Draft as of 0803 IRS Gov Internal Revenue Service Form

Understanding the Draft As Of 0803 IRS gov Internal Revenue Service

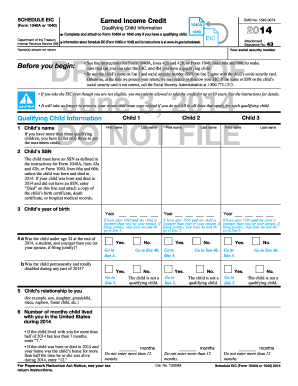

The Draft As Of 0803 IRS gov Internal Revenue Service represents a preliminary version of a form or document that the IRS is preparing for public use. This draft may contain updates or changes that have not yet been finalized. It is essential for taxpayers and businesses to review these drafts to stay informed about potential modifications that could affect their tax obligations or filing processes.

How to Utilize the Draft As Of 0803 IRS gov Internal Revenue Service

To effectively use the Draft As Of 0803 IRS gov Internal Revenue Service, individuals should first download the document from the IRS website. After obtaining the draft, carefully review its contents, noting any areas that may require clarification or additional information. It is advisable to compare the draft with previous versions to identify changes. This can help taxpayers prepare for upcoming filing requirements or adjustments in compliance measures.

Steps to Complete the Draft As Of 0803 IRS gov Internal Revenue Service

Completing the Draft As Of 0803 IRS gov Internal Revenue Service involves several key steps:

- Read through the entire draft to understand its purpose and requirements.

- Gather all necessary documentation, such as income statements, receipts, and previous tax returns.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Review the completed draft for any errors or omissions.

- Submit the form according to the instructions provided, whether online or via mail.

Legal Considerations for the Draft As Of 0803 IRS gov Internal Revenue Service

The Draft As Of 0803 IRS gov Internal Revenue Service carries legal implications for taxpayers. It is crucial to understand that using a draft form may not fulfill legal requirements until it is officially adopted by the IRS. Taxpayers should ensure they are using the most current and finalized version of any IRS document to avoid potential penalties or issues with compliance.

Key Elements of the Draft As Of 0803 IRS gov Internal Revenue Service

Key elements to focus on when reviewing the Draft As Of 0803 IRS gov Internal Revenue Service include:

- Filing requirements and deadlines.

- Eligibility criteria for various tax situations.

- Specific instructions for completing each section of the form.

- Potential changes in tax law that may affect the information required.

Examples of Using the Draft As Of 0803 IRS gov Internal Revenue Service

Examples of scenarios where the Draft As Of 0803 IRS gov Internal Revenue Service may be relevant include:

- A self-employed individual preparing their annual tax return.

- A business entity seeking to claim deductions or credits.

- Taxpayers needing to report changes in income or filing status.

Quick guide on how to complete draft as of 0803 irs gov internal revenue service

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform via airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to initiate.

- Utilize the features we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Draft As Of 0803 IRS gov Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the draft as of 0803 irs gov internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the Draft As Of 0803 IRS gov Internal Revenue Service?

The Draft As Of 0803 IRS gov Internal Revenue Service refers to specific guidelines and forms provided by the IRS. Understanding these documents is crucial for compliance and accurate tax filing. airSlate SignNow can help streamline the process of signing and submitting these forms electronically.

-

How does airSlate SignNow simplify the signing process for IRS documents?

airSlate SignNow offers an intuitive platform that allows users to eSign documents, including those related to the Draft As Of 0803 IRS gov Internal Revenue Service. With features like templates and automated workflows, businesses can efficiently manage their document signing needs without the hassle of paper forms.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while ensuring you can manage documents related to the Draft As Of 0803 IRS gov Internal Revenue Service effectively.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows users to manage documents related to the Draft As Of 0803 IRS gov Internal Revenue Service alongside their existing tools, enhancing productivity and ensuring compliance.

-

What features does airSlate SignNow offer for document security?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and authentication measures to protect sensitive documents, including those related to the Draft As Of 0803 IRS gov Internal Revenue Service. Users can trust that their information is secure while eSigning important documents.

-

How can airSlate SignNow benefit my business in terms of efficiency?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management. The platform's ability to eSign documents related to the Draft As Of 0803 IRS gov Internal Revenue Service means faster turnaround times and improved workflow efficiency, allowing teams to focus on core business activities.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any questions or issues they may encounter. Whether you need help with documents related to the Draft As Of 0803 IRS gov Internal Revenue Service or general inquiries, our support team is ready to help.

Get more for Draft As Of 0803 IRS gov Internal Revenue Service

- Media stay request form

- Consent form sponsored medical treatment abroad gov mt

- Scuba schools international replacement card form

- Formulario de solicitud de seguro de arriendamiento

- Order form american needlepoint guild needlepoint

- Stamped hose selection hydraulic supply com form

- Parking ticket appeal form stord kommune

- Home health care hhc application and requirement cinico cinico form

Find out other Draft As Of 0803 IRS gov Internal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors