Tc 721 2018

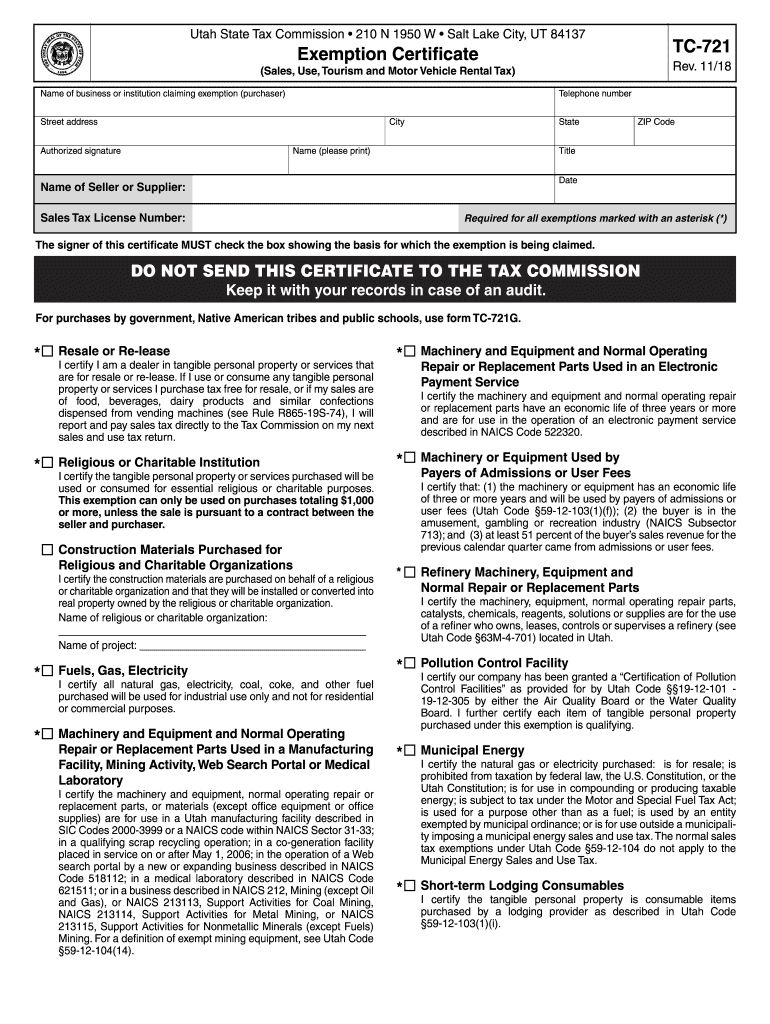

What is the TC 721?

The TC 721 form, also known as the Utah Tax Exempt Form TC 721, is a document used by residents of Utah to apply for property tax exemptions. This form is particularly relevant for senior citizens, disabled individuals, and certain qualifying homeowners. By filling out the TC 721, applicants can potentially reduce their property tax burden, making homeownership more affordable.

How to Use the TC 721

To effectively use the TC 721, individuals must first determine their eligibility based on the criteria set forth by the state of Utah. Once eligibility is confirmed, the form can be completed online or printed for manual submission. It is essential to provide accurate information, including personal details and any required documentation, to ensure the application is processed smoothly.

Steps to Complete the TC 721

Completing the TC 721 involves several key steps:

- Gather necessary personal information, including Social Security numbers and income details.

- Review eligibility requirements to ensure compliance with state regulations.

- Fill out the form accurately, paying attention to all required fields.

- Attach any supporting documents that may be required, such as proof of age or disability.

- Submit the completed form either online or via mail to the appropriate county office.

Legal Use of the TC 721

The TC 721 form is legally recognized in Utah for the purpose of applying for property tax exemptions. It is important for applicants to understand that submitting false information on this form can lead to penalties, including fines or disqualification from receiving future exemptions. Therefore, accuracy and honesty are crucial when completing this document.

