How Do You Set a Tab Order that Incorporates Textboxes and 2023-2026

Understanding the Illinois 1040 Schedule M

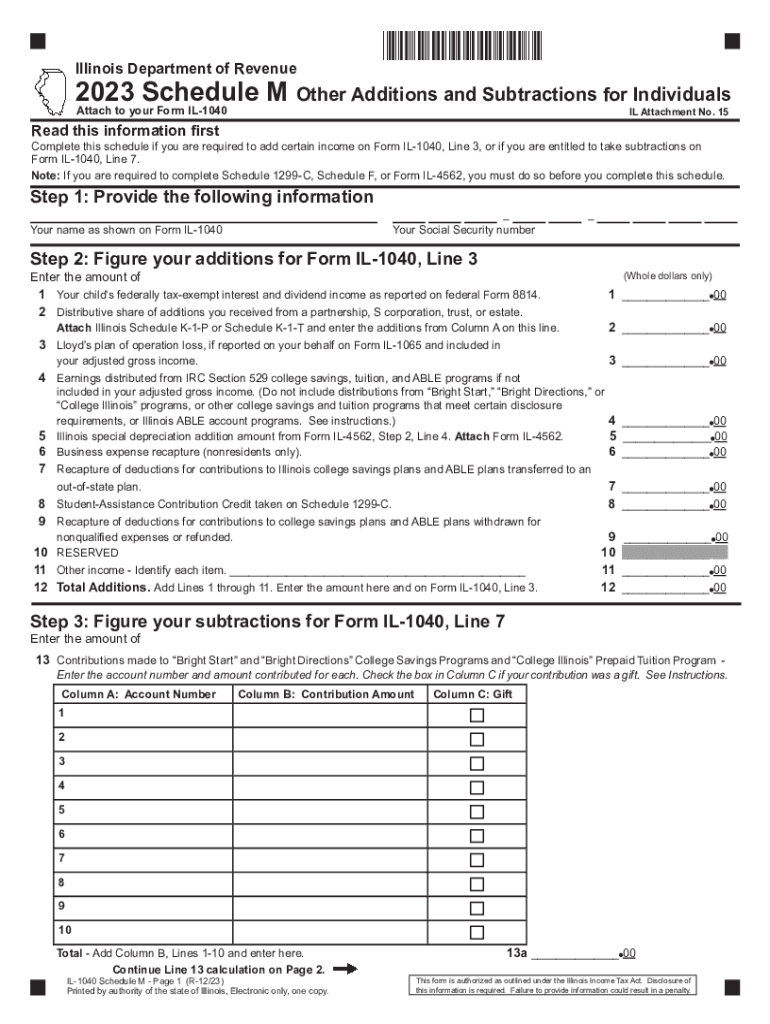

The Illinois 1040 Schedule M is a crucial form used by residents of Illinois to report various additions and subtractions to their income. This form helps taxpayers adjust their federal adjusted gross income (AGI) to determine their state taxable income. It is essential for ensuring accurate tax calculations and compliance with state tax laws.

Taxpayers must complete the Illinois Schedule M if they have specific income adjustments, such as contributions to retirement accounts, student loan interest deductions, or other allowable subtractions. Understanding the nuances of this form can significantly impact your overall tax liability.

Key Elements of the Illinois Schedule M Form

The Illinois Schedule M form includes several key components that taxpayers need to be aware of:

- Additions: These are items that increase the taxable income, such as income from other states or certain business income.

- Subtractions: These reduce the taxable income and may include exemptions for retirement contributions or specific deductions allowed by Illinois law.

- Instructions: The form provides detailed guidance on how to report each item correctly, ensuring compliance with state requirements.

Filing Deadlines for the Illinois Schedule M

Timely filing of the Illinois 1040 Schedule M is essential to avoid penalties. The standard deadline for filing individual income tax returns, including the Schedule M, is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply.

Required Documents for Completing the Illinois Schedule M

To accurately complete the Illinois Schedule M, taxpayers should gather the following documents:

- Federal tax return (Form 1040) and any supporting schedules.

- Documentation for any income adjustments, such as W-2 forms, 1099 forms, or receipts for deductible expenses.

- Records of contributions to retirement accounts or other allowable deductions.

Having these documents ready will facilitate a smoother filing process and ensure all necessary information is included.

Form Submission Methods for the Illinois Schedule M

Taxpayers have several options for submitting the Illinois 1040 Schedule M. They can file the form:

- Online: Many taxpayers choose to e-file through authorized tax software, which often simplifies the process and speeds up refunds.

- By Mail: The form can be printed, completed, and mailed to the Illinois Department of Revenue. It is important to check the mailing address based on the type of return being filed.

- In Person: Some taxpayers may opt to deliver their forms directly to local tax offices, especially if they have questions or require assistance.

Penalties for Non-Compliance with the Illinois Schedule M

Failing to file the Illinois 1040 Schedule M or inaccuracies in reporting can lead to penalties. The Illinois Department of Revenue may impose fines for late submissions or underreporting income. Additionally, interest may accrue on any unpaid taxes. It is crucial for taxpayers to ensure that their filings are accurate and submitted on time to avoid these consequences.

Quick guide on how to complete how do you set a tab order that incorporates textboxes and

Complete How Do You Set A Tab Order That Incorporates Textboxes And effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle How Do You Set A Tab Order That Incorporates Textboxes And on any device using the airSlate SignNow apps available for Android or iOS and streamline any document-oriented process today.

How to modify and eSign How Do You Set A Tab Order That Incorporates Textboxes And with ease

- Obtain How Do You Set A Tab Order That Incorporates Textboxes And and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign How Do You Set A Tab Order That Incorporates Textboxes And while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how do you set a tab order that incorporates textboxes and

Create this form in 5 minutes!

How to create an eSignature for the how do you set a tab order that incorporates textboxes and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois 1040 Schedule M?

The Illinois 1040 Schedule M is a form used by taxpayers in Illinois to report additional income and adjustments. It helps determine your total income tax liability by allowing you to list specific adjustments not included on the standard 1040. Completing the Illinois 1040 Schedule M accurately is essential for ensuring compliance with state tax laws.

-

How do I fill out the Illinois 1040 Schedule M?

Filling out the Illinois 1040 Schedule M involves gathering your financial information and understanding which adjustments apply to you. You will need to report specific types of income and deductions that may affect your tax liability. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and send completed forms securely.

-

Is there a fee associated with filing the Illinois 1040 Schedule M?

While the Illinois 1040 Schedule M itself does not have a filing fee, you should consider any potential costs associated with tax preparation services. Using airSlate SignNow offers a cost-effective way to handle document signing and submissions electronically. This can save you money and time when filing your taxes.

-

What are the benefits of using airSlate SignNow for the Illinois 1040 Schedule M?

Using airSlate SignNow for the Illinois 1040 Schedule M simplifies the e-signing process, allowing you to manage your tax documents efficiently. Its user-friendly interface ensures a quick turnaround time for document processing. Additionally, with compliance and security features, your information remains protected throughout the entire process.

-

Can I integrate airSlate SignNow with tax software to manage the Illinois 1040 Schedule M?

Yes, airSlate SignNow offers integrations with various tax software platforms, making it easier to manage your Illinois 1040 Schedule M and other tax documents. This integration streamlines the workflow by allowing you to eSign documents directly within your chosen software. This enhances efficiency and keeps your tax filing organized.

-

What types of documents can I eSign related to the Illinois 1040 Schedule M?

You can eSign various documents related to the Illinois 1040 Schedule M, including the schedule itself, supporting documentation, and correspondence from your tax preparer. airSlate SignNow provides a platform where you can securely sign and send all necessary documents electronically. This ensures that everything is neatly organized and easily accessible.

-

How does airSlate SignNow ensure the security of my Illinois 1040 Schedule M documents?

airSlate SignNow utilizes industry-standard encryption protocols to ensure the security of your Illinois 1040 Schedule M documents. All transactions are protected, and your sensitive information is kept confidential. This security framework allows you to eSign documents with peace of mind, knowing your data is safe.

Get more for How Do You Set A Tab Order That Incorporates Textboxes And

Find out other How Do You Set A Tab Order That Incorporates Textboxes And

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document