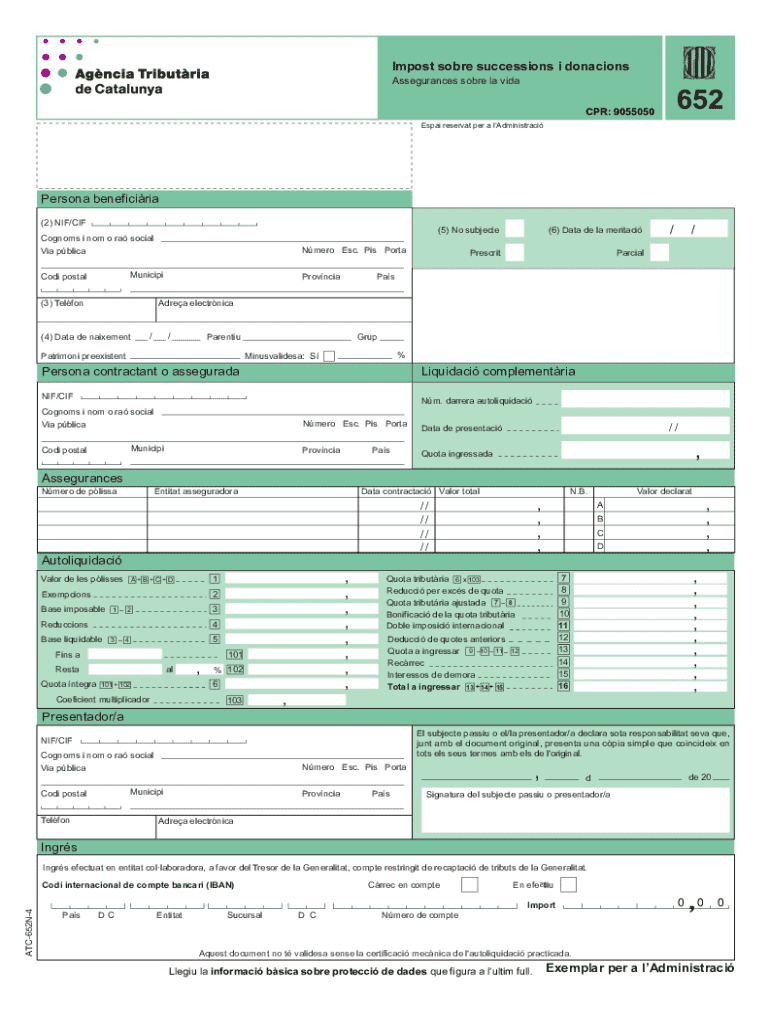

Impost Sobre Successions I Donacions Form

What is the Impost Sobre Successions I Donacions

The Impost Sobre Successions I Donacions is a tax levied on the transfer of assets upon death or as a gift. This tax is applicable in various jurisdictions and is designed to ensure that the state collects revenue from the transfer of wealth. In the United States, similar taxes may vary by state, with each having its own regulations and rates. Understanding this tax is crucial for individuals involved in estate planning or those who are beneficiaries of an estate or gifts.

Steps to complete the Impost Sobre Successions I Donacions

Completing the Impost Sobre Successions I Donacions involves several key steps:

- Gather necessary information about the deceased or donor, including assets and liabilities.

- Determine the fair market value of the assets at the time of transfer.

- Identify any exemptions or deductions that may apply based on state laws.

- Complete the relevant forms accurately, ensuring all information is correct.

- Submit the forms to the appropriate tax authority by the specified deadline.

Each step is essential to ensure compliance and avoid penalties.

Required Documents

When filing the Impost Sobre Successions I Donacions, several documents are typically required:

- Death certificate or documentation of the gift.

- Inventory of the deceased's or donor's assets.

- Appraisals for real estate or valuable items.

- Financial statements showing liabilities.

- Completed tax forms specific to the jurisdiction.

Having these documents ready will facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Impost Sobre Successions I Donacions can vary significantly by state. Generally, the tax must be filed within a specific period after the transfer occurs, often within nine months. It is important to check with local tax authorities for precise dates to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely compliance.

Legal use of the Impost Sobre Successions I Donacions

The legal framework governing the Impost Sobre Successions I Donacions includes various statutes and regulations that dictate how the tax is assessed and collected. Understanding these laws is vital for individuals and estates to ensure compliance and minimize tax liability. Consulting with a tax professional or attorney can provide clarity on legal obligations and potential strategies for tax planning.

Examples of using the Impost Sobre Successions I Donacions

Examples of situations where the Impost Sobre Successions I Donacions may apply include:

- An individual inherits property from a deceased relative, triggering the tax based on the value of the estate.

- A parent gifts a substantial sum of money to their child, which may be subject to gift tax regulations.

- Assets transferred during estate planning, such as trusts or joint ownership arrangements, may also invoke this tax.

These examples illustrate the importance of understanding the tax implications of asset transfers.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impost sobre successions i donacions 629921498

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impost Sobre Successions I Donacions?

The Impost Sobre Successions I Donacions is a tax levied on inheritances and donations in certain jurisdictions. Understanding this tax is crucial for individuals and businesses involved in estate planning or asset transfer. airSlate SignNow can help streamline the documentation process related to these transactions.

-

How can airSlate SignNow assist with Impost Sobre Successions I Donacions?

airSlate SignNow provides an efficient platform for managing documents related to the Impost Sobre Successions I Donacions. With our eSigning capabilities, you can easily prepare, send, and sign necessary documents, ensuring compliance and reducing the risk of errors. This simplifies the process for both individuals and legal professionals.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our plans are designed to provide value while ensuring you have the tools necessary to manage documents related to the Impost Sobre Successions I Donacions effectively. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing Impost Sobre Successions I Donacions?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for handling Impost Sobre Successions I Donacions. These features help ensure that all necessary documentation is completed accurately and efficiently, saving you time and effort.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling documents related to the Impost Sobre Successions I Donacions. We utilize advanced encryption and security protocols to protect your data, ensuring that your sensitive information remains confidential.

-

Can airSlate SignNow integrate with other software for managing Impost Sobre Successions I Donacions?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when dealing with the Impost Sobre Successions I Donacions. This allows you to connect with your existing tools, making document management seamless and efficient.

-

What are the benefits of using airSlate SignNow for Impost Sobre Successions I Donacions?

Using airSlate SignNow for the Impost Sobre Successions I Donacions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, allowing you to focus on what matters most—managing your assets and ensuring compliance.

Get more for Impost Sobre Successions I Donacions

- Nj lease agreement pdf filler form

- Proceed patient assistance program viekira pak form

- Informal observation form

- Physicians statement of examination 16670887 form

- Army fste justification example form

- Medical emergency contacts list names and phone s form

- Month rental agreement template form

- Month to month room rental agreement template form

Find out other Impost Sobre Successions I Donacions

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast