Form 2439 Fill in Version Notice to Shareholder of Undistributed Long Term Capital Gains

What is the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

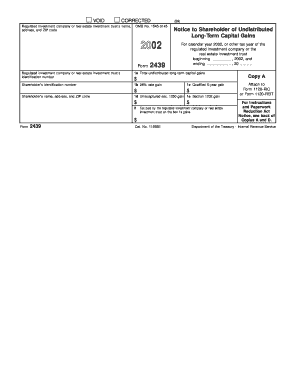

The Form 2439 is a tax document issued by regulated investment companies to inform shareholders about undistributed long-term capital gains. This form is essential for shareholders who need to report these gains on their tax returns. It provides details about the amount of capital gains that have not been distributed, which can impact the tax liability of the shareholder. By receiving this form, shareholders can ensure they are aware of their tax obligations related to these gains, as they may need to pay taxes on the amount reported, even if they did not receive a cash distribution.

How to use the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Using Form 2439 involves a few straightforward steps. First, shareholders should carefully review the information provided on the form, including the total amount of undistributed long-term capital gains. It's important to note how these gains will affect their tax returns. Shareholders must report the amount from Form 2439 on their tax returns, typically on Schedule D of Form 1040. This ensures that they accurately reflect their tax liability. Additionally, keeping a copy of the form for personal records is advisable, as it may be needed for future reference or audits.

Steps to complete the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Completing Form 2439 requires careful attention to detail. Here are the steps to follow:

- Review the form for accuracy, ensuring that all information is correct and up to date.

- Identify the total amount of undistributed long-term capital gains listed on the form.

- Transfer this amount to the appropriate section of your tax return, typically Schedule D.

- Keep a copy of the completed form for your records.

By following these steps, shareholders can ensure compliance with tax regulations and accurately report their capital gains.

Legal use of the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

The legal use of Form 2439 is crucial for compliance with U.S. tax laws. Shareholders are required to report undistributed long-term capital gains as part of their taxable income. Failure to report these amounts can lead to penalties and interest charges from the Internal Revenue Service (IRS). The form serves as an official notification from the investment company to the shareholder, establishing the tax liability associated with these undistributed gains. Therefore, it is essential for shareholders to understand the legal implications of this form and ensure it is accurately reflected in their tax filings.

Key elements of the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Key elements of Form 2439 include:

- The name and address of the shareholder.

- The name of the investment company issuing the form.

- The total amount of undistributed long-term capital gains.

- The tax year for which the gains are reported.

Each of these components is critical for ensuring that shareholders can accurately report their income and comply with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for Form 2439 align with the general tax filing deadlines set by the IRS. Typically, shareholders must report the information from Form 2439 when they file their annual tax returns, which is usually due on April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for shareholders to be aware of these dates to avoid penalties and ensure timely compliance with tax obligations.

Quick guide on how to complete form 2439 fill in version notice to shareholder of undistributed long term capital gains 5996304

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Create this form in 5 minutes!

How to create an eSignature for the form 2439 fill in version notice to shareholder of undistributed long term capital gains 5996304

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains?

The Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains is a document that shareholders receive to report long-term capital gains from mutual funds or real estate investment trusts (REITs). This form outlines the amounts of undistributed gains and the tax implications for shareholders. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow assist with completing Form 2439 Fill in Version?

airSlate SignNow offers an easy-to-use platform that enables users to fill in and eSign the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains efficiently. With customizable templates and a straightforward interface, users can quickly complete and send the required documents electronically, reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for Form 2439 Fill in Version?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Users can choose a plan that provides them with access to features specifically designed for completing documents like the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains, at a competitive rate.

-

What features does airSlate SignNow offer for managing Form 2439 Fill in Version?

airSlate SignNow provides features such as document templates, cloud storage, and electronic signatures to simplify the management of the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains. These features streamline the filling process, enhance collaboration, and ensure secure storage of important documents.

-

Can I integrate airSlate SignNow with my accounting software for Form 2439 Fill in Version?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software solutions. This allows you to easily manage and file the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains alongside your other financial documentation.

-

What are the benefits of using airSlate SignNow for Form 2439 Fill in Version?

Using airSlate SignNow to manage the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains offers signNow benefits, including time savings, decreased paperwork, and improved accuracy. By eSigning and sharing documents electronically, businesses can streamline their operations and enhance customer satisfaction.

-

Is technical support available when using airSlate SignNow for Form 2439 Fill in Version?

Yes, airSlate SignNow provides dedicated customer support to assist users with any inquiries related to the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains. Whether you need help with features, troubleshooting, or general questions, the support team is available to guide you through the process.

Get more for Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Find out other Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document