Form Il 1040Login Pages Finder Login Faq Com 2021

Understanding the Illinois 2210 Form

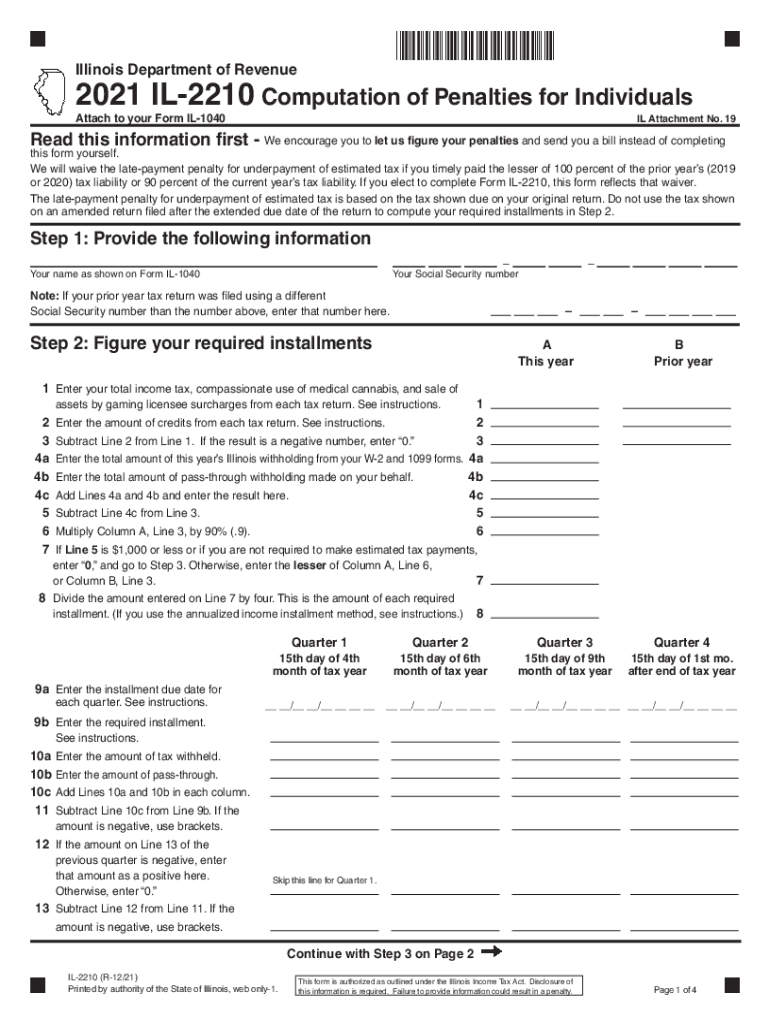

The Illinois 2210 form is a crucial document for taxpayers who may owe penalties due to underpayment of estimated tax. This form helps individuals calculate whether they owe a penalty for not paying enough tax throughout the year. It is essential for those who have income that is not subject to withholding, such as self-employment income, dividends, or interest. By accurately completing the form, taxpayers can determine their tax obligations and avoid unnecessary penalties.

Steps to Complete the Illinois 2210 Form

Completing the Illinois 2210 form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year, taking into account all sources of income.

- Determine your estimated tax payments made throughout the year.

- Use the form to calculate any potential penalties for underpayment by comparing your total tax liability with your estimated payments.

- Review the completed form for accuracy before submission.

Penalties for Non-Compliance

Failing to file or pay the correct amount of tax can result in penalties. The Illinois 2210 form outlines potential penalties for underpayment, which can include:

- A penalty based on the amount of underpayment, which may increase if the underpayment is significant.

- Interest on unpaid amounts, which accrues over time.

- Additional penalties for late filing, which can add to the overall tax burden.

Understanding these penalties can help taxpayers take proactive steps to avoid them.

Filing Deadlines and Important Dates

Timely submission of the Illinois 2210 form is essential to avoid penalties. Key deadlines include:

- The annual tax filing deadline, typically April fifteenth.

- Quarterly estimated tax payment deadlines, which are usually in April, June, September, and January of the following year.

Staying aware of these dates can help ensure compliance and avoid unnecessary penalties.

Digital vs. Paper Version of the Illinois 2210 Form

Taxpayers have the option to complete the Illinois 2210 form either digitally or on paper. Each method has its benefits:

- The digital version allows for easier calculations and automatic updates based on input data.

- The paper version may be preferred by those who are more comfortable with traditional methods.

Regardless of the method chosen, it is essential to ensure that the form is completed accurately to avoid penalties.

Eligibility Criteria for Using the Illinois 2210 Form

Not all taxpayers will need to file the Illinois 2210 form. Eligibility typically includes:

- Taxpayers who expect to owe tax of one thousand dollars or more after subtracting withholding and refundable credits.

- Individuals with income from sources not subject to withholding.

Understanding these criteria can help determine if the form is necessary for your tax situation.

Quick guide on how to complete 2021 form il 1040login pages finder login faqcom

Complete Form Il 1040Login Pages Finder Login Faq com effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form Il 1040Login Pages Finder Login Faq com on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Form Il 1040Login Pages Finder Login Faq com without hassle

- Locate Form Il 1040Login Pages Finder Login Faq com and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant portions of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form Il 1040Login Pages Finder Login Faq com to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form il 1040login pages finder login faqcom

Create this form in 5 minutes!

How to create an eSignature for the 2021 form il 1040login pages finder login faqcom

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is il 2210 and how does it relate to airSlate SignNow?

Il 2210 refers to a specific form used for calculating underpayment penalties on federal income tax. When using airSlate SignNow, businesses can efficiently eSign and send their il 2210 documents, ensuring compliance while saving time in the tax preparation process.

-

How does airSlate SignNow streamline the process for completing il 2210 forms?

AirSlate SignNow streamlines the il 2210 process with easy document uploads and customizable templates. Users can quickly fill out their il 2210 forms online, add signatures, and send them to recipients securely, enhancing both speed and accuracy.

-

Is airSlate SignNow a cost-effective solution for small businesses handling il 2210 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By enabling electronic signatures and reducing the need for paper, shipping, and storage costs associated with il 2210 documents, it helps small businesses manage their finances more efficiently.

-

What features does airSlate SignNow offer for managing il 2210 documents?

AirSlate SignNow offers a range of features for managing il 2210 documents, including automated workflows, real-time tracking, and secure storage. These features help businesses stay organized and compliant with tax regulations while handling their submissions.

-

Can airSlate SignNow integrate with accounting software for easier il 2210 submissions?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing for easy data import for il 2210 submissions. This integration simplifies the process of preparing and sending tax-related documents electronically.

-

Are there any mobile capabilities for managing il 2210 forms with airSlate SignNow?

Yes, airSlate SignNow has mobile capabilities that allow users to manage their il 2210 forms on-the-go. The mobile app enables users to sign, send, and track documents anytime, making it convenient for busy tax professionals.

-

What security measures does airSlate SignNow implement for il 2210 document handling?

AirSlate SignNow prioritizes document security by implementing encryption, two-factor authentication, and audit trails for all il 2210 document transactions. This ensures that sensitive taxpayer information remains protected throughout the entire signing process.

Get more for Form Il 1040Login Pages Finder Login Faq com

- Bill of sale of automobile and odometer statement for as is sale missouri form

- Construction contract cost plus or fixed fee missouri form

- Painting contract for contractor missouri form

- Trim carpenter contract for contractor missouri form

- Fencing contract for contractor missouri form

- Hvac contract for contractor missouri form

- Landscape contract for contractor missouri form

- Commercial contract for contractor missouri form

Find out other Form Il 1040Login Pages Finder Login Faq com

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple