Nonresident Certificate of Exemption Purchase of Motor Vehicle Form

Understanding the Nonresident Certificate of Exemption for Vehicle Purchases

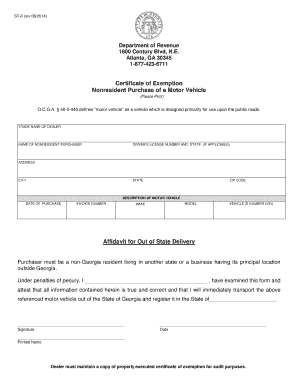

The Nonresident Certificate of Exemption for the purchase of a motor vehicle is a crucial document for individuals who reside outside of Georgia but wish to buy a vehicle within the state. This certificate allows nonresidents to avoid paying certain taxes that would typically apply to vehicle purchases made by residents. By obtaining this certificate, buyers can ensure compliance with state laws while benefiting from tax exemptions that can lead to significant savings.

Steps to Complete the Nonresident Certificate of Exemption

Completing the Nonresident Certificate of Exemption involves several straightforward steps:

- Obtain the form from the appropriate state agency or download it from the official website.

- Fill out the required fields, including personal information and details about the vehicle being purchased.

- Provide proof of residency outside of Georgia, such as a utility bill or lease agreement.

- Submit the completed form to the dealership or seller, who will then process it as part of the vehicle purchase.

Eligibility Criteria for the Nonresident Certificate of Exemption

To qualify for the Nonresident Certificate of Exemption, applicants must meet specific criteria:

- The buyer must reside outside of Georgia.

- The vehicle must be registered in the buyer's home state.

- Proof of residency must be provided at the time of purchase.

Required Documents for the Nonresident Certificate of Exemption

When applying for the Nonresident Certificate of Exemption, certain documents are necessary to validate the application:

- A completed Nonresident Certificate of Exemption form.

- Proof of residency outside of Georgia.

- Identification, such as a driver’s license or state ID.

Legal Use of the Nonresident Certificate of Exemption

The Nonresident Certificate of Exemption serves a legal purpose by ensuring that nonresidents are not unfairly taxed when purchasing vehicles in Georgia. It is essential for buyers to understand that misuse of this certificate can lead to penalties, including fines or back taxes owed to the state.

How to Obtain the Nonresident Certificate of Exemption

Obtaining the Nonresident Certificate of Exemption is a straightforward process. Buyers can typically acquire the form from the Georgia Department of Revenue's website or directly from the dealership where they intend to purchase the vehicle. It is advisable to gather all necessary documents beforehand to streamline the process.

Quick guide on how to complete nonresident certificate of exemption purchase of motor vehicle

Complete Nonresident Certificate Of Exemption Purchase Of Motor Vehicle effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Nonresident Certificate Of Exemption Purchase Of Motor Vehicle on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nonresident Certificate Of Exemption Purchase Of Motor Vehicle with ease

- Locate Nonresident Certificate Of Exemption Purchase Of Motor Vehicle and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Nonresident Certificate Of Exemption Purchase Of Motor Vehicle and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonresident certificate of exemption purchase of motor vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 8 form and why is it important?

The ST 8 form is a crucial document used for sales tax exemption in various states. It allows eligible organizations to make tax-exempt purchases, which can signNowly reduce costs. Understanding how to properly fill out and submit the ST 8 form is essential for businesses looking to maximize their savings.

-

How can airSlate SignNow help with the ST 8 form?

airSlate SignNow simplifies the process of completing and signing the ST 8 form electronically. Our platform allows users to fill out the form, add signatures, and send it securely, all in one place. This streamlines the workflow and ensures that your documents are processed quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the ST 8 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered, including the ability to manage the ST 8 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the ST 8 form?

airSlate SignNow provides a range of features for managing the ST 8 form, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your document management process, making it easier to handle tax exemption forms like the ST 8 form. Additionally, our user-friendly interface ensures a smooth experience.

-

Can I integrate airSlate SignNow with other software for the ST 8 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the ST 8 form. Whether you use CRM systems, accounting software, or other tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the ST 8 form?

Using airSlate SignNow for the ST 8 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution ensures that your documents are signed quickly and stored securely. This not only saves time but also helps maintain compliance with tax regulations.

-

How secure is airSlate SignNow when handling the ST 8 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, including the ST 8 form. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe throughout the signing process.

Get more for Nonresident Certificate Of Exemption Purchase Of Motor Vehicle

- Body sugaring intake form nwa skin care solutions

- Smp 20 form

- Employment contract uae pdf form

- Panasonic 5 year warranty registration form

- Application for duplicate certificate of title nh gov nh form

- What is form 6251 alternative minimum tax individuals

- Ho 5a form

- Job description agreement template form

Find out other Nonresident Certificate Of Exemption Purchase Of Motor Vehicle

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure