Tc 721 Form 2017

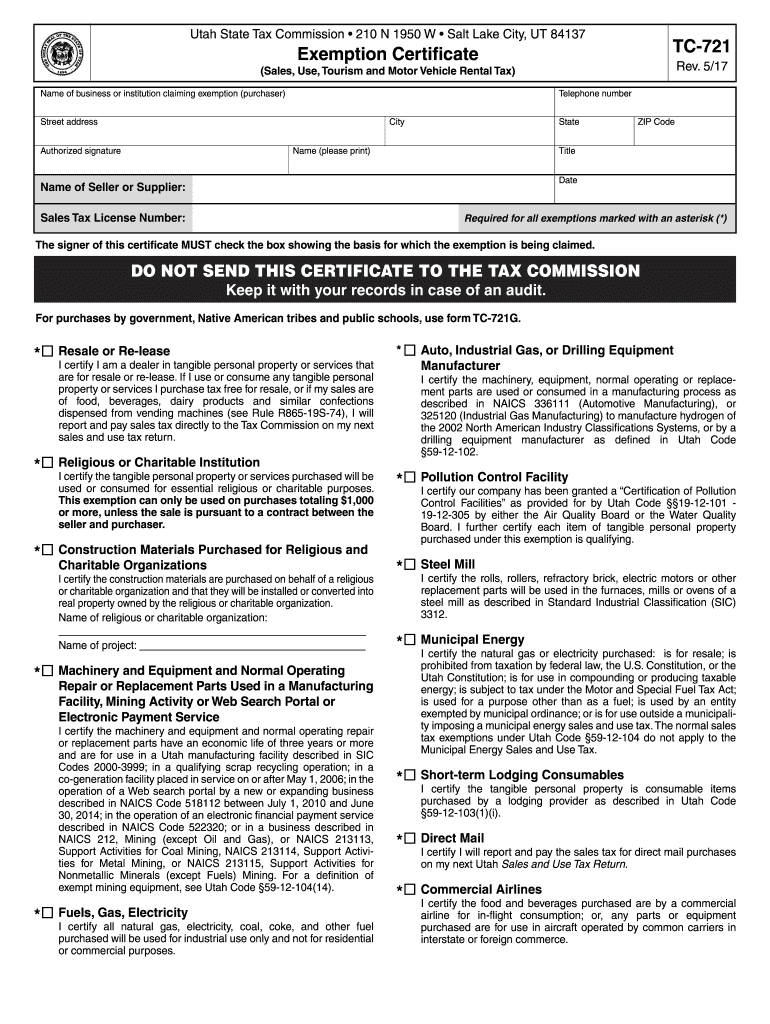

What is the Tc 721 Form

The Tc 721 Form is a specific tax document used primarily for reporting certain financial information to the IRS. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form typically includes sections for personal identification, income details, and deductions. Understanding the purpose and requirements of the Tc 721 Form is crucial for proper tax reporting.

How to use the Tc 721 Form

Using the Tc 721 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and submitting it. Utilizing an eSignature solution can simplify this process, allowing for a secure and efficient submission.

Steps to complete the Tc 721 Form

Completing the Tc 721 Form involves a systematic approach:

- Gather necessary documentation, including W-2s, 1099s, and receipts for deductions.

- Access the Tc 721 Form online or through authorized channels.

- Fill in personal information, including name, address, and Social Security number.

- Report income accurately in the designated sections.

- Include any applicable deductions and credits.

- Review the completed form for accuracy.

- Sign the form electronically or by hand, if required.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Tc 721 Form

The legal use of the Tc 721 Form is governed by IRS regulations. It is important to ensure that the form is completed in accordance with federal tax laws. Using the form for its intended purpose helps prevent legal issues and potential penalties. Additionally, electronic signatures are recognized by the IRS, making it easier for taxpayers to submit their forms while maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Tc 721 Form vary depending on the tax year and the taxpayer's status. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain circumstances. It is essential to stay informed about these deadlines to avoid late filing penalties and interest charges.

Form Submission Methods

The Tc 721 Form can be submitted through various methods, including:

- Online submission via the IRS e-filing system.

- Mailing a paper copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely delivery of the form.

Quick guide on how to complete tc 721 2017 form

Your assistance manual on how to prepare your Tc 721 Form

If you’re curious about creating and submitting your Tc 721 Form, here are a few straightforward tips to simplify tax filing.

To start, you just need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, generate, and finalize your tax forms with ease. With its editor, you can easily alternate between text, check boxes, and eSignatures and return to amend details as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Tc 721 Form in just a few minutes:

- Sign up for your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore different types and schedules.

- Click Get form to access your Tc 721 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print out your version, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to more errors and longer refund times. Before electronically filing your taxes, be sure to check the IRS website for submission guidelines in your area.

Create this form in 5 minutes or less

Find and fill out the correct tc 721 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the tc 721 2017 form

How to make an eSignature for the Tc 721 2017 Form online

How to make an eSignature for the Tc 721 2017 Form in Google Chrome

How to create an eSignature for putting it on the Tc 721 2017 Form in Gmail

How to generate an electronic signature for the Tc 721 2017 Form from your smart phone

How to make an eSignature for the Tc 721 2017 Form on iOS

How to create an eSignature for the Tc 721 2017 Form on Android OS

People also ask

-

What is the Tc 721 Form and why do I need it?

The Tc 721 Form is a crucial document used for various tax purposes, particularly in property transactions. Businesses often require this form to ensure compliance with tax regulations. Using airSlate SignNow, you can easily prepare, send, and eSign the Tc 721 Form, streamlining your documentation process.

-

How does airSlate SignNow simplify the Tc 721 Form process?

airSlate SignNow simplifies the Tc 721 Form process by providing an intuitive platform for document management. You can create templates, fill out the Tc 721 Form, and send it for electronic signatures all in one place. This not only saves time but also reduces the chances of errors typically associated with manual handling.

-

Is there a cost associated with using airSlate SignNow for the Tc 721 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost-effective solution allows businesses to manage the Tc 721 Form and other documents without breaking the bank. You can choose a plan that offers the features you need for seamless document management.

-

Can I integrate airSlate SignNow with other software for handling the Tc 721 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions to enhance your workflow. Whether you're using CRM systems or accounting software, you can easily connect them to manage the Tc 721 Form efficiently alongside your other business documents.

-

What are the benefits of eSigning the Tc 721 Form with airSlate SignNow?

eSigning the Tc 721 Form with airSlate SignNow offers numerous benefits such as increased efficiency, security, and compliance. It allows you to sign documents from anywhere, ensuring that your transactions are expedited. Additionally, the platform maintains a complete audit trail for your records.

-

How secure is the airSlate SignNow platform for handling the Tc 721 Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Tc 721 Form. The platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are secure while being processed and stored.

-

Can I customize the Tc 721 Form within airSlate SignNow?

Yes, you can easily customize the Tc 721 Form within airSlate SignNow to suit your specific needs. The platform allows you to add fields, instructions, and branding elements to tailor the document effectively. This customization ensures that the form aligns with your business requirements.

Get more for Tc 721 Form

- California cpe form

- Renewal application cg10r form

- How to fill out vn219 form

- Chapter 2 origins of american government worksheet answers form

- Direct depositpayroll deduction form chevron federal credit union chevronfcu

- Www iowadnr govportalsidnrwater and wastewater operator certificaiton program affidavit form

- Self employed agreement template form

- Sell agreement template form

Find out other Tc 721 Form

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast