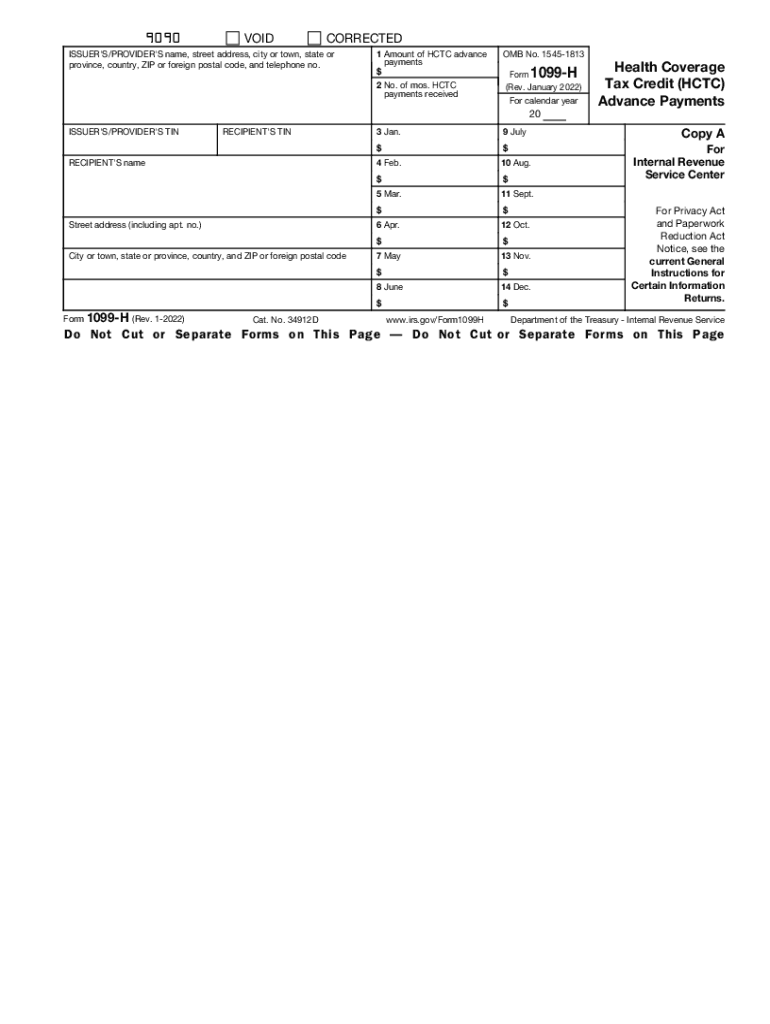

Form 1099 H Rev January Internal Revenue Service 2022-2026

What is the Form 1099 H?

The Form 1099 H is a tax document used in the United States, specifically designed for reporting health coverage tax credits. This form is issued by the Internal Revenue Service (IRS) to individuals who qualify for certain health insurance premium subsidies. The form helps taxpayers understand their eligibility for health coverage tax credits, which can significantly reduce their healthcare costs. It is essential for individuals who have received these credits to ensure accurate reporting on their tax returns.

How to Use the Form 1099 H

Using the Form 1099 H involves several steps to ensure accurate reporting of health coverage tax credits. Taxpayers should first review the information provided on the form, including the amount of credit received and the qualifying health insurance premiums. This information must be reported on the taxpayer's federal income tax return, typically on Form 1040. It is crucial to keep the form for personal records, as it may be needed for future reference or audits.

Steps to Complete the Form 1099 H

Completing the Form 1099 H requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal identification details and health insurance premium amounts.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your federal income tax return.

Legal Use of the Form 1099 H

The legal use of the Form 1099 H is governed by IRS regulations. It is essential for taxpayers to use this form correctly to claim health coverage tax credits legally. Misuse or incorrect reporting can lead to penalties or audits by the IRS. Therefore, individuals should ensure they meet the eligibility criteria and accurately report the information to maintain compliance with tax laws.

Filing Deadlines for Form 1099 H

Filing deadlines for the Form 1099 H are crucial for taxpayers to adhere to in order to avoid penalties. The IRS typically requires that the form be submitted by January 31st of the year following the tax year in which the credits were received. Taxpayers should plan ahead to ensure timely filing, especially if they are submitting their tax returns electronically or by mail.

Who Issues the Form 1099 H

The Form 1099 H is issued by the IRS to eligible individuals who have received health coverage tax credits. Additionally, certain state agencies or health insurance providers may also issue this form to report the credits to taxpayers. It is important for recipients to verify the source of the form to ensure its accuracy and legitimacy.

Penalties for Non-Compliance with Form 1099 H

Failing to comply with the requirements associated with the Form 1099 H can result in significant penalties. Taxpayers who do not report their health coverage tax credits accurately may face fines, interest on unpaid taxes, or even audits. It is vital for individuals to understand their responsibilities regarding this form to avoid any legal repercussions.

Quick guide on how to complete form 1099 h rev january 2022 internal revenue service

Complete Form 1099 H Rev January Internal Revenue Service effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without interruptions. Manage Form 1099 H Rev January Internal Revenue Service on any platform using airSlate SignNow Android or iOS applications and streamline any document-centric task today.

The most efficient way to modify and eSign Form 1099 H Rev January Internal Revenue Service with ease

- Obtain Form 1099 H Rev January Internal Revenue Service and then click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1099 H Rev January Internal Revenue Service to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 h rev january 2022 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 1099 h rev january 2022 internal revenue service

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is a 1099 h, and who needs it?

A 1099 h form is used to report certain payments made to individuals, particularly for health insurance premiums. Businesses that have paid individuals or entities for medical expenses must file this form with the IRS. Understanding the 1099 h is crucial for ensuring compliance with tax regulations.

-

How does airSlate SignNow simplify the 1099 h signing process?

AirSlate SignNow offers an intuitive interface that allows users to easily create, send, and eSign 1099 h forms in minutes. Its electronic signature feature streamlines the process, making it faster and more efficient to complete your tax documents. This ensures you can meet your deadlines without hassle.

-

What are the pricing options for airSlate SignNow when handling 1099 h forms?

AirSlate SignNow offers competitive pricing plans that cater to all business sizes. Whether you require basic functionality or advanced features, there's a suitable pricing tier for you. With the ability to handle 1099 h forms effectively, investing in our service saves you time and money.

-

Can I integrate airSlate SignNow with other accounting software for 1099 h forms?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software solutions. This enables users to automatically generate and manage 1099 h forms alongside other financial documents. Integration simplifies your workflow, ensuring consistency and accuracy across your financial reporting.

-

Is it secure to eSign a 1099 h form using airSlate SignNow?

Absolutely! AirSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your data while eSigning 1099 h forms. Your information remains confidential, giving you peace of mind while completing sensitive documents.

-

What are the benefits of using airSlate SignNow for 1099 h management?

Using airSlate SignNow for managing your 1099 h forms allows for faster processing, increased accuracy, and ease of access. The platform's digital solutions reduce paper clutter and the risks of manual errors. Furthermore, this solution enhances the overall efficiency of your tax filing process.

-

How long does it take to set up airSlate SignNow for 1099 h forms?

Setting up airSlate SignNow for managing 1099 h forms is quick and straightforward, typically taking just a few minutes. After signing up, you can easily configure your settings and start using the platform immediately. This rapid setup ensures you're ready for tax season without delays.

Get more for Form 1099 H Rev January Internal Revenue Service

- Minnesota assets 497312871 form

- Essential documents for the organized traveler package minnesota form

- Essential documents for the organized traveler package with personal organizer minnesota form

- Postnuptial agreements package minnesota form

- Letters of recommendation package minnesota form

- Minnesota construction or mechanics lien package individual minnesota form

- Mn lien form

- Storage business package minnesota form

Find out other Form 1099 H Rev January Internal Revenue Service

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT