Get the State Tax Forms Arizona pdfFiller on Line PDF Form Filler, Editor, Type on PDF, Fill, Print 2020

Understanding the Arizona A2 Tax Form

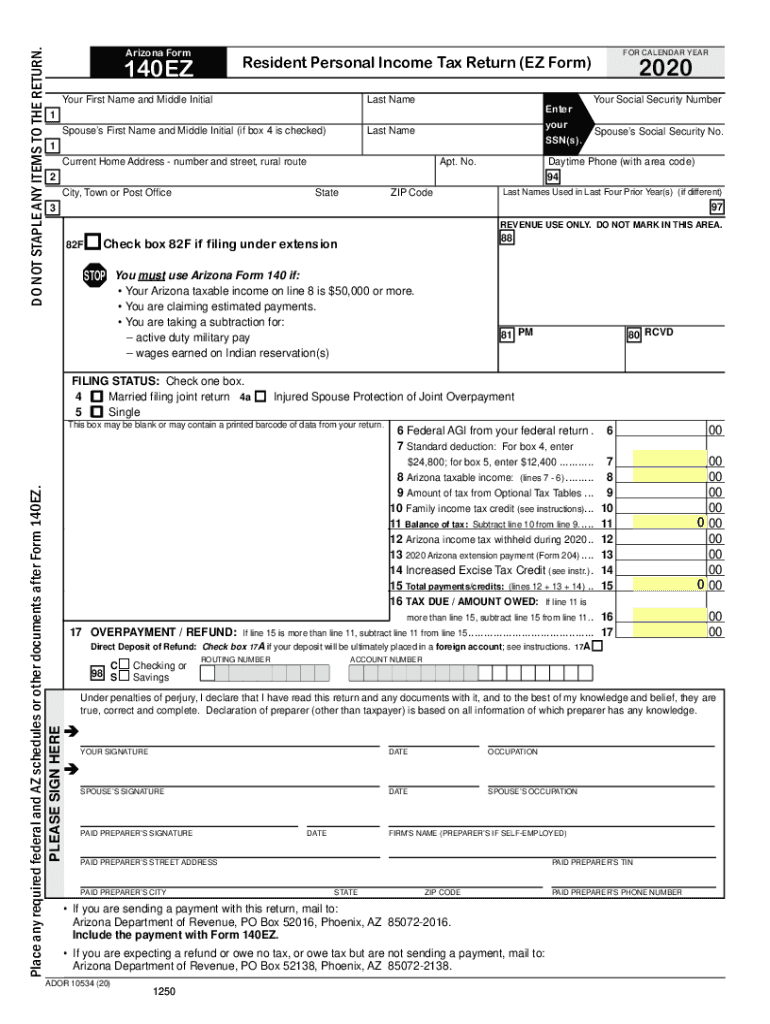

The Arizona A2 tax form is a crucial document for residents who need to report their income and calculate their state tax obligations. This form is specifically designed for individuals and businesses that earn income in Arizona. It is essential to accurately complete the A2 form to ensure compliance with state tax laws and to avoid potential penalties.

Key Elements of the Arizona A2 Tax Form

The Arizona A2 tax form includes several key sections that taxpayers must fill out. These sections typically cover personal information, income details, deductions, and tax credits. Understanding each part of the form is vital for accurate reporting. Additionally, taxpayers should be aware of any specific instructions provided by the Arizona Department of Revenue to ensure they meet all requirements.

Steps to Complete the Arizona A2 Tax Form

Completing the Arizona A2 tax form involves a series of steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any eligible deductions and tax credits.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

Filing Deadlines for the Arizona A2 Tax Form

Timely filing of the Arizona A2 tax form is crucial to avoid penalties. The typical deadline for filing state tax returns in Arizona aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify any changes to deadlines that may occur due to specific circumstances or state announcements.

Form Submission Methods for the Arizona A2 Tax Form

Taxpayers have several options for submitting the Arizona A2 tax form. These methods include:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing a printed copy of the form to the appropriate state address.

- In-person submission at designated state tax offices.

Penalties for Non-Compliance with the Arizona A2 Tax Form

Failure to file the Arizona A2 tax form on time or inaccuracies in reporting can result in penalties. Common penalties include late filing fees and interest on unpaid taxes. It is essential for taxpayers to understand these potential consequences and ensure that their filings are accurate and timely.

Quick guide on how to complete get the free state tax forms 2019 arizona pdffiller on line pdf form filler editor type on pdf fill print

Accomplish Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print across any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print with ease

- Find Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free state tax forms 2019 arizona pdffiller on line pdf form filler editor type on pdf fill print

Create this form in 5 minutes!

How to create an eSignature for the get the free state tax forms 2019 arizona pdffiller on line pdf form filler editor type on pdf fill print

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the Arizona A2 tax form?

The Arizona A2 tax form is a document used for reporting certain taxes in Arizona. It is essential for businesses and individuals who need to comply with state tax regulations. Understanding this form can help ensure accurate filing and avoid potential penalties.

-

How can airSlate SignNow help with the Arizona A2 tax form?

airSlate SignNow simplifies the process of preparing and eSigning the Arizona A2 tax form. Our platform allows users to fill out the form easily and securely send it for electronic signatures. This streamlines the submission process and enhances overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the Arizona A2 tax form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Arizona A2 tax form and other documents. Pricing varies based on the features you choose, but we provide competitive rates to ensure you can efficiently manage your tax documentation. Consider our plans to find the best fit for your needs.

-

What features does airSlate SignNow offer for the Arizona A2 tax form?

With airSlate SignNow, you gain access to robust features for the Arizona A2 tax form, including customizable templates, automated workflows, and secure cloud storage. These features facilitate easy collaboration and ensure your form is filled out correctly before submission.

-

Are there any benefits to using airSlate SignNow for eSigning the Arizona A2 tax form?

Using airSlate SignNow for eSigning the Arizona A2 tax form offers several benefits, including speed and convenience. It eliminates the need for printing and mailing, saving time and reducing costs. Additionally, our platform provides a legally binding eSignature solution that ensures compliance.

-

Can I integrate airSlate SignNow with other applications for managing the Arizona A2 tax form?

Absolutely! airSlate SignNow easily integrates with other applications, making it simpler to manage the Arizona A2 tax form. This means you can connect with tools such as accounting software, CRM systems, and more to enhance your workflow and streamline document management.

-

What if I need assistance with the Arizona A2 tax form while using airSlate SignNow?

If you need assistance with the Arizona A2 tax form, airSlate SignNow provides customer support to help guide you through the process. Our knowledgeable team can answer your questions and ensure you effectively utilize our platform for your tax needs. Feel free to signNow out to our support for any help.

Get more for Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print

- Move in move out inspection checklist form

- Australia change address checklist form

- Sebco apartments application form

- Ions pogil answer key form

- Quebec selection certificate 14626050 form

- Manitoba disability application form

- Systems of equations word problems worksheet pdf form

- Ssa 1199 op16 direct deposit sign up form malta

Find out other Get The State Tax Forms Arizona PdfFiller On line PDF Form Filler, Editor, Type On PDF, Fill, Print

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT