Tc 721 Form 2018

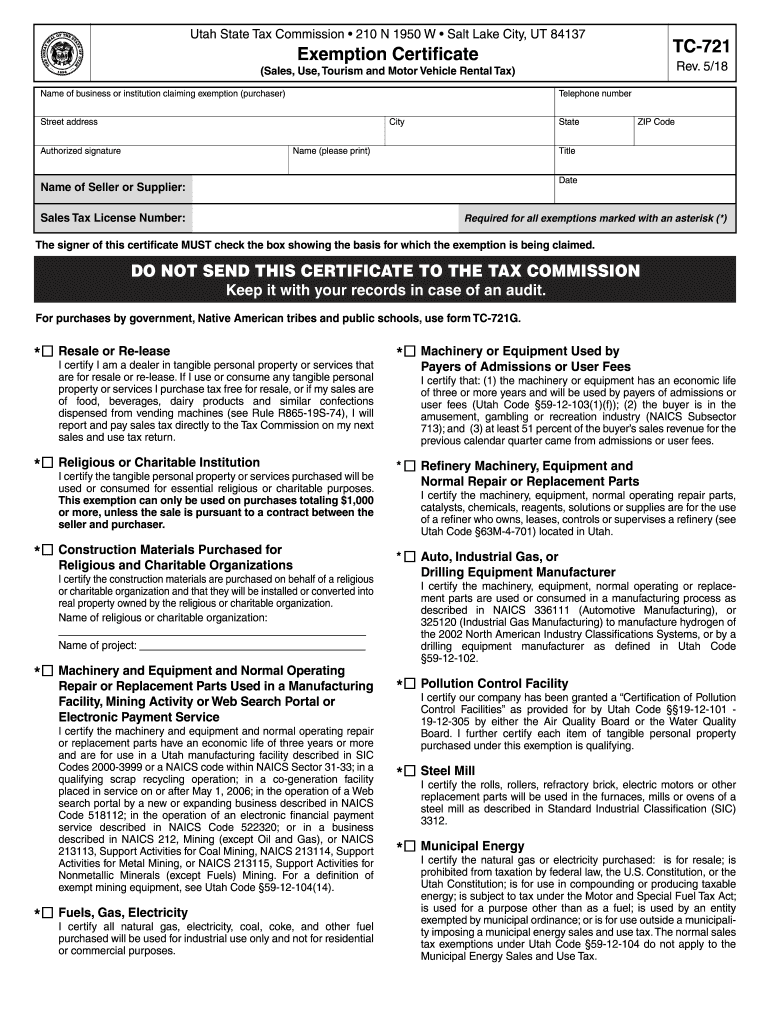

What is the Tc 721 Form

The Tc 721 Form is a specific document used for reporting purposes within the United States tax system. It is primarily utilized by individuals and businesses to provide essential information required by the Internal Revenue Service (IRS). This form is part of the broader tax compliance framework, ensuring that taxpayers accurately report their income and other pertinent financial details. Understanding the purpose and requirements of the Tc 721 Form is crucial for maintaining compliance with federal tax laws.

How to use the Tc 721 Form

Using the Tc 721 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and relevant tax records. Next, fill out the form with precise information, ensuring that all fields are completed as required. It is important to review the form for any errors before submitting it. Depending on your situation, you may need to attach additional documentation to support your claims. Finally, submit the form through the designated method, whether electronically or via mail.

Steps to complete the Tc 721 Form

Completing the Tc 721 Form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant documents, such as W-2s, 1099s, and other income records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions or credits accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring that you comply with eSignature requirements if submitting electronically.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the Tc 721 Form

The legal use of the Tc 721 Form is governed by IRS regulations, which outline the requirements for accurate reporting and compliance. It is essential for taxpayers to understand that submitting this form correctly is not only a legal obligation but also a way to ensure that they are not subject to penalties or audits. The IRS accepts eSignatures on this form, making it easier for individuals and businesses to comply with legal requirements while maintaining the integrity of their submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Tc 721 Form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing dates each tax year, as these can vary. Meeting these deadlines is essential to avoid late fees and penalties.

Form Submission Methods

The Tc 721 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-filing system, which allows for quick processing.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring that it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, which may be available for specific situations.

Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete tc 721 2018 2019 form 456260325

Your assistance manual on how to prepare your Tc 721 Form

If you’re looking to understand how to create and transmit your Tc 721 Form, here are some concise guidelines on how to simplify tax submitting signNowly.

To begin, you simply need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that allows you to edit, create, and finalize your tax documents effortlessly. With its editor, you can navigate between text, checkboxes, and eSignatures, and return to modify responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and straightforward sharing options.

Follow the steps below to complete your Tc 721 Form in no time:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Tc 721 Form in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Examine your document and rectify any errors.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can increase errors in returns and postpone reimbursements. Certainly, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tc 721 2018 2019 form 456260325

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the tc 721 2018 2019 form 456260325

How to create an eSignature for the Tc 721 2018 2019 Form 456260325 online

How to make an electronic signature for the Tc 721 2018 2019 Form 456260325 in Google Chrome

How to make an electronic signature for putting it on the Tc 721 2018 2019 Form 456260325 in Gmail

How to generate an electronic signature for the Tc 721 2018 2019 Form 456260325 right from your mobile device

How to create an eSignature for the Tc 721 2018 2019 Form 456260325 on iOS

How to create an eSignature for the Tc 721 2018 2019 Form 456260325 on Android

People also ask

-

What is the Tc 721 Form and how is it used?

The Tc 721 Form is a vital document used for various administrative and legal purposes. Primarily, it's utilized for tax compliance in specific industries. By using airSlate SignNow, you can efficiently fill, send, and eSign the Tc 721 Form to streamline your business processes.

-

How can I eSign the Tc 721 Form using airSlate SignNow?

With airSlate SignNow, eSigning the Tc 721 Form is quick and straightforward. You can upload the form, add signers, and send it out for signatures effortlessly. Our user-friendly platform ensures that you can complete the signing process securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Tc 721 Form?

Yes, there is a pricing structure associated with using airSlate SignNow for the Tc 721 Form. However, the solution is designed to be cost-effective, providing substantial value for those needing to manage documents efficiently. You can explore our pricing plans on our website to find one that fits your needs.

-

What features does airSlate SignNow offer for managing the Tc 721 Form?

airSlate SignNow offers a variety of features tailored for managing the Tc 721 Form. These include customizable templates, real-time tracking of document status, and automated reminders for signers. All these features work together to facilitate a seamless signing experience.

-

Can I integrate airSlate SignNow with other software systems for the Tc 721 Form?

Absolutely! airSlate SignNow enables integration with various software systems to enhance your productivity. You can integrate it with CRMs, cloud storage services, and other applications, making it easier to manage and send the Tc 721 Form within your existing workflows.

-

What benefits does airSlate SignNow provide for businesses using the Tc 721 Form?

Using airSlate SignNow for the Tc 721 Form offers several benefits, including enhanced efficiency and reduced turnaround time. Businesses can ensure compliance while minimizing errors in document processing. Ultimately, this translates to saving time and resources, allowing you to focus on core operations.

-

Is airSlate SignNow legally compliant for signing the Tc 721 Form?

Yes, airSlate SignNow is fully compliant with legal requirements for electronic signatures, making it a trusted choice for the Tc 721 Form. Our platform adheres to both national and international electronic signature laws, ensuring that your signed documents hold up in court.

Get more for Tc 721 Form

- Da form 4856 continuation sheet fillable

- How to complete unclaimed money form osr

- Elc007 master electrician application pub texas department of form

- Clothing allowance reimbursement form

- Benefits planning query handbook bpqy form

- Ab 540 affidavit csu chico csuchico form

- Sell car agreement template form

- Seller buyer agreement template form

Find out other Tc 721 Form

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile