1099 2018

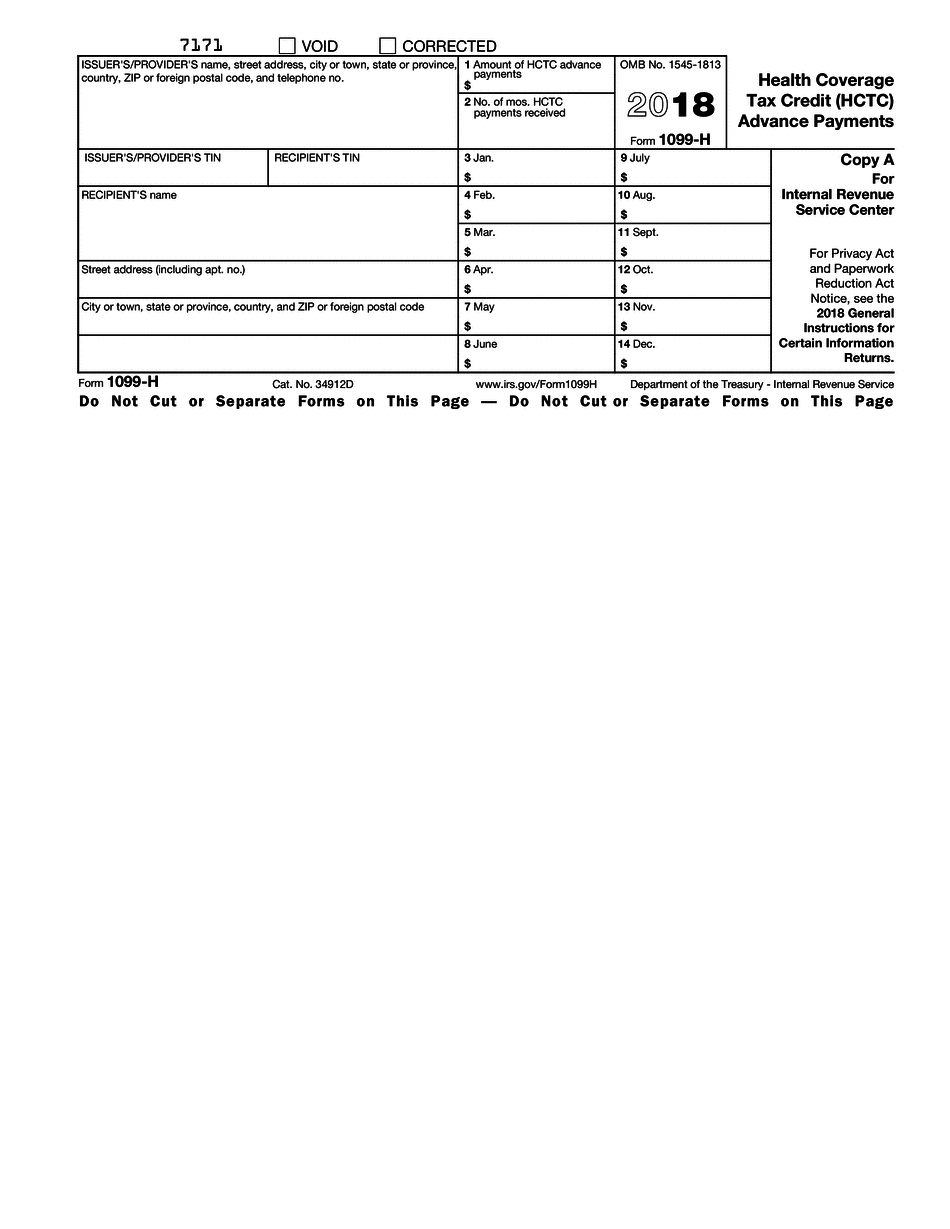

What is the 1099h form?

The 1099h form is a tax document used in the United States to report certain types of income. Specifically, it is designed for reporting health coverage tax credits (HCTCs) for eligible individuals. This form is essential for those who qualify for the HCTC, as it allows them to claim a tax credit for health insurance premiums. Understanding the purpose of the 1099h form is crucial for ensuring accurate tax reporting and maximizing available benefits.

How to obtain the 1099h form

To obtain the 1099h form, individuals can visit the official IRS website or contact their health insurance provider. The form is typically provided by the insurance company to those who have qualified for the health coverage tax credit. It is important to ensure that the form is current and reflects the correct tax year to avoid any complications during tax filing.

Steps to complete the 1099h form

Completing the 1099h form involves several key steps:

- Gather necessary information, including your personal details and health insurance premium amounts.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS along with your tax return or as required by your specific situation.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the 1099h form. It is essential to follow these guidelines to ensure compliance and avoid penalties. Key points include:

- Ensure the form is filled out correctly and submitted on time.

