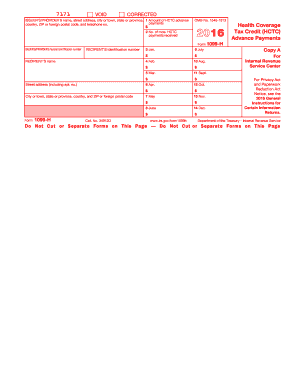

Form 1099 H Internal Revenue Service 2016

What is the Form 1099-H Internal Revenue Service

The Form 1099-H is a tax document used by the Internal Revenue Service (IRS) to report certain types of health coverage tax credits. This form is primarily utilized by individuals who qualify for the premium assistance tax credit under the Affordable Care Act. The information provided on this form helps the IRS ensure that taxpayers receive the correct amount of tax credits for their health insurance premiums.

How to use the Form 1099-H Internal Revenue Service

To effectively use the Form 1099-H, taxpayers should first verify their eligibility for health coverage tax credits. Once eligibility is confirmed, the form must be filled out accurately, providing necessary details such as the taxpayer's name, Social Security number, and the amount of premium assistance received. This information is crucial for accurately filing federal tax returns and ensuring compliance with IRS regulations.

Steps to complete the Form 1099-H Internal Revenue Service

Completing the Form 1099-H involves several key steps:

- Gather all relevant information, including personal identification details and health insurance premium amounts.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS, either electronically or via mail, depending on your filing preference.

Legal use of the Form 1099-H Internal Revenue Service

The legal use of the Form 1099-H is governed by IRS regulations. It is essential for taxpayers to use this form to report any health coverage tax credits received. Failure to report this information can lead to discrepancies in tax filings and potential penalties. Additionally, using the form correctly ensures compliance with federal tax laws and helps taxpayers avoid legal issues related to their health insurance credits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099-H are crucial for taxpayers to adhere to. Typically, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Taxpayers should also be aware of the deadlines for their individual tax returns, as the information from the Form 1099-H is often required to complete those filings accurately.

Who Issues the Form

The Form 1099-H is issued by the health insurance provider or the entity responsible for administering the health coverage tax credits. These organizations are required to provide the form to eligible recipients, ensuring that individuals have the necessary documentation to report their tax credits accurately on their federal tax returns.

Quick guide on how to complete 2016 form 1099 h internal revenue service

Easily Prepare Form 1099 H Internal Revenue Service on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Form 1099 H Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Adjust and Electronically Sign Form 1099 H Internal Revenue Service Effortlessly

- Obtain Form 1099 H Internal Revenue Service and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require new document prints. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 1099 H Internal Revenue Service to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1099 h internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1099 h internal revenue service

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 1099 H Internal Revenue Service and why is it important?

Form 1099 H Internal Revenue Service is used to report payments made for certain types of health coverage. It's important for taxpayers to report these payments accurately to comply with IRS regulations and avoid penalties.

-

How can airSlate SignNow help with signing Form 1099 H Internal Revenue Service?

airSlate SignNow offers a simple and efficient way to eSign Form 1099 H Internal Revenue Service. With our user-friendly platform, you can securely sign and send the form to various parties, ensuring a smooth process that saves time and resources.

-

What pricing options are available for airSlate SignNow when handling Form 1099 H Internal Revenue Service?

airSlate SignNow provides flexible pricing plans tailored to different business needs. Our cost-effective solutions include features that streamline the process of managing documents like Form 1099 H Internal Revenue Service, ensuring you get the best value.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099 H Internal Revenue Service?

Yes, airSlate SignNow offers integrations with popular accounting software. This allows you to seamlessly manage Form 1099 H Internal Revenue Service alongside other financial documents, enhancing efficiency and accuracy in your workflow.

-

What security measures does airSlate SignNow implement for handling Form 1099 H Internal Revenue Service?

We prioritize your data security with advanced technologies such as encryption and secure servers. airSlate SignNow ensures that all transactions involving Form 1099 H Internal Revenue Service are protected, giving you peace of mind as you manage sensitive information.

-

Is it easy to set up and start using airSlate SignNow for Form 1099 H Internal Revenue Service?

Absolutely! Setting up airSlate SignNow is quick and straightforward. Once you register, you'll have immediate access to tools enabling you to manage and eSign Form 1099 H Internal Revenue Service without any hassle.

-

Can I track the status of Form 1099 H Internal Revenue Service once it’s sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including Form 1099 H Internal Revenue Service. You can easily monitor the status of your documents, ensuring that you are informed of any updates or completions.

Get more for Form 1099 H Internal Revenue Service

- Satisfaction release or cancellation of deed of trust by individual idaho form

- Partial release of property from deed of trust for corporation idaho form

- Partial release of property from deed of trust for individual idaho form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy idaho form

- Warranty deed for parents to child with reservation of life estate idaho form

- Idaho community property form

- Warranty deed for separate or joint property to joint tenancy idaho form

- Warranty deed to separate property of one spouse to both spouses as joint tenants idaho form

Find out other Form 1099 H Internal Revenue Service

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free