Apply for an Extension Individuals State of Oregon 2016

Understanding the Oregon Form OR-40 Instructions

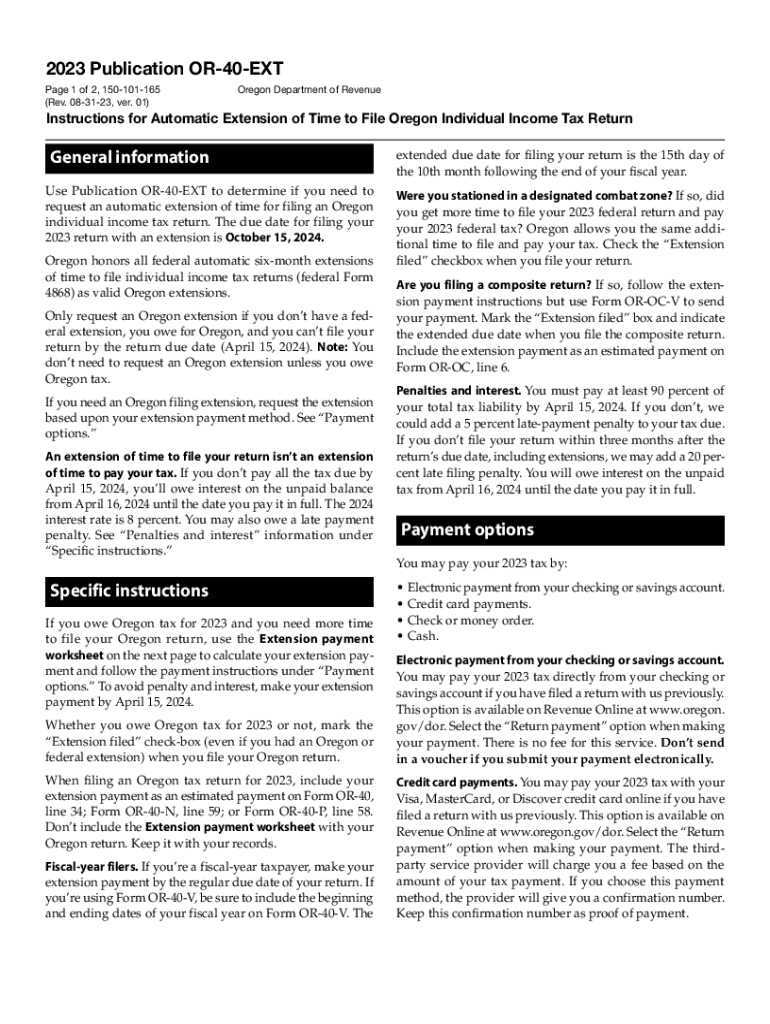

The Oregon Form OR-40 Instructions provide essential guidance for individuals filing their state income tax returns. This form is specifically designed for residents of Oregon, detailing how to report income, deductions, and credits. Understanding these instructions is crucial for ensuring accurate and compliant tax filings. The form outlines the necessary steps for calculating taxable income, determining tax liability, and claiming any applicable credits or deductions.

Steps to Complete the Oregon Form OR-40 Instructions

Completing the Oregon Form OR-40 requires several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your tax situation.

- Fill out the form, ensuring all information is accurate and complete.

- Calculate your total income, deductions, and credits as outlined in the instructions.

- Double-check your calculations to avoid errors that could lead to penalties.

- Submit the completed form by the designated deadline, either electronically or by mail.

Filing Deadlines and Important Dates

Filing deadlines for the Oregon Form OR-40 are critical to avoid penalties. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time to file, you can apply for an extension, which generally allows for an additional six months to submit your return.

Required Documents for Oregon Form OR-40

To complete the Oregon Form OR-40, you will need to gather several documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses, such as medical or educational costs

- Any relevant tax documents from previous years

Having these documents ready will streamline the filing process and help ensure accuracy in your tax return.

Form Submission Methods for Oregon Form OR-40

You can submit the Oregon Form OR-40 through various methods:

- Online: Use the Oregon Department of Revenue's e-filing system for a quick and secure submission.

- Mail: Send a paper copy of the completed form to the appropriate address provided in the instructions.

- In-Person: Visit a local tax office to submit your form directly.

Choosing the right submission method can enhance the efficiency of your filing process.

Penalties for Non-Compliance with Oregon Tax Regulations

Failure to comply with Oregon tax regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which may accrue if the return is submitted after the deadline.

- Underpayment penalties if insufficient tax is paid throughout the year.

- Interest on unpaid taxes, which compounds over time.

It's essential to adhere to all filing requirements to avoid these financial repercussions.

Eligibility Criteria for Oregon Form OR-40

To be eligible to file the Oregon Form OR-40, you must meet specific criteria:

- You must be a resident of Oregon for the entire tax year.

- Your income must exceed the minimum filing threshold set by the state.

- You must report all sources of income, including wages, self-employment income, and investment earnings.

Understanding these eligibility criteria is vital for ensuring compliance with state tax laws.

Quick guide on how to complete apply for an extension individuals state of oregon

Effortlessly prepare Apply For An Extension Individuals State Of Oregon on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Apply For An Extension Individuals State Of Oregon on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign Apply For An Extension Individuals State Of Oregon effortlessly

- Find Apply For An Extension Individuals State Of Oregon and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or blackout sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Apply For An Extension Individuals State Of Oregon and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct apply for an extension individuals state of oregon

Create this form in 5 minutes!

How to create an eSignature for the apply for an extension individuals state of oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon OR-40 instructions income tax form?

The Oregon OR-40 instructions income tax form is used by residents of Oregon to report their income and calculate their state tax liability. This form guides you through the process of completing your tax return accurately. Understanding the Oregon OR-40 is essential for ensuring compliance with state tax requirements.

-

How can airSlate SignNow help me complete the Oregon OR-40 instructions income tax form?

airSlate SignNow offers an intuitive platform that allows you to eSign documents, including your Oregon OR-40 instructions income tax form. Our easy-to-use interface simplifies the signing process, helping you complete your tax forms swiftly and securely. This solution ensures that you can manage your tax documents without hassle.

-

What features does airSlate SignNow provide for managing tax forms like the Oregon OR-40 instructions income tax form?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and electronic signature capabilities that streamline the management of tax forms like the Oregon OR-40 instructions income tax form. With these tools, you can prepare, send, and sign your documents efficiently, reducing the time spent on tax preparation.

-

Can I integrate airSlate SignNow with accounting software for the Oregon OR-40 instructions income tax form?

Yes, airSlate SignNow can integrate seamlessly with various accounting software to assist with filing the Oregon OR-40 instructions income tax form. This integration facilitates a smoother workflow, allowing you to pull data directly from your accounting software into your tax forms. Such compatibility enhances efficiency and accuracy.

-

What benefits does airSlate SignNow offer for eSigning the Oregon OR-40 instructions income tax form?

Using airSlate SignNow to eSign the Oregon OR-40 instructions income tax form saves you time and simplifies the signing process. You can sign and share documents from any device, ensuring you meet deadlines without needing to print or mail physical forms. This convenience makes airSlate SignNow an excellent choice for tax filing.

-

Is airSlate SignNow cost-effective for small businesses preparing the Oregon OR-40 instructions income tax form?

Absolutely, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their tax documents, including the Oregon OR-40 instructions income tax form. With affordable pricing plans and comprehensive features, you can ensure your tax processes are efficient and budget-friendly. Investing in our service ultimately saves you time and money.

-

How secure is airSlate SignNow when handling the Oregon OR-40 instructions income tax form?

airSlate SignNow prioritizes security, utilizing encryption and secure storage protocols when handling your Oregon OR-40 instructions income tax form. We adhere to industry standards to protect your sensitive information during the signing and submission process. You can trust that your documents are safe with our platform.

Get more for Apply For An Extension Individuals State Of Oregon

Find out other Apply For An Extension Individuals State Of Oregon

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document