Printable Illinois Form IL 2210 Computation of Penalties for Individuals 2020

Understanding the Printable Illinois Form IL 2210 Computation of Penalties for Individuals

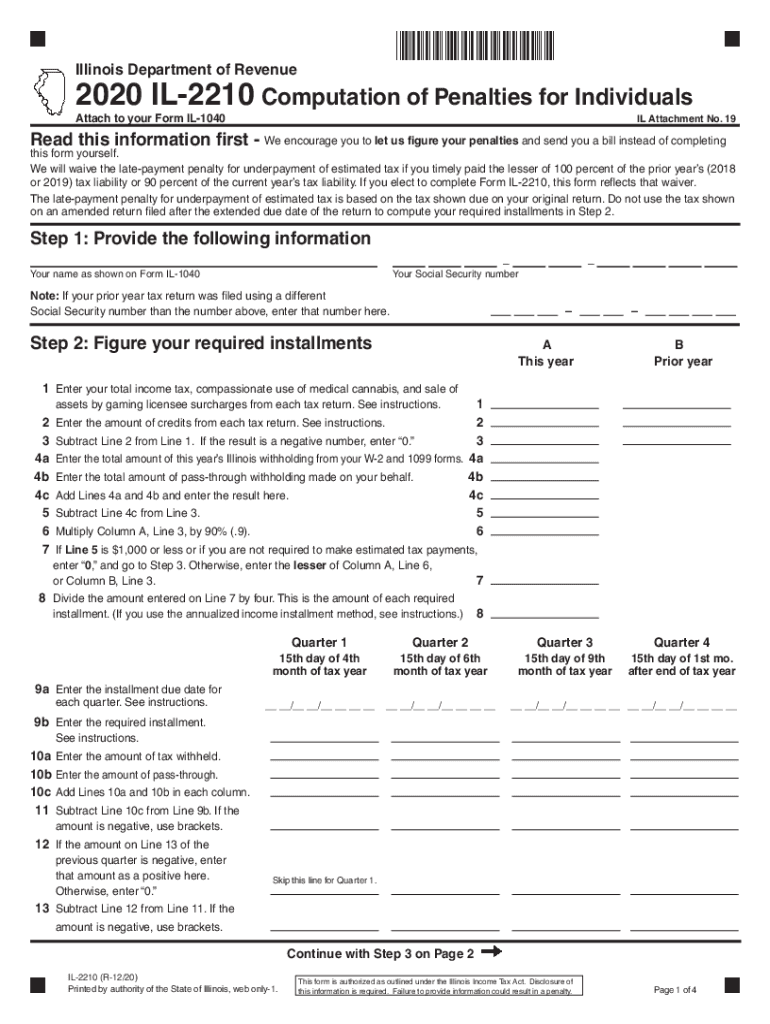

The Printable Illinois Form IL 2210 is specifically designed for individuals who need to calculate penalties related to underpayment of state income tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. By accurately completing the IL 2210, individuals can determine if they owe any penalties and how much they should pay. This form is particularly relevant for those who may have experienced changes in income or tax liability during the year, which can affect their overall tax obligations.

Steps to Complete the Printable Illinois Form IL 2210

Completing the Printable Illinois Form IL 2210 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, follow these steps:

- Fill out your personal information at the top of the form.

- Calculate your total tax liability for the year.

- Determine the total amount of tax you have paid through withholding and estimated payments.

- Use the provided worksheets to calculate any penalties for underpayment.

- Review your calculations for accuracy before submitting the form.

By following these steps, you can ensure that the form is completed correctly, minimizing the risk of errors that could lead to additional penalties.

Legal Use of the Printable Illinois Form IL 2210

The Printable Illinois Form IL 2210 is legally recognized as a valid document for reporting underpayment penalties to the Illinois Department of Revenue. It is important to understand that this form must be filed accurately and on time to avoid further penalties. The form is compliant with state tax laws and serves as an official record of your tax calculations and payments. Proper use of this form can help protect you from legal repercussions associated with underreporting your tax obligations.

Obtaining the Printable Illinois Form IL 2210

The Printable Illinois Form IL 2210 can be easily obtained from the Illinois Department of Revenue's official website. It is available in a downloadable PDF format, allowing you to print and fill it out at your convenience. Additionally, you may find copies at local tax offices or public libraries. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the Printable Illinois Form IL 2210

Several key elements must be included when filling out the Printable Illinois Form IL 2210. These include:

- Your name and Social Security number.

- Total income and tax liability for the year.

- Amounts paid through withholding and estimated payments.

- Calculations for any penalties incurred due to underpayment.

Attention to these elements will help ensure that your form is complete and accurate, reducing the likelihood of issues with the Illinois Department of Revenue.

Filing Deadlines for the Printable Illinois Form IL 2210

It is crucial to be aware of the filing deadlines associated with the Printable Illinois Form IL 2210. Typically, this form must be submitted by the same deadline as your annual income tax return. For most individuals, this means it is due on April 15 of the following year. If you need to file for an extension, ensure that any penalties are still calculated and reported on time to avoid additional fees.

Quick guide on how to complete printable 2020 illinois form il 2210 computation of penalties for individuals

Complete Printable Illinois Form IL 2210 Computation Of Penalties For Individuals effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Printable Illinois Form IL 2210 Computation Of Penalties For Individuals on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Printable Illinois Form IL 2210 Computation Of Penalties For Individuals effortlessly

- Find Printable Illinois Form IL 2210 Computation Of Penalties For Individuals and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Printable Illinois Form IL 2210 Computation Of Penalties For Individuals and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 illinois form il 2210 computation of penalties for individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 illinois form il 2210 computation of penalties for individuals

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow's role in managing Illinois computation documents?

airSlate SignNow streamlines the process of sending and eSigning documents related to Illinois computation. By providing a user-friendly interface, businesses can efficiently manage their documentation needs, which is crucial for compliance and record-keeping in Illinois.

-

How does airSlate SignNow ensure the security of Illinois computation data?

Security is a top priority for airSlate SignNow, especially regarding Illinois computation data. The platform utilizes advanced encryption protocols and secure server environments to protect sensitive information, ensuring that all documents are safely managed during the eSigning process.

-

What features does airSlate SignNow offer for Illinois computation tasks?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for Illinois computation tasks. These tools not only enhance productivity but also simplify the document management process for businesses operating within Illinois.

-

What are the pricing options for airSlate SignNow related to Illinois computation?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those dealing with Illinois computation. Each plan unlocks various features, allowing businesses to choose a cost-effective solution that fits their requirements.

-

Can airSlate SignNow integrate with other software for Illinois computation?

Yes, airSlate SignNow integrates seamlessly with numerous applications that facilitate Illinois computation. This capability allows businesses to connect their existing tools and streamline their workflows, enhancing overall efficiency.

-

What benefits does eSigning provide for Illinois computation documents?

eSigning with airSlate SignNow offers signNow benefits for Illinois computation documents, including faster turnaround times and reduced paper usage. This not only improves efficiency but also supports eco-friendly business practices.

-

Is airSlate SignNow compliant with Illinois state laws regarding computation?

Absolutely, airSlate SignNow is fully compliant with Illinois state laws concerning document eSigning and computation. This compliance ensures that all electronic signatures and document processes meet the legal standards required in Illinois.

Get more for Printable Illinois Form IL 2210 Computation Of Penalties For Individuals

Find out other Printable Illinois Form IL 2210 Computation Of Penalties For Individuals

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple