11 04, Page 1 MICHIGAN Nonresident and Part Year Resident Schedule Issued under Authority of P Form

What is the 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

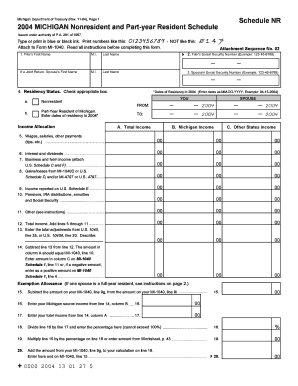

The 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P is a tax form specifically designed for nonresident and part-year resident taxpayers in Michigan. This form is essential for individuals who earn income in Michigan but do not reside there for the entire tax year. It allows these taxpayers to report their Michigan-source income and calculate their tax liability accurately. Understanding this form is crucial for compliance with state tax laws and ensuring that the correct amount of tax is paid based on income earned within Michigan's borders.

Steps to complete the 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

Completing the 11 04 form involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements reflecting earnings from Michigan sources. Next, fill out the identification section, providing your name, address, and social security number. Then, report your Michigan-source income, which may include wages, rental income, or business income. After calculating your total tax liability based on this income, complete the payment section if a balance is owed. Finally, review the form for accuracy before submission.

Legal use of the 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

The legal use of the 11 04 form is governed by Michigan tax laws, which require nonresident and part-year resident individuals to report their income earned within the state. Filing this form is not only a legal obligation but also a means to ensure that taxpayers are taxed fairly based on their actual income generated in Michigan. Failure to file this form accurately may lead to penalties, interest, or other legal consequences. It is essential for taxpayers to understand their obligations under Michigan law to avoid non-compliance issues.

Key elements of the 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

Key elements of the 11 04 form include sections for personal information, income reporting, and tax calculation. The personal information section requires the taxpayer's name, address, and social security number. The income reporting section is critical, as it details all Michigan-source income, including wages, business earnings, and other taxable income. Additionally, the form includes calculations for determining tax liability, allowing taxpayers to understand their financial obligations clearly. Each part of the form plays a vital role in ensuring accurate tax reporting and compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 11 04 form align with Michigan's tax filing schedule. Typically, the deadline for submitting this form is April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any additional deadlines for estimated tax payments or extensions, which can affect their overall tax obligations. Staying informed about these dates is crucial for timely and accurate filing.

Who Issues the Form

The 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule is issued by the Michigan Department of Treasury. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The Department of Treasury provides the necessary forms, instructions, and guidelines for taxpayers to fulfill their tax obligations accurately. It is important for taxpayers to refer to the official resources provided by the Department of Treasury for the most current information regarding the form and its requirements.

Quick guide on how to complete 11 04 page 1 michigan nonresident and part year resident schedule issued under authority of p

Accomplish [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary format and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to preserve your changes.

- Select your preferred method of sharing your form—via email, SMS, or invite link—or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and electronically sign [SKS] and guarantee excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 11 04 page 1 michigan nonresident and part year resident schedule issued under authority of p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does Michigan determine residency?

If an individual lives in this state at least 183 days during the tax year or more than 1/2 the days during a taxable year of less than 12 months he shall be deemed a resident individual domiciled in this state.

-

What is the difference between a nonresident and part-year resident in Michigan?

A Michigan Part-Year Resident is an individual whose permanent home was moved into or out of the state during the tax year. A Michigan Nonresident would be an individual who is neither a resident, or a part-year resident.

-

What is Michigan Schedule 1?

To determine income subject to state income taxes, adjustments must be made to the federal AGI . These additions and subtractions from income are listed on the form entitled, “Michigan Schedule 1,” and a detailed description may be found in the instructions for Schedule 1 .

-

Do non residents pay taxes in Michigan?

Nonresidents and part-year residents must pay income tax to Michigan on all income earned in Michigan or attributable to Michigan.

-

Do I need to file a nonresident Michigan tax return?

Nonresidents and part-year residents must pay income tax to Michigan on all income earned in Michigan or attributable to Michigan.

-

What is a part time resident in Michigan?

You are a part-year resident if you lived in Michigan for at least 6 months of the year for the year you are filing. Temporary absence from Michigan, such as spending the winter in a southern state does NOT make you a part-year resident.

-

What is considered a part-year resident in Michigan?

What is a Part-Year Resident? You are a part-year resident if you lived in Michigan for at least 6 months of the year for the year you are filing. Temporary absence from Michigan, such as spending the winter in a southern state does NOT make you a part-year resident.

-

What makes me a non resident?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

Get more for 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

Find out other 11 04, Page 1 MICHIGAN Nonresident And Part year Resident Schedule Issued Under Authority Of P

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now