Not Enter Data in Yellow Fields 2019

What is the Not Enter Data In Yellow Fields

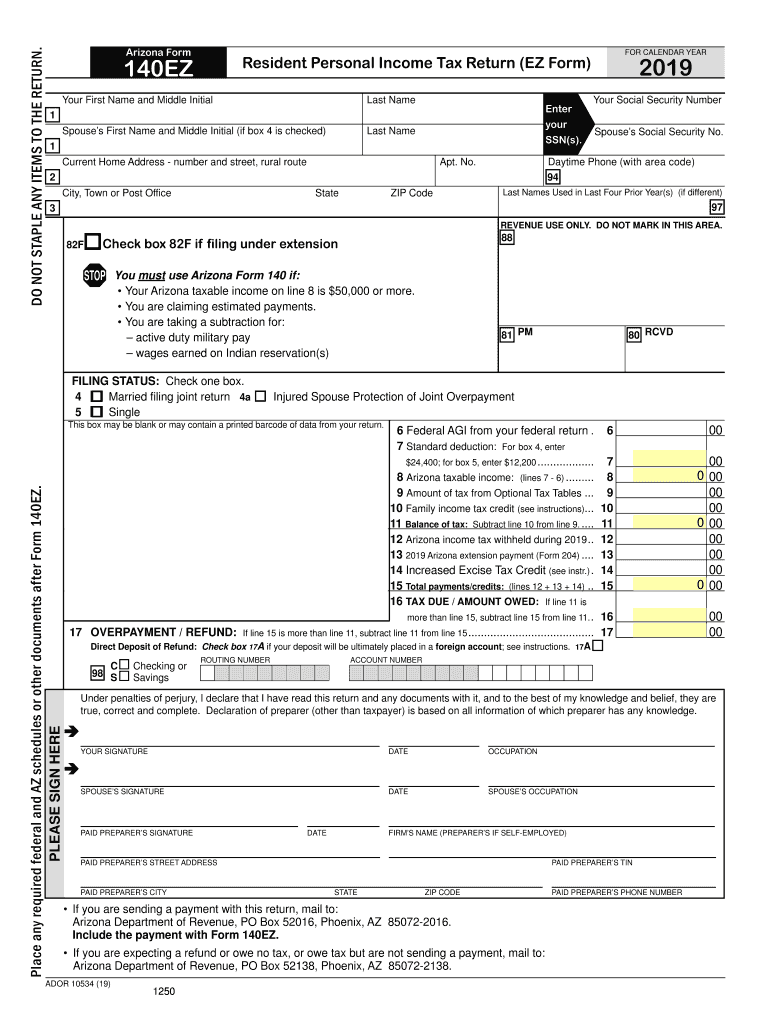

The "Not Enter Data In Yellow Fields" instruction is a crucial guideline for completing the Arizona A2 tax form. This directive indicates that certain fields are pre-filled or locked, meaning taxpayers should not input any information into these areas. These yellow fields typically contain data that the Arizona Department of Revenue has already processed or that is automatically calculated based on other entries. Adhering to this instruction ensures that the form is filled out correctly and minimizes the risk of errors that could lead to delays in processing.

How to use the Not Enter Data In Yellow Fields

When filling out the Arizona A2 tax form, it is essential to recognize the yellow-highlighted fields. Taxpayers should focus on completing only the designated areas that require their input. By avoiding the yellow fields, individuals can ensure that the information submitted is accurate and in compliance with the form's requirements. If a taxpayer accidentally enters data in these fields, it may lead to complications, such as rejection of the form or the need for additional clarification from the tax authority.

Steps to complete the Not Enter Data In Yellow Fields

To effectively complete the Arizona A2 tax form while adhering to the "Not Enter Data In Yellow Fields" guideline, follow these steps:

- Review the form thoroughly to identify which fields are highlighted in yellow.

- Gather all necessary documentation and information needed to fill out the form accurately.

- Complete only the fields that are not highlighted, ensuring that all required information is provided.

- Double-check entries for accuracy, avoiding any input in the yellow fields.

- Submit the form according to the specified filing methods, ensuring compliance with deadlines.

Legal use of the Not Enter Data In Yellow Fields

Understanding the legal implications of the "Not Enter Data In Yellow Fields" instruction is vital for taxpayers. This guideline is part of the official instructions provided by the Arizona Department of Revenue, and following it is necessary for ensuring the legal validity of the submitted form. Incorrectly entering data in these fields could result in non-compliance with state tax laws, potentially leading to penalties or delays in processing. Taxpayers should always refer to the official instructions accompanying the Arizona A2 tax form for the most accurate guidance.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona A2 tax form are critical for taxpayers to observe. Typically, the deadline for submitting state income tax returns aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to stay informed about any changes to these dates, as late submissions can incur penalties and interest on unpaid taxes. Always check with the Arizona Department of Revenue for the most current deadlines and important dates.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Arizona A2 tax form. The form can be filed online through the Arizona Department of Revenue's e-filing system, which is often the quickest and most efficient method. Alternatively, taxpayers may choose to mail their completed forms to the designated address provided in the form instructions. For those who prefer a personal touch, in-person submissions can be made at local tax offices. Each method has its own processing times and requirements, so taxpayers should select the option that best suits their needs.

Quick guide on how to complete not enter data in yellow fields

Effortlessly Prepare Not Enter Data In Yellow Fields on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. This method serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without delays. Handle Not Enter Data In Yellow Fields on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Not Enter Data In Yellow Fields with Ease

- Locate Not Enter Data In Yellow Fields and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Not Enter Data In Yellow Fields to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct not enter data in yellow fields

Create this form in 5 minutes!

How to create an eSignature for the not enter data in yellow fields

How to make an eSignature for your Not Enter Data In Yellow Fields online

How to generate an eSignature for the Not Enter Data In Yellow Fields in Chrome

How to create an eSignature for signing the Not Enter Data In Yellow Fields in Gmail

How to make an eSignature for the Not Enter Data In Yellow Fields straight from your smartphone

How to generate an electronic signature for the Not Enter Data In Yellow Fields on iOS devices

How to generate an electronic signature for the Not Enter Data In Yellow Fields on Android devices

People also ask

-

What does it mean to 'Not Enter Data In Yellow Fields' in airSlate SignNow?

In airSlate SignNow, you should 'Not Enter Data In Yellow Fields' as these fields are typically designated for specific automated processes or calculations. Filling them incorrectly can lead to errors in document processing, so it's important to adhere to this guideline to ensure smooth operations.

-

How can I ensure I do 'Not Enter Data In Yellow Fields' when using airSlate SignNow?

To avoid the mistake of 'Not Enter Data In Yellow Fields', familiarize yourself with the document templates and their specific field requirements. airSlate SignNow provides tooltips and guidelines within the platform to help you identify which fields are editable and which are not.

-

What features does airSlate SignNow offer to help avoid errors like 'Not Enter Data In Yellow Fields'?

airSlate SignNow offers a variety of features designed to minimize errors, such as customizable templates and intuitive drag-and-drop fields. These features help users understand where to enter data and reinforce the guideline of 'Not Enter Data In Yellow Fields' to maintain document integrity.

-

What are the pricing options for airSlate SignNow if I need to avoid mistakes like 'Not Enter Data In Yellow Fields'?

airSlate SignNow offers several pricing tiers to accommodate businesses of all sizes, ensuring you have access to the necessary features that help you 'Not Enter Data In Yellow Fields'. Each plan includes tools and support to facilitate smooth document management and eSigning.

-

Can I integrate airSlate SignNow with other software to help manage data entry?

Yes, airSlate SignNow offers integrations with various software tools such as CRM systems, cloud storage, and project management applications. These integrations can help streamline workflows and prevent issues like 'Not Enter Data In Yellow Fields' by automating data entry.

-

What benefits does airSlate SignNow provide to avoid data entry errors like 'Not Enter Data In Yellow Fields'?

By using airSlate SignNow, businesses benefit from a user-friendly interface and automated workflows that greatly reduce the risk of errors like 'Not Enter Data In Yellow Fields'. This not only saves time but also enhances the accuracy of your documents.

-

Is there customer support available if I accidentally 'Enter Data In Yellow Fields'?

Yes, airSlate SignNow provides comprehensive customer support to assist you if you encounter issues such as 'Enter Data In Yellow Fields'. Our support team can guide you through correcting mistakes and optimizing your use of the platform.

Get more for Not Enter Data In Yellow Fields

- Grade 1 assessments form

- Spad data collection form rt3119b railway undertakings

- Content form 42751924

- Untitled form 401 standard residential lease wordpresscom

- Affidavit of conversion in an adobe pdf file washoe county nevada washoecounty form

- Transcript request form poly prep country day school

- Social developmental history public schools of robeson county robeson k12 nc form

- Irs stop 6525 form

Find out other Not Enter Data In Yellow Fields

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT