Reset Form DO NOT STAPLE ANY ITEMS to the RETURN 2022

Understanding the Arizona State Tax Form 140EZ

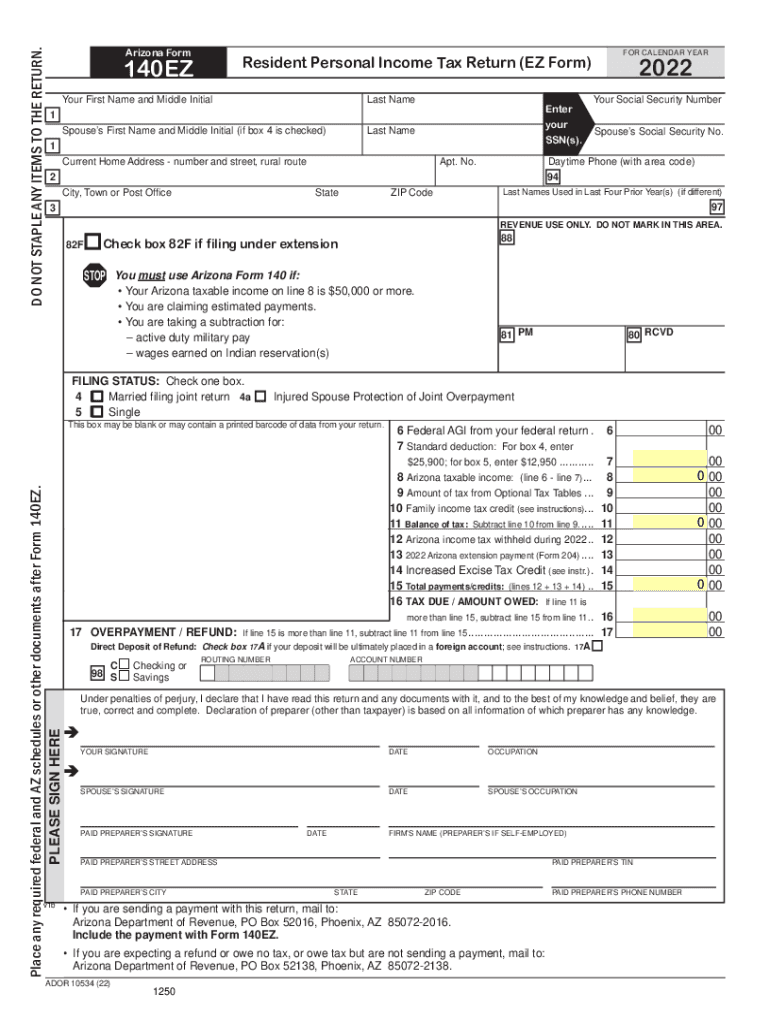

The Arizona State Tax Form 140EZ is designed for residents who have a straightforward tax situation. This form is suitable for individuals with a taxable income below a specific threshold, allowing for a simplified filing process. It is essential to ensure that you meet the eligibility criteria, which typically includes having income from wages, salaries, and pensions, but excludes business income or rental income. The 140EZ form streamlines the tax filing experience, making it accessible for many taxpayers.

Steps to Complete the Arizona 140EZ Form

Completing the Arizona 140EZ form involves several straightforward steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income as indicated, ensuring that all figures are accurate.

- Calculate your tax liability using the provided tax tables or software.

- Claim any applicable credits or deductions that you qualify for.

- Sign and date the form to validate your submission.

Filing Deadlines for the 140EZ Form

It is crucial to be aware of the filing deadlines for the Arizona 140EZ form to avoid penalties. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions available, but it is essential to file for an extension before the original deadline.

Legal Use of the Arizona 140EZ Form

The Arizona 140EZ form is legally binding when completed correctly and submitted on time. To ensure compliance, taxpayers must adhere to the instructions provided by the Arizona Department of Revenue. This includes accurately reporting income, claiming appropriate deductions, and signing the form. Failure to comply with these requirements may result in penalties or delays in processing your return.

Form Submission Methods for the Arizona 140EZ

Taxpayers have several options for submitting the Arizona 140EZ form:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing systems. This method is efficient and often results in quicker processing times.

- Mail Submission: If you prefer to file by mail, ensure that you send your completed form to the correct address as specified in the instructions. Use certified mail for tracking purposes.

- In-Person Submission: Some taxpayers may opt to deliver their forms in person at designated tax offices. This method allows for immediate confirmation of receipt.

Key Elements of the Arizona 140EZ Form

Understanding the key elements of the Arizona 140EZ form is vital for accurate completion. The form includes sections for personal information, income reporting, tax calculations, and signature lines. Each section must be filled out carefully to ensure that all information is correct. Additionally, taxpayers should be aware of any specific instructions related to deductions and credits that may apply to their situation.

Quick guide on how to complete reset form do not staple any items to the return

Prepare Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN with minimal effort

- Find Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reset form do not staple any items to the return

Create this form in 5 minutes!

How to create an eSignature for the reset form do not staple any items to the return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az 140ez return ez, and how does it work?

The az 140ez return ez is a simplified tax return form designed for eligible Arizona taxpayers. It allows users to complete their tax filing process quickly and efficiently. By using the az 140ez return ez form, taxpayers can streamline their tax preparation and possibly receive faster refunds.

-

How can airSlate SignNow assist with the az 140ez return ez?

airSlate SignNow can help you securely send and eSign your az 140ez return ez documents online. Our platform enables users to handle their tax documents with ease and eliminates the need for physical signatures. This convenience helps you focus more on your financial matters rather than paperwork.

-

What are the pricing options for airSlate SignNow for az 140ez return ez users?

airSlate SignNow offers competitive pricing for users wanting to leverage the platform for their az 140ez return ez needs. Our pricing is designed to be cost-effective while providing access to powerful eSignature features. Users can choose from various plans that accommodate different volumes of document processing.

-

What are the key features of airSlate SignNow related to the az 140ez return ez?

Key features of airSlate SignNow include secure electronic signatures, document templates, and cloud storage options. These features make completing the az 140ez return ez process more efficient and organized. You can easily manage your documents in one place and ensure compliance with local regulations.

-

Are there any integration options available for the az 140ez return ez process?

Yes, airSlate SignNow offers various integrations with popular applications and platforms. This means you can seamlessly incorporate your az 140ez return ez processes with tools you already use. Integrating with accounting or project management software can enhance your workflow signNowly.

-

Can I track the status of my az 140ez return ez documents using airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your az 140ez return ez documents in real time. You’ll receive notifications for each action taken on your documents, providing you peace of mind and ensuring you stay updated throughout the signing process.

-

Is airSlate SignNow secure for submitting an az 140ez return ez?

Yes, airSlate SignNow prioritizes security to ensure your az 140ez return ez documents are safe. We use encryption and other best practices to protect your sensitive information. You can confidently send and store your documents knowing they are safeguarded against unauthorized access.

Get more for Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN

Find out other Reset Form DO NOT STAPLE ANY ITEMS TO THE RETURN

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed