POINTIEST FORMWithdrawal Preregistered Plans & FSA 2021-2026

Understanding Canada TFSA Withdrawal

The Tax-Free Savings Account (TFSA) is a popular savings vehicle in Canada that allows individuals to save and invest money without paying taxes on the earnings. When considering a Canada TFSA withdrawal, it's essential to understand the implications, including the impact on contribution room and any potential tax consequences. Withdrawals from a TFSA are not taxed, and the amount withdrawn can be re-contributed in future years without affecting the annual contribution limit.

Steps to Complete a Canada TFSA Withdrawal

Completing a Canada TFSA withdrawal involves several straightforward steps:

- Determine the amount you wish to withdraw from your TFSA.

- Contact your financial institution or use their online platform to initiate the withdrawal process.

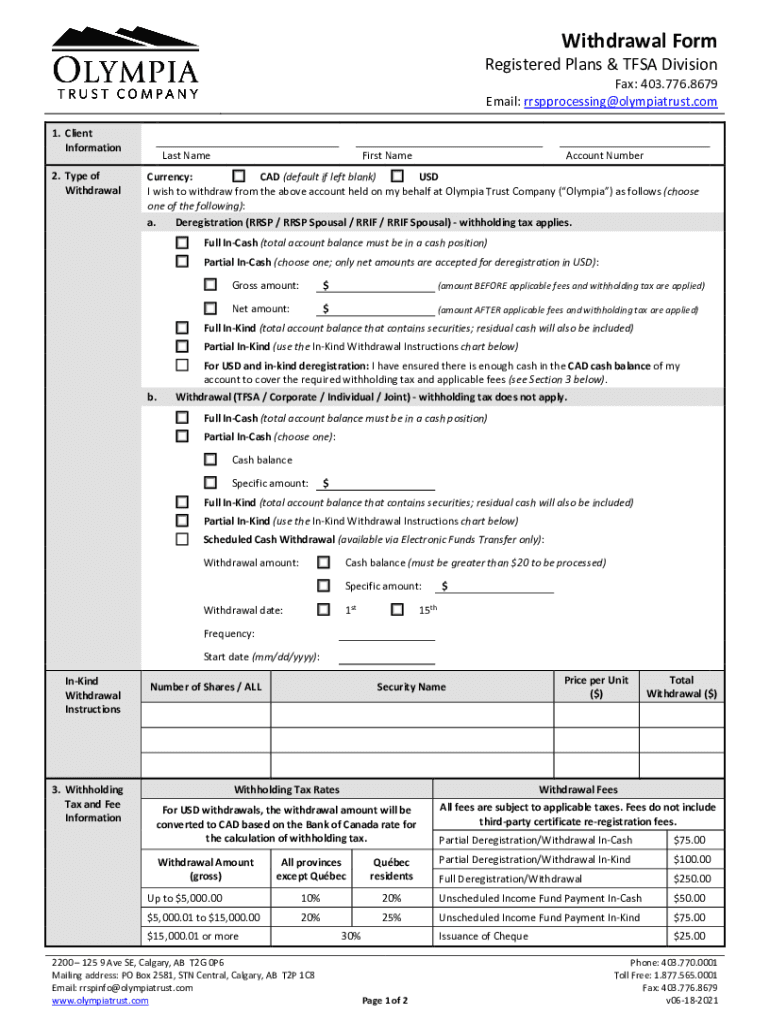

- Fill out the required withdrawal form, which may include providing identification and account details.

- Submit the form as directed, either online or in person, to your financial institution.

- Confirm the withdrawal has been processed and check your account balance to ensure accuracy.

Required Documents for Canada TFSA Withdrawal

To successfully process a Canada TFSA withdrawal, you may need to provide specific documentation. Commonly required documents include:

- A government-issued photo ID for identity verification.

- Your TFSA account number.

- Any forms provided by your financial institution related to the withdrawal.

Legal Considerations for Canada TFSA Withdrawal

While withdrawals from a TFSA are generally straightforward, there are legal considerations to keep in mind. Withdrawals do not trigger taxes, but they do affect your contribution room for future years. It is crucial to maintain accurate records of your contributions and withdrawals to avoid over-contributing, which can lead to penalties. Additionally, understanding the specific rules set by your financial institution regarding withdrawals is essential.

Eligibility Criteria for Canada TFSA Withdrawal

To withdraw funds from a TFSA, you must meet certain eligibility criteria. These include:

- You must be a resident of Canada and at least eighteen years old.

- You must have a valid Social Insurance Number (SIN).

- Your TFSA must be in good standing with your financial institution.

Form Submission Methods for Canada TFSA Withdrawal

When submitting a Canada TFSA withdrawal request, you typically have several options. Most financial institutions allow for:

- Online submission through their secure portal.

- In-person submission at a local branch.

- Mailing the completed withdrawal form to the designated address.

Quick guide on how to complete pointiest formwithdrawal preregistered plans fsa

Complete POINTIEST FORMWithdrawal Preregistered Plans & FSA effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your files swiftly without any holdups. Handle POINTIEST FORMWithdrawal Preregistered Plans & FSA on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign POINTIEST FORMWithdrawal Preregistered Plans & FSA with ease

- Find POINTIEST FORMWithdrawal Preregistered Plans & FSA and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, laborious form searches, or mistakes that require printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign POINTIEST FORMWithdrawal Preregistered Plans & FSA and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pointiest formwithdrawal preregistered plans fsa

Create this form in 5 minutes!

How to create an eSignature for the pointiest formwithdrawal preregistered plans fsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to get money out of an FSA account?

There are two ways to disburse FSA funds: by crediting the student's account for allowable charges at your school or by paying the student or parent directly. When a school disburses FSA funds to a student by crediting a student's account, it may do so only for allowable charges.

-

Can I reimburse myself from an FSA?

Health Care FSA - You can use your health care FSA to pay yourself back for eligible health care, vision, and dental expenses for yourself, your spouse, or eligible dependents (children, siblings, parents, and other dependents as defined in your plan documents).

-

Are FSA distributions taxable?

A health FSA may receive contributions from an eligible individual. Employers may also contribute. Contributions aren't includible in income. Reimbursements from an FSA that are used to pay qualified medical expenses aren't taxed.

-

Do I get a tax document for my FSA?

The funds in your Medical and Dependent Care FSA are deposited pre-tax and the amount is deducted from your Annual Gross Income. This will be represented on the W-2 you receive from your Employer for tax reporting. There are no additional tax forms issued for the FSA plans.

-

Do I get a tax form for my dependent care FSA?

You're receiving a tax benefit because under the plan, you're not paying taxes on the money set aside to pay for the dependent care expenses. You must complete and attach Form 2441, Child and Dependent Care Expenses to your tax return.

-

Will I get a 1099 for my FSA?

There is no 1099-SA form or other tax statement for the Flexible Spending Account (FSA), which is different from the Health Savings Account (HSA). FSA funds are already tax-free and not needed for tax purposes. Dependent Care account information is reflected in Box 10 of your W-2 statement.

-

Do I need to report dependent care FSA on taxes?

You're receiving a tax benefit because under the plan, you're not paying taxes on the money set aside to pay for the dependent care expenses. You must complete and attach Form 2441, Child and Dependent Care Expenses to your tax return.

-

Does dependent care FSA show up on W-2?

Box 10 on your W-2 form should indicate the total annual amount of your Dependent Care FSA deductions. When completing your tax return, you will need to attach a Child and Dependent Care Expenses form (Form 2441 for a 1040 return; Schedule A for a 1040A return).

Get more for POINTIEST FORMWithdrawal Preregistered Plans & FSA

- In the iowa district court for county in re the ma form

- Maricopa county state of arizona form

- Opengovny complacechijbwezhprk4craptyrjsndiiglendale city court5711 w glendale ave glendale az 85301 form

- Proof of service by fax form

- Hon steven m jaeger form

- Acknowledgement and waiver of rights violation courts state nh form

- Macomb county clerk carmella sabaughs form

- Absentee mail ballot application form

Find out other POINTIEST FORMWithdrawal Preregistered Plans & FSA

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document