140ez Form Fill Out & Sign Online 2023-2026

What is the Arizona Form 140ez?

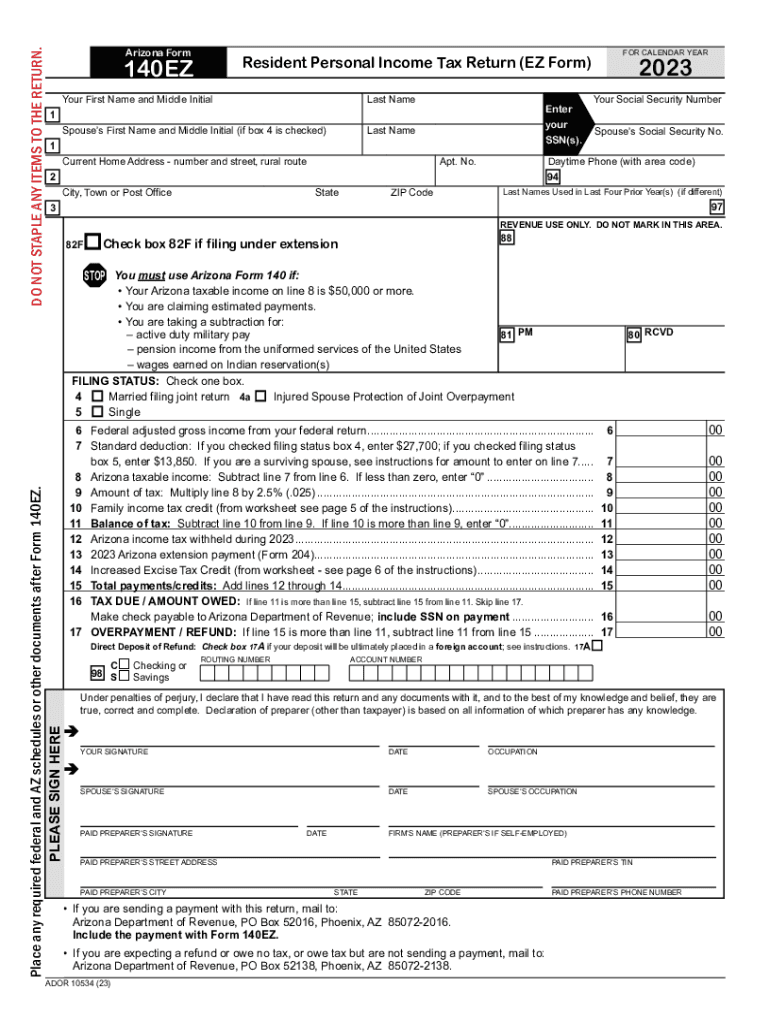

The Arizona Form 140ez is a simplified state income tax form designed for individuals with straightforward tax situations. This form is primarily used by residents of Arizona who have a taxable income below a certain threshold and meet specific eligibility criteria. It allows taxpayers to report their income, claim deductions, and calculate their tax liability efficiently. The 140ez form is particularly beneficial for those who prefer a streamlined process when filing their state taxes.

Key Elements of the Arizona Form 140ez

The Arizona Form 140ez includes several key components that taxpayers must understand to complete it accurately. These elements typically consist of:

- Personal Information: This section requires basic details such as name, address, and Social Security number.

- Income Reporting: Taxpayers must list their sources of income, which may include wages, interest, and dividends.

- Deductions: The form allows for specific deductions, which can reduce taxable income.

- Tax Calculation: This section helps taxpayers compute their total tax liability based on the reported income and deductions.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate.

Steps to Complete the Arizona Form 140ez

Completing the Arizona Form 140ez involves several straightforward steps. Here is a guide to help you through the process:

- Gather Required Documents: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number in the designated fields.

- Report Income: Accurately list all sources of income as instructed on the form.

- Claim Deductions: Identify and enter any eligible deductions to reduce your taxable income.

- Calculate Tax: Follow the instructions to compute your total tax liability based on the information provided.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Eligibility Criteria for the Arizona Form 140ez

To file using the Arizona Form 140ez, taxpayers must meet specific eligibility criteria. Generally, these include:

- Filing as a single or married individual with no dependents.

- Having a gross income below the established threshold for the tax year.

- Not claiming any credits or deductions that require more complex forms.

- Being a full-year resident of Arizona.

Form Submission Methods for the Arizona Form 140ez

The Arizona Form 140ez can be submitted through various methods to accommodate different preferences. Taxpayers may choose to:

- File Online: Use electronic filing options available through approved software or services.

- Mail the Form: Print the completed form and send it to the appropriate state tax office address.

- In-Person Submission: Visit a local Arizona Department of Revenue office to submit the form directly.

Filing Deadlines for the Arizona Form 140ez

It is essential to be aware of the filing deadlines associated with the Arizona Form 140ez. Typically, the deadline for filing state income tax returns is the same as the federal deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may wish to file to ensure compliance.

Quick guide on how to complete 140ez form fill out ampamp sign online

Finalize 140ez Form Fill Out & Sign Online effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage 140ez Form Fill Out & Sign Online on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 140ez Form Fill Out & Sign Online effortlessly

- Locate 140ez Form Fill Out & Sign Online and click on Obtain Form to begin.

- Utilize the tools we provide to submit your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Complete button to save your adjustments.

- Choose your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and eSign 140ez Form Fill Out & Sign Online to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 140ez form fill out ampamp sign online

Create this form in 5 minutes!

How to create an eSignature for the 140ez form fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with the 2012 Arizona tax process?

airSlate SignNow is a robust eSignature platform that allows businesses to manage and sign documents electronically. When it comes to the 2012 Arizona tax process, SignNow streamlines document preparation and submission, saving time and reducing errors.

-

How can I ensure my 2012 Arizona tax documents are secure with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents. With features such as bank-level encryption and secure cloud storage, you can handle all your 2012 Arizona tax documents confidently, knowing they are protected from unauthorized access.

-

What are the pricing options for airSlate SignNow when managing 2012 Arizona tax documents?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Whether you're handling simple 2012 Arizona tax forms or more complex documents, you can find a plan that suits your budget and operational requirements.

-

Can airSlate SignNow integrate with other tools for managing 2012 Arizona tax tasks?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business applications. This allows you to automate and streamline your workflows for handling 2012 Arizona tax documents, enhancing productivity across your organization.

-

What are the benefits of using airSlate SignNow for 2012 Arizona tax filings?

Using airSlate SignNow for your 2012 Arizona tax filings offers numerous benefits, including faster document turnaround, improved accuracy, and an eco-friendly solution. The intuitive interface also makes it easy for users of all experience levels to navigate the filing process.

-

How can I get started with airSlate SignNow for my 2012 Arizona tax needs?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you can begin managing your 2012 Arizona tax documents right away. Our user-friendly platform provides a range of tutorials to help you navigate your first steps.

-

Is there customer support available if I have questions about 2012 Arizona tax documents?

Absolutely! airSlate SignNow offers robust customer support to assist you with any questions regarding your 2012 Arizona tax documents. Whether you need help with technical issues or have specific inquiries, our team is ready to provide assistance.

Get more for 140ez Form Fill Out & Sign Online

Find out other 140ez Form Fill Out & Sign Online

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple