Educational Requirements for CPA Licensure Self Assessment 2019-2026

What are the educational requirements for CPA licensure?

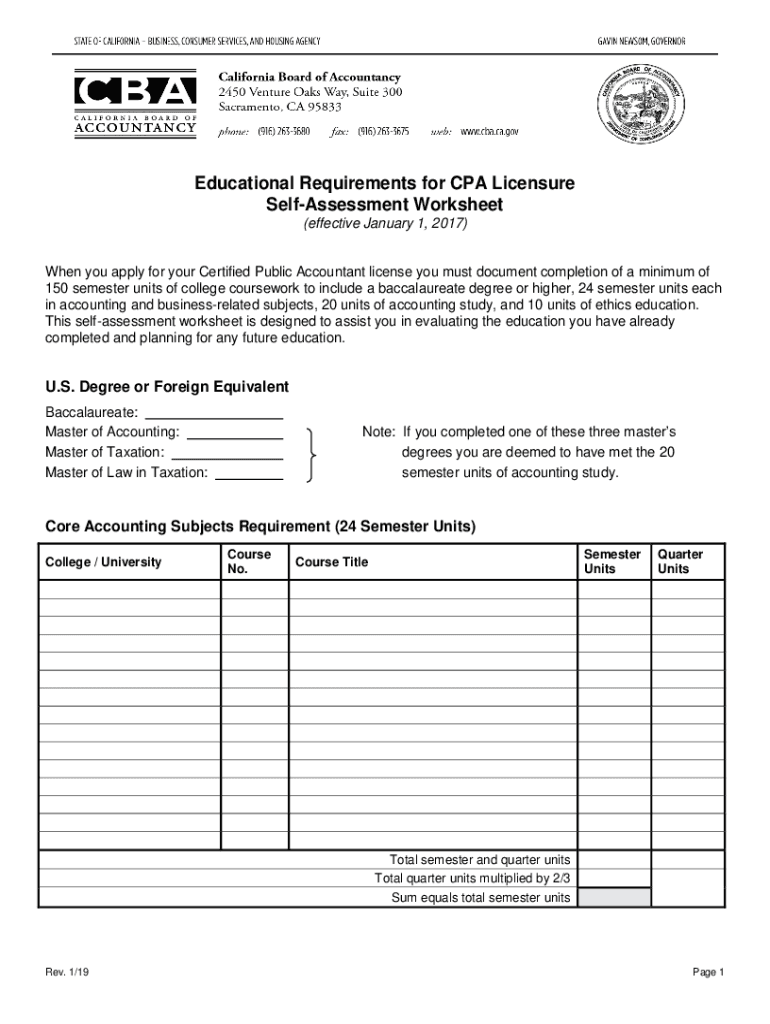

The educational requirements for CPA licensure in California typically include the completion of a bachelor's degree with a concentration in accounting or a related field. Candidates must earn at least 150 semester units of college education, which often involves additional coursework beyond a standard four-year degree. This education must include specific courses in accounting, business, and ethics, ensuring that candidates are well-prepared for the responsibilities of a CPA.

Steps to complete the educational requirements for CPA licensure

To fulfill the educational requirements for CPA licensure in California, follow these steps:

- Complete a bachelor's degree from an accredited institution.

- Ensure that your degree includes at least twenty-four semester units in accounting subjects and twenty-four semester units in business-related subjects.

- Take additional courses to reach the required total of 150 semester units, which may include graduate-level coursework.

- Maintain documentation of your educational credentials, as these will be necessary for your application.

How to use the educational requirements for CPA licensure self-assessment

The educational requirements for CPA licensure self-assessment is a tool designed to help candidates evaluate their educational background against the state requirements. To use this self-assessment:

- Gather your academic transcripts and course descriptions.

- Compare your completed courses with the required subjects listed by the California Board of Accountancy.

- Identify any gaps in your education that need to be addressed before applying for licensure.

Key elements of the educational requirements for CPA licensure

Understanding the key elements of the educational requirements for CPA licensure is crucial for prospective candidates. These elements include:

- A minimum of 150 semester units of college education.

- Specific coursework in accounting, auditing, taxation, and business ethics.

- Documentation of your educational history, including transcripts and course syllabi.

Eligibility criteria for CPA licensure in California

To be eligible for CPA licensure in California, candidates must meet several criteria, including:

- Completion of the required educational units and coursework.

- Passing the Uniform CPA Examination.

- Meeting the experience requirements, which typically involve working under the supervision of a licensed CPA.

Application process and approval time for CPA licensure

The application process for CPA licensure in California involves several steps:

- Submit your application along with the required documentation, including transcripts and proof of experience.

- Pay the application fee as outlined by the California Board of Accountancy.

- Wait for the Board to review your application, which can take several weeks to months, depending on the volume of applications.

Quick guide on how to complete educational requirements for cpa licensure self assessment

Effortlessly Prepare Educational Requirements For CPA Licensure Self Assessment on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and efficiently. Manage Educational Requirements For CPA Licensure Self Assessment on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The simplest way to modify and electronically sign Educational Requirements For CPA Licensure Self Assessment with ease

- Find Educational Requirements For CPA Licensure Self Assessment and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important areas of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Educational Requirements For CPA Licensure Self Assessment and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct educational requirements for cpa licensure self assessment

Create this form in 5 minutes!

How to create an eSignature for the educational requirements for cpa licensure self assessment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I prepare myself for the CPA exam?

How to Pass the CPA Exam Develop a Study Plan and Stick to It. ... Ensure Your Family and Friends Understand the Commitment You're Undertaking. ... Take Electives in Your Degree Program that Prepare You for the Exam. ... Practice, Practice, Practice. ... Don't Waste Time Studying what You Already Know.

-

How long do you need to study for the CPA exam?

Depending on the Discipline you choose, you can expect your CPA Exam study time to be between 320 and 420 hours, or between 80 and 120 hours per section. But with a smart study strategy and the right materials, you can keep from getting overwhelmed while making sure you're ready to walk into the exam with confidence.

-

Do you need 150 units to sit for CPA?

Education Requirements 150 total semester units including 24 semester units of accounting subjects, 24 semester units of business-related subjects, 20 semester units of accounting study subjects, and 10 semester units of ethics study.

-

Can you study for the CPA exam while working full time?

As a full-time employee, you'll have to find a way to allocate time from your 24-hour day toward studying. Unless you're a genius, it'll take you a few weeks or longer to study for each section. Therefore, it's important that you find time to study before, during, after work and on the weekends.

-

What are the requirements for CPA in California 2024?

The educational requirements for California CPAs includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor's degree. As part of these 150 hours, you must have 24 hours of accounting subjects, 24 hours of business subjects, 20 hours of accounting study subjects, and 10 units of ethics.

-

What are the minimum educational requirements for a CPA license in California?

Education Requirements for Becoming a CPA in California. Education requirements for CPA licensure vary among states, but you need a bachelor's degree at minimum. In California, you'll need to complete at least 150 college credits before you can become a CPA.

-

Is it possible to self study for the CPA exam?

With the extensive coverage of topics, comprehensive questions, and time constraints, many choose to prepare through self-study or review courses offered by various providers. Cramming may not the best option to prepare for the CPA exam.

-

Can you self study for CPA exams?

A. Yes. 100 percent of the CE requirements may be completed by qualifying self-study programs.

Get more for Educational Requirements For CPA Licensure Self Assessment

- Soc 426a 1 16 form

- Dual citizenship application form philippine consulate general

- Optum rx prior auth form

- Patient access to release medical records form

- Roland morris acute low back pain disability questionnaire form

- Colorado birth certificate request mesa county public health form

- Colorado first judicial district attorneys officecreating a form

- Dmap prior authorization form 557971262

Find out other Educational Requirements For CPA Licensure Self Assessment

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free