Eligibility Criteria

Eligibility for the TC 721 varies based on several factors, including age, disability status, and income level. Generally, applicants must be at least sixty-five years old or have a qualifying disability. Additionally, there may be income limits that applicants must not exceed to qualify for the exemption. It is advisable to review the specific criteria outlined by the Utah State Tax Commission to ensure compliance.

Form Submission Methods

The TC 721 can be submitted through various methods, providing flexibility for applicants. Individuals can choose to complete the form online via the Utah State Tax Commission's website or print it out for submission by mail. In-person submissions may also be accepted at local county offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete tc 721 2018 2019 form

Your assistance manual on how to prepare your Tc 721

If you’re curious about how to generate and file your Tc 721, here are a few brief instructions on how to simplify tax submission.

First, you simply need to create your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to amend responses whenever necessary. Streamline your tax management with advanced PDF editing, eSigning, and intuitive sharing options.

Adhere to the steps below to finalize your Tc 721 in just minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to access any IRS tax form; explore various versions and schedules.

- Select Get form to access your Tc 721 in our editor.

- Complete the necessary fillable fields with your details (textual information, figures, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to increased errors and delay refunds. Additionally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tc 721 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the tc 721 2018 2019 form

How to generate an eSignature for your Tc 721 2018 2019 Form online

How to create an electronic signature for the Tc 721 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the Tc 721 2018 2019 Form in Gmail

How to create an eSignature for the Tc 721 2018 2019 Form right from your smart phone

How to generate an eSignature for the Tc 721 2018 2019 Form on iOS

How to generate an eSignature for the Tc 721 2018 2019 Form on Android

People also ask

-

What is the tc 721 form utah used for?

The tc 721 form utah is used to report a sale or transfer of a vehicle in Utah. This form helps ensure that the transaction is properly documented and that the appropriate taxes are recorded. It's essential for both buyers and sellers to complete the tc 721 form utah to avoid future legal complications.

-

How can airSlate SignNow assist with the tc 721 form utah?

airSlate SignNow simplifies the signing and sending process for the tc 721 form utah. With our platform, users can securely eSign documents from any device, making it easy to complete vehicle transactions. This streamlines the process and enhances efficiency for businesses and individuals alike.

-

Is there a cost associated with using airSlate SignNow for the tc 721 form utah?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling the tc 721 form utah. Our plans are designed to be cost-effective while providing robust features. Contact us for detailed pricing options that best fit your requirements.

-

What features does airSlate SignNow offer for the tc 721 form utah?

airSlate SignNow includes features such as document templates, advanced security, and cloud storage to manage the tc 721 form utah efficiently. Additionally, our platform supports integration with other applications to facilitate seamless workflow. This helps users manage their vehicle sales and transfers more effectively.

-

Can I integrate airSlate SignNow with other software for the tc 721 form utah?

Yes, airSlate SignNow provides integrations with various software solutions to enhance the handling of the tc 721 form utah. This includes CRM systems, document management tools, and more. Our seamless integration capabilities help automate processes and improve overall efficiency.

-

How secure is my information when using airSlate SignNow for the tc 721 form utah?

Your information is kept secure when using airSlate SignNow for the tc 721 form utah, with industry-standard encryption and compliance measures in place. We take data protection seriously, ensuring sensitive information remains confidential. Trust our platform for reliable and secure document handling.

-

What are the benefits of using airSlate SignNow for the tc 721 form utah?

Using airSlate SignNow for the tc 721 form utah offers numerous benefits, including increased efficiency and reduced paperwork. Our user-friendly interface allows for quick document preparation and signing, saving you time. Additionally, you can track document statuses easily, ensuring a smoother transaction process.

Get more for Tc 721

- Huskymate agreement form

- Grady hospital discharge papers form

- Permission form dufferin peel catholic district school board

- Mental residual functional capacity mrfc form

- Mcrf form 100591735

- Lease with house rules form

- Hipaa notice of privacy practices the health insurance form

- Self storage agreement template form

Find out other Tc 721

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document