Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 2016

What is the Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

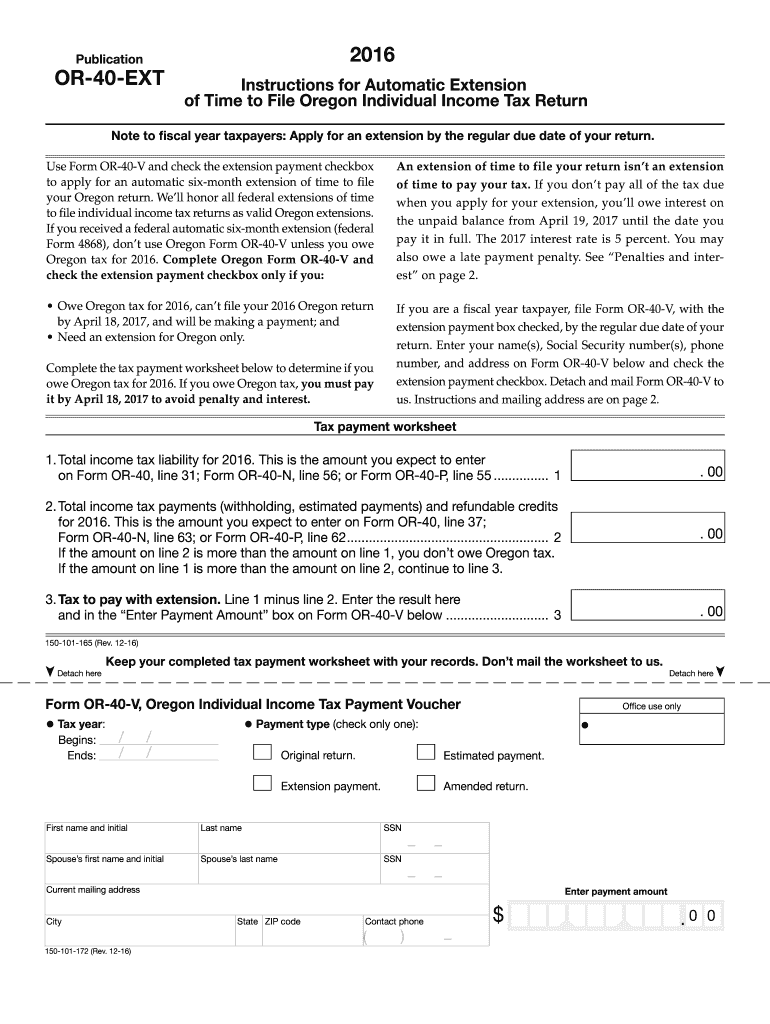

The Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 is a tax-related document used by residents of Oregon to facilitate the payment of state income taxes. This form provides detailed instructions for taxpayers on how to correctly complete their income tax payment voucher. It is essential for ensuring that payments are processed accurately and on time, helping taxpayers avoid potential penalties associated with late or incorrect submissions.

Steps to complete the Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

Completing the Form 40 ESV involves several key steps that ensure accuracy and compliance with Oregon tax regulations:

- Gather necessary information, including your Social Security number, income details, and any deductions or credits you plan to claim.

- Fill out the personal information section, ensuring all details are correct to avoid delays.

- Calculate your total income tax liability based on the provided instructions.

- Complete the payment section, indicating the amount you are submitting and the method of payment.

- Review the form for accuracy and completeness before signing.

- Submit the completed form according to the specified submission methods.

Legal use of the Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

The legal use of the Form 40 ESV is governed by Oregon tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Electronic signatures are acceptable if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that the document holds legal weight. It is crucial for taxpayers to retain copies of submitted forms for their records, as they may be required for future reference or audits.

State-specific rules for the Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

Oregon has specific rules and regulations that apply to the completion and submission of the Form 40 ESV. Taxpayers must be aware of the following:

- The form must be submitted by the state's tax filing deadline to avoid penalties.

- Taxpayers should ensure that they are using the most current version of the form, as updates may occur annually.

- Specific instructions regarding deductions and credits may vary based on individual circumstances, so it is advisable to consult the instructions carefully.

How to obtain the Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

The Form 40 ESV can be obtained through several channels. Taxpayers can access the form directly from the Oregon Department of Revenue's official website. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the correct version of the form for the current tax year to avoid any issues with your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 40 ESV are critical for compliance. Taxpayers should be aware that the typical deadline for submitting the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any changes in deadlines, especially for extensions or special circumstances that may affect filing dates.

Quick guide on how to complete 2016 form 40 esv instructions oregon 40 v income tax payment voucher 150 101 026

Effortlessly Prepare Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 Stress-Free

- Locate Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026 while ensuring excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 40 esv instructions oregon 40 v income tax payment voucher 150 101 026

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 40 esv instructions oregon 40 v income tax payment voucher 150 101 026

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What are the Form 40 ESV Instructions for Oregon 40 V Income Tax Payment Voucher, 150 101 026?

The Form 40 ESV Instructions for Oregon 40 V Income Tax Payment Voucher, 150 101 026 provide detailed guidance on how to accurately complete and submit your tax payment voucher. This includes step-by-step instructions, crucial deadlines, and useful notes to ensure compliance with Oregon tax regulations. Following these instructions can help prevent errors that may delay your tax processing.

-

How can airSlate SignNow assist with the Oregon 40 V Income Tax Payment Voucher?

airSlate SignNow offers an efficient platform for electronically signing the Oregon 40 V Income Tax Payment Voucher. With easy-to-use tools for document management, you can ensure that all necessary signatures are obtained quickly and securely, simplifying the process of filing your taxes in accordance with the Form 40 ESV Instructions. This feature streamlines your tax preparation, saving you time during tax season.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. These plans provide access to a range of features including the ability to securely eSign documents, such as the Oregon 40 V Income Tax Payment Voucher. Investing in our services can lead to signNow time and cost savings, especially during tax preparation.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure cloud storage for all your tax documents, including the Oregon 40 V Income Tax Payment Voucher. You can easily organize and access the Form 40 ESV Instructions, ensuring you have everything needed for a smooth tax submission. These features enhance overall efficiency and accuracy in managing your tax-related paperwork.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software solutions. This allows you to manage your tax documentation and filing, including the Oregon 40 V Income Tax Payment Voucher, directly from your preferred platform. These integrations can signNowly streamline your workflow and keep all your financial documentation in one place.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize bank-level encryption and double authentication measures to protect your information, including the Form 40 ESV Instructions and the Oregon 40 V Income Tax Payment Voucher. You can trust that your sensitive tax data remains confidential and secure throughout the eSign process.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow offers benefits such as faster processing times, improved accuracy in completing the Oregon 40 V Income Tax Payment Voucher, and a user-friendly interface to manage your tax documents. You'll also experience reduced paper waste and simplified tracking of your submissions, making it a smart choice for efficient tax management based on Form 40 ESV Instructions.

Get more for Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

- Malta work permit application form pdf

- Dbpr form ys 6000 1

- Microscope photo form

- Authority letter for collection of ielts trf form

- Jrotc unit marksmanship inspection form

- Mips reference sheet form

- Humana pain management form

- Form 5434 a rev 11 joint board for the enrollment of actuaries application for renewal of enrollment

Find out other Form 40 ESV Instructions, Oregon 40 V Income Tax Payment Voucher, 150 101 026

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free