Arizona Form 140ez 2018

What is the Arizona Form 140ez

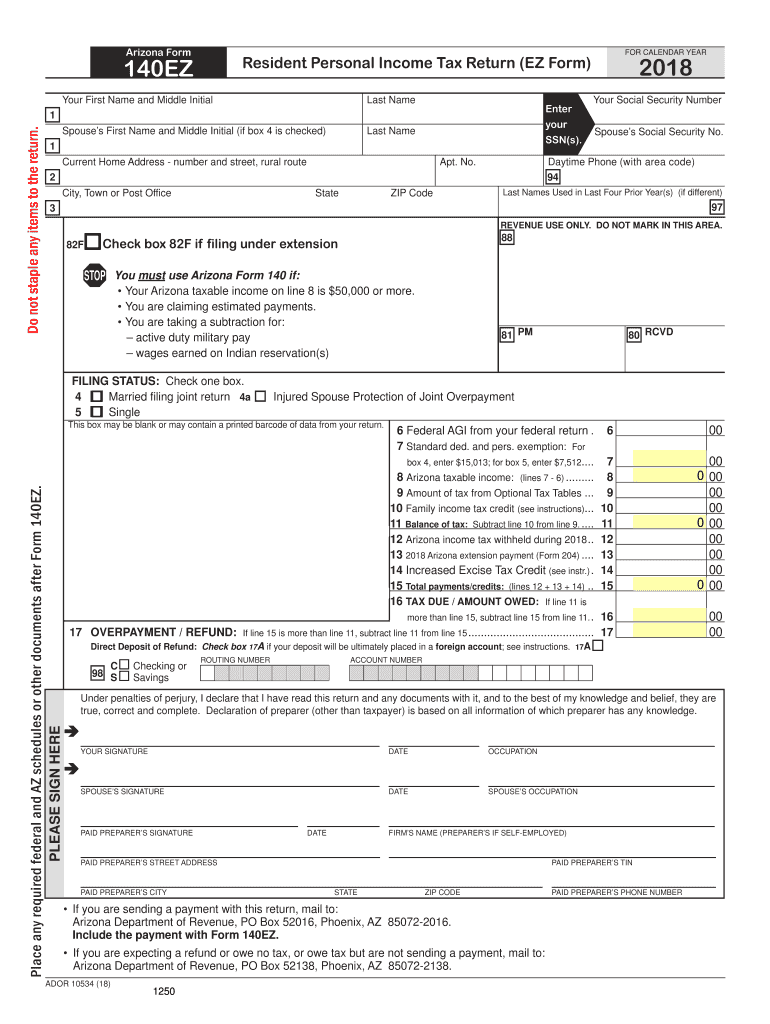

The Arizona Form 140ez is a simplified income tax return designed for eligible taxpayers in Arizona. This form is specifically for individuals who have a straightforward tax situation, allowing them to report their income, claim deductions, and calculate their tax liability efficiently. The 140ez form is primarily used by single filers and married couples filing jointly, provided their income falls below a certain threshold. It streamlines the filing process, making it accessible for those who may not have extensive tax knowledge.

How to use the Arizona Form 140ez

Using the Arizona Form 140ez involves several key steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, download the form from the Arizona Department of Revenue website or access it through a tax preparation software that supports Arizona tax forms. After obtaining the form, carefully fill it out, ensuring all information is accurate. Once completed, review the form for any errors before submitting it. The 140ez form can be filed electronically or mailed to the appropriate tax office, depending on your preference.

Steps to complete the Arizona Form 140ez

Completing the Arizona Form 140ez involves a series of methodical steps:

- Gather all required financial documents, including income statements and any relevant deductions.

- Download the form from the Arizona Department of Revenue website or use tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income as indicated on your W-2s and other income forms.

- Claim any deductions you are eligible for, such as the standard deduction or personal exemptions.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Legal use of the Arizona Form 140ez

The Arizona Form 140ez is legally recognized for filing state income taxes, provided that the taxpayer meets the eligibility criteria. It is essential to use this form accurately and honestly to avoid any legal repercussions. Misrepresentation of income or failure to report all necessary information can lead to penalties or audits by the Arizona Department of Revenue. Therefore, ensuring compliance with all state tax laws when using the 140ez form is crucial.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Arizona Form 140ez. Generally, the filing deadline for individual income tax returns is April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any extensions that may apply, allowing for additional time to file their return. It is advisable to check the Arizona Department of Revenue's website for any updates or changes to these dates.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 140ez can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically using approved e-filing services, which can expedite the processing of their returns. Alternatively, the form can be printed and mailed to the Arizona Department of Revenue. For those who prefer a personal touch, in-person submissions may be made at designated tax offices. Regardless of the method chosen, it is essential to keep a copy of the submitted form for personal records.

Quick guide on how to complete 2012 arizona form 2018 2019

Your assistance guide on how to prepare your Arizona Form 140ez

If you’re curious about how to finalize and submit your Arizona Form 140ez, here are some succinct instructions on how to streamline your tax filing process.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your approach to handling documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editing tool, you can toggle between text, checkboxes, and eSignatures, and revisit for any necessary adjustments. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to finish your Arizona Form 140ez in just a few minutes:

- Establish your account and begin managing PDFs in moments.

- Utilize our directory to obtain any IRS tax form; explore different versions and schedules.

- Hit Get form to access your Arizona Form 140ez in our editor.

- Input the necessary fillable fields with your details (text, figures, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Save changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper may lead to more mistakes in returns and delays in reimbursements. Moreover, before e-filing your taxes, verify the IRS website for filing regulations pertinent to your state.

Create this form in 5 minutes or less

Find and fill out the correct 2012 arizona form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 2012 arizona form 2018 2019

How to generate an electronic signature for your 2012 Arizona Form 2018 2019 in the online mode

How to make an electronic signature for the 2012 Arizona Form 2018 2019 in Chrome

How to create an electronic signature for putting it on the 2012 Arizona Form 2018 2019 in Gmail

How to create an electronic signature for the 2012 Arizona Form 2018 2019 from your smartphone

How to create an eSignature for the 2012 Arizona Form 2018 2019 on iOS devices

How to make an electronic signature for the 2012 Arizona Form 2018 2019 on Android

People also ask

-

What is the Arizona Form 140ez used for?

The Arizona Form 140ez is a simplified tax return form designed for eligible residents of Arizona. This form allows individuals with straightforward tax situations to file their state income taxes efficiently, making it a great option for those looking to streamline their filing process.

-

How can airSlate SignNow help with the Arizona Form 140ez?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including the Arizona Form 140ez. With our solution, you can securely collect signatures and send your completed tax forms in just a few clicks, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 140ez?

Yes, airSlate SignNow offers a range of pricing plans to cater to different business needs, including options for individuals needing to file the Arizona Form 140ez. Our pricing is competitive and designed to provide cost-effective solutions for efficient document management.

-

Can I integrate airSlate SignNow with my existing accounting software for Arizona Form 140ez?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software solutions, allowing you to manage the Arizona Form 140ez and other documents effortlessly. This integration helps you streamline your workflow, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for filing the Arizona Form 140ez?

Using airSlate SignNow to file the Arizona Form 140ez offers numerous benefits, including enhanced security features for your documents and a user-friendly interface. Additionally, you can track the signing process in real-time, ensuring you never miss an important deadline.

-

How do I get started with airSlate SignNow for the Arizona Form 140ez?

Getting started with airSlate SignNow is simple! Visit our website to sign up for an account, and you can begin uploading and sending your Arizona Form 140ez documents for eSignature immediately. Our platform is designed for ease of use, making the onboarding process quick and effortless.

-

What types of documents can I send using airSlate SignNow besides the Arizona Form 140ez?

In addition to the Arizona Form 140ez, airSlate SignNow allows you to send a wide variety of documents for eSignature, including contracts, agreements, and other tax forms. Our versatile platform is perfect for all your document needs, ensuring a comprehensive solution for businesses.

Get more for Arizona Form 140ez

- 1 pracodawca nazwa firmy adres wykaz dokumentw form

- Bcia 4057 child abuse central index inquiry request for out of state foster care amp adoption agencies child abuse central form

- Ssa711 form

- Patientsname form

- Maandoverzicht inkomsten en uitgaven abnamronl form

- Clearwater inspection pdf the city of south beloit southbeloit form

- Wolfs 109a vendor form sao state wy

- Form 760es estimated income tax payment vouchers for

Find out other Arizona Form 140ez

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document