- Keep a copy of the completed form for your records.

- Consult the IRS instructions for any updates or changes to the form requirements.

Filing Deadlines / Important Dates

Filing deadlines for the 1099h form align with the general tax filing deadlines set by the IRS. Typically, the form must be submitted by April fifteenth of the following tax year. It is important to be aware of these dates to avoid late fees or penalties. Additionally, if you are submitting the form electronically, be mindful of any earlier deadlines that may apply.

Who Issues the Form

The 1099h form is issued by health insurance providers to individuals who qualify for the health coverage tax credit. These providers are responsible for ensuring that the form is accurate and sent to the correct recipients. If you believe you should receive a 1099h form but have not, it is advisable to contact your insurance provider for assistance.

Quick guide on how to complete 1099 h 2018 2019 form

Uncover the easiest method to complete and endorse your 1099

Are you still spending time crafting your official documents on paper instead of online? airSlate SignNow provides a superior approach to finalize and sign your 1099 and associated forms for public services. Our advanced electronic signature tool equips you with everything necessary to handle paperwork efficiently and in compliance with formal standards - comprehensive PDF editing, management, protection, signing, and sharing capabilities all accessible within an intuitive interface.

Just a few steps are needed to complete and sign your 1099:

- Insert the fillable template into the editor using the Get Form button.

- Review what information you need to include in your 1099.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Blackout areas that are no longer needed.

- Press Sign to create a legally binding electronic signature using any method you prefer.

- Insert the Date next to your signature and finish your task with the Done button.

Store your completed 1099 in the Documents folder within your profile, download it, or transfer it to your favorite cloud storage. Our solution also facilitates versatile file sharing. There’s no requirement to print your templates when you need to transmit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 h 2018 2019 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 1099 h 2018 2019 form

How to make an eSignature for the 1099 H 2018 2019 Form in the online mode

How to create an electronic signature for the 1099 H 2018 2019 Form in Google Chrome

How to create an eSignature for signing the 1099 H 2018 2019 Form in Gmail

How to generate an electronic signature for the 1099 H 2018 2019 Form right from your smartphone

How to generate an electronic signature for the 1099 H 2018 2019 Form on iOS devices

How to make an electronic signature for the 1099 H 2018 2019 Form on Android devices

People also ask

-

What is a 1099 form and how can airSlate SignNow help with it?

A 1099 form is a tax document used to report income other than wages, salaries, and tips. airSlate SignNow simplifies the process of sending and signing 1099 forms electronically, ensuring a fast and secure way to manage your tax documents. With our platform, you can easily prepare, send, and track 1099s to your contractors or freelancers.

-

How much does airSlate SignNow cost for sending 1099 forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including sending 1099 forms. Our plans start at a competitive rate, allowing you to choose the one that best fits your budget while enjoying unlimited access to our eSignature features. Take advantage of our cost-effective solution for all your document signing needs.

-

Can I integrate airSlate SignNow with my accounting software for 1099 forms?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to help you manage your 1099 forms efficiently. This integration allows for automatic data transfer, reducing manual entry and the risk of errors. You can easily sync your accounting data with our platform to streamline the 1099 reporting process.

-

What features does airSlate SignNow offer for 1099 management?

airSlate SignNow provides a range of features for effective 1099 management, including templates, bulk sending, and tracking capabilities. Our user-friendly interface allows you to customize your 1099 forms and monitor their status in real-time. With our secure eSignature technology, you can ensure that your documents are legally binding and compliant.

-

Is airSlate SignNow compliant with IRS regulations for 1099 forms?

Absolutely! airSlate SignNow is designed to comply with IRS regulations for 1099 forms, ensuring that your electronic signatures are legally recognized. We prioritize security and compliance, so you can confidently manage your tax documents knowing that they meet all legal requirements.

-

How long does it take to send a 1099 form using airSlate SignNow?

Sending a 1099 form with airSlate SignNow is quick and efficient, typically taking just a few minutes. You can easily upload your document, add recipient details, and send it out for eSignature in no time. This speed helps you meet tax deadlines without hassle.

-

Can I track the status of my 1099 forms sent via airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your 1099 forms in real-time. You can see when the document is sent, viewed, and signed by the recipient, giving you peace of mind and helping you manage your workflow effectively. This tracking feature is essential for ensuring timely tax reporting.

Get more for 1099

- Pw 633 application for certificate of compliance in pa form

- Englishforeveryone org form

- Delaware county civil cover sheet form

- Outdoor lighting standards certification form palm beach county

- Security handover template form

- De88 payment coupon 100092890 form

- Charles schwab change address form

- Brown and gray clean company project proposal form

Find out other 1099

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document