Form M R 2018

What is the Form M R

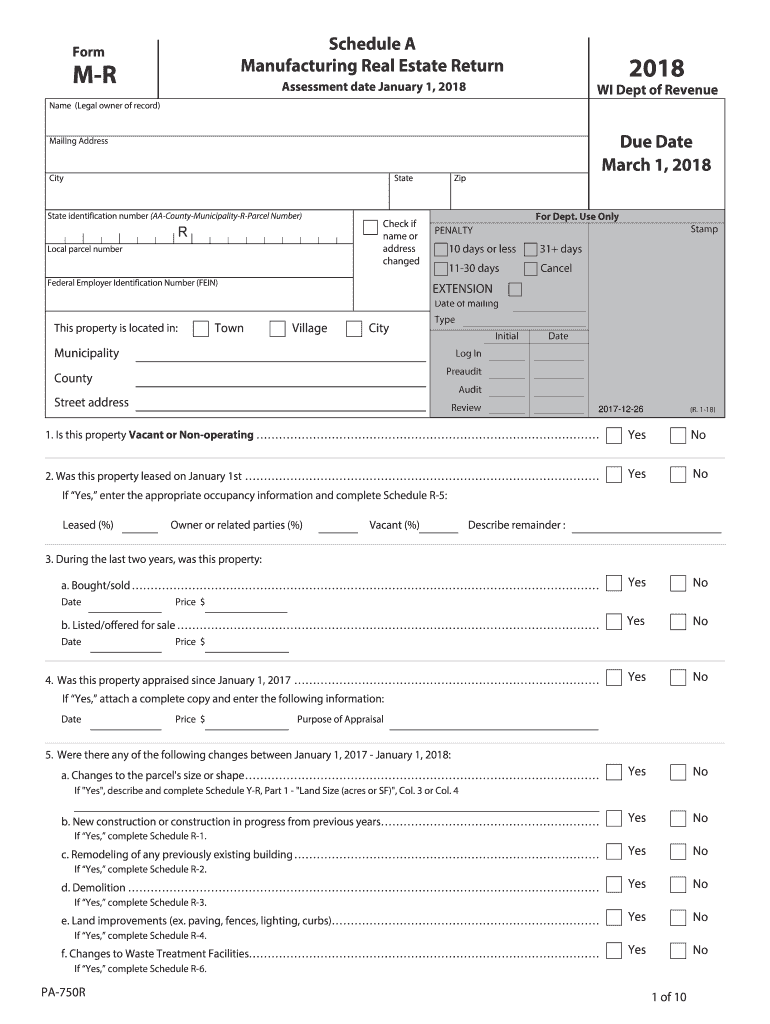

The Form M R is a tax form used in the United States for specific reporting purposes. It is primarily utilized by individuals and businesses to report various financial activities to the Internal Revenue Service (IRS). This form ensures compliance with federal tax regulations and helps in the accurate calculation of tax liabilities. Understanding the purpose and requirements of the Form M R is essential for proper tax reporting.

How to use the Form M R

Using the Form M R involves several key steps. First, gather all necessary financial information, including income, deductions, and credits relevant to the reporting period. Next, accurately fill out the form, ensuring that all fields are completed correctly. After completing the form, review it for any errors or omissions before submission. The form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to complete the Form M R

Completing the Form M R requires a methodical approach. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and any receipts for deductions.

- Access the Form M R online or obtain a physical copy from authorized sources.

- Fill out the form, ensuring that all personal and financial information is accurate.

- Double-check your entries for accuracy and completeness.

- Sign and date the form, if required.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Form M R

The Form M R must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of all information reported. The IRS allows for electronic signatures on the Form M R, which can streamline the filing process. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form M R are critical for compliance. Typically, the form must be submitted by April 15 of the year following the tax year being reported. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines or requirements announced by the IRS, as these can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Form M R can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through IRS-approved software, which often simplifies the process.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline.

- In-Person: Some taxpayers may opt to deliver the form in person at designated IRS offices, though this method is less common.

Quick guide on how to complete form m r 2018 2019

Your assistance manual on how to prepare your Form M R

If you’re curious about how to complete and submit your Form M R, here are a few concise guidelines on how to streamline tax processing.

To start, you simply need to sign up for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that allows you to edit, create, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Form M R in no time:

- Create your account and start working on PDFs within moments.

- Browse our catalog to obtain any IRS tax form; explore versions and schedules.

- Click Get form to access your Form M R in our editor.

- Populate the required fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can heighten return errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form m r 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

Create this form in 5 minutes!

How to create an eSignature for the form m r 2018 2019

How to make an electronic signature for the Form M R 2018 2019 online

How to generate an electronic signature for the Form M R 2018 2019 in Chrome

How to generate an eSignature for signing the Form M R 2018 2019 in Gmail

How to create an eSignature for the Form M R 2018 2019 right from your mobile device

How to make an eSignature for the Form M R 2018 2019 on iOS

How to make an electronic signature for the Form M R 2018 2019 on Android devices

People also ask

-

What is Form M R and how does it work with airSlate SignNow?

Form M R is a specific form used for various regulatory processes. With airSlate SignNow, you can easily fill out and eSign Form M R, enhancing your workflow with a seamless digital solution.

-

How much does it cost to use airSlate SignNow for Form M R?

airSlate SignNow offers competitive pricing plans that accommodate various business needs. You can choose a plan that best suits your requirements for managing Form M R, ensuring a cost-effective solution.

-

What features are available for Form M R on airSlate SignNow?

airSlate SignNow provides a range of features for managing Form M R, including customizable templates, secure eSignature capabilities, and document tracking. These features streamline your form management process.

-

Can Form M R be integrated with other applications using airSlate SignNow?

Yes, airSlate SignNow allows integration with various applications to streamline your workflow involving Form M R. You can connect it with CRM systems, cloud storage, and more to enhance productivity.

-

What are the benefits of using airSlate SignNow for Form M R?

Using airSlate SignNow for Form M R simplifies the signing process and saves time. It ensures compliance, increases efficiency, and reduces the need for physical paperwork, making it an ideal choice for businesses.

-

Is airSlate SignNow secure for handling sensitive Form M R documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption methods to protect sensitive Form M R documents. Your information remains secure throughout the signing process.

-

How can I get started with airSlate SignNow for Form M R?

Getting started with airSlate SignNow for Form M R is easy. Simply sign up for an account, create or upload your Form M R, and begin eSigning with just a few clicks.

Get more for Form M R

Find out other Form M R

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe