows users to easily create, send, and eSign the 2210 computation form seamlessly. Our platform simplifies the document management process, ensuring that you can focus on your tax calculations without the hassle of paperwork. With airSlate SignNow, you’ll have the tools you need to manage your tax forms efficiently.

-

Is airSlate SignNow cost-effective for handling the 2210 computation form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 2210 computation form. Our competitive pricing ensures that businesses of all sizes can access essential document eSigning services without breaking the bank. Investing in airSlate SignNow means you get great value for simplifying your document processes.

-

What features does airSlate SignNow offer for the 2210 computation form?

airSlate SignNow provides several features that streamline the process of handling the 2210 computation form, including customizable templates, secure eSignature options, and real-time tracking of document status. These features not only enhance efficiency but also provide peace of mind by ensuring compliance and security in your transactions.

-

Can I integrate airSlate SignNow with other tools to manage the 2210 computation form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and accounting software like QuickBooks. This allows you to seamlessly manage and share your 2210 computation form with your team, making collaboration easier and more efficient.

-

What are the benefits of using airSlate SignNow for the 2210 computation form?

Using airSlate SignNow for the 2210 computation form brings numerous benefits, such as reduced turnaround time, enhanced security, and improved organization. Our platform ensures that your documents are easily accessible and securely stored, minimizing the risks associated with paper documents. Additionally, it allows for efficient tracking and management of essential forms.

-

How secure is airSlate SignNow for handling the 2210 computation form?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication protocols to protect your documents, including the 2210 computation form, throughout the signing process. Our commitment to security means you can trust that your sensitive tax information is safe and confidential.

Get more for Il 1040 Fill Out And Sign Printable PDF TemplatesignNow

- Beer judging sheet form

- Master formula record sample pdf

- Risk assessment example pdf form

- Sf3112b form

- Exclusive right to sell contract sample form

- Request for replacement diploma form nova southeastern

- Toronto hydro tenant form fill online printable fillable

- Copia de formularios para inicio de relaciones y anexos xlsx

Find out other Il 1040 Fill Out And Sign Printable PDF TemplatesignNow

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF