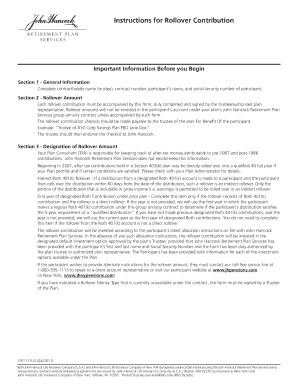

Instructions for Rollover Contribution John Hancock Retirement Form

Understanding the Instructions for Rollover Contribution John Hancock Retirement

The Instructions for Rollover Contribution John Hancock Retirement provide essential guidelines for individuals looking to transfer funds from one retirement account to another. This process is crucial for maintaining the tax-advantaged status of retirement savings. The instructions detail the types of accounts eligible for rollover, including traditional IRAs and employer-sponsored plans, ensuring that users understand their options and obligations.

Steps to Complete the Rollover Contribution Instructions

Completing the rollover contribution instructions involves several key steps:

- Gather necessary information about your current retirement account, including account numbers and contact information for your financial institution.

- Review the eligibility requirements for the rollover to ensure compliance with IRS regulations.

- Fill out the required forms accurately, providing all requested details to avoid delays.

- Submit the completed forms to John Hancock, following the specified submission methods.

Required Documents for Rollover Contribution

To successfully complete the rollover contribution process, you will need to provide specific documents. These typically include:

- A copy of your current retirement account statement.

- The completed rollover contribution form from John Hancock.

- Any additional documentation required by your current plan administrator.

Ensuring that all documents are accurate and complete is vital to prevent any issues with your rollover.

Eligibility Criteria for Rollover Contributions

Eligibility for making a rollover contribution to a John Hancock retirement account generally includes the following criteria:

- You must be transferring funds from a qualified retirement plan, such as a 401(k) or traditional IRA.

- The funds must be eligible for rollover according to IRS guidelines.

- You should not have exceeded the annual contribution limits for your retirement account.

Understanding these criteria helps ensure that your rollover is processed smoothly and without penalties.

Form Submission Methods for Rollover Contributions

There are multiple methods available for submitting your rollover contribution forms to John Hancock:

- Online submission through the John Hancock retirement account portal.

- Mailing the completed forms to the designated address provided in the instructions.

- In-person submission at a local John Hancock office, if available.

Choosing the right submission method can expedite the processing of your rollover contribution.

IRS Guidelines for Rollover Contributions

The IRS provides specific guidelines regarding rollover contributions to ensure compliance and avoid tax penalties. Key points include:

- Funds must be rolled over within sixty days of withdrawal to maintain tax-deferred status.

- Only one rollover per twelve-month period is permitted for IRAs.

- Direct rollovers from one qualified plan to another are generally not subject to withholding taxes.

Adhering to these guidelines is essential for protecting your retirement savings from unnecessary tax implications.

Quick guide on how to complete instructions for rollover contribution john hancock retirement

Prepare [SKS] effortlessly on any device

The management of documents online has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-driven workflow today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your files or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign [SKS] while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Rollover Contribution John Hancock Retirement

Create this form in 5 minutes!

How to create an eSignature for the instructions for rollover contribution john hancock retirement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Rollover Contribution John Hancock Retirement?

The Instructions For Rollover Contribution John Hancock Retirement provide a step-by-step guide on how to transfer funds from your previous retirement account to your John Hancock account. This process ensures that your retirement savings continue to grow tax-deferred. Following these instructions carefully can help you avoid any penalties or tax implications.

-

How can I access the Instructions For Rollover Contribution John Hancock Retirement?

You can access the Instructions For Rollover Contribution John Hancock Retirement directly on the John Hancock website or through your account portal. Additionally, airSlate SignNow offers easy document management tools to help you organize and eSign any necessary forms related to your rollover contribution.

-

Are there any fees associated with the rollover contribution process?

Typically, there are no fees for rolling over your retirement funds to John Hancock, but it's essential to review the specific terms of your previous account. The Instructions For Rollover Contribution John Hancock Retirement will outline any potential fees or conditions you should be aware of. Always check with both financial institutions for clarity.

-

What documents do I need for the rollover contribution?

To complete the rollover contribution, you will need your previous account statements and the completed forms as outlined in the Instructions For Rollover Contribution John Hancock Retirement. airSlate SignNow can help you eSign and manage these documents efficiently, ensuring a smooth transition of your retirement funds.

-

How long does the rollover contribution process take?

The rollover contribution process can vary, but typically it takes between 5 to 10 business days once all required documents are submitted. Following the Instructions For Rollover Contribution John Hancock Retirement can help expedite this process. Make sure to provide accurate information to avoid delays.

-

Can I track the status of my rollover contribution?

Yes, you can track the status of your rollover contribution through your John Hancock account. The Instructions For Rollover Contribution John Hancock Retirement may also provide additional resources for monitoring your transfer. Utilizing airSlate SignNow can help you keep all related documents organized for easy reference.

-

What are the benefits of rolling over to John Hancock Retirement?

Rolling over to John Hancock Retirement can provide you with a range of investment options, lower fees, and personalized retirement planning services. The Instructions For Rollover Contribution John Hancock Retirement will highlight these benefits and guide you through the process. This transition can help you better manage your retirement savings.

Get more for Instructions For Rollover Contribution John Hancock Retirement

- 09 32 05 bulletin march 18 minnesota department of dhs state mn form

- 09 32 18 bulletin december 23 minnesota department of dhs state mn form

- Fy state circular 03 jun 11 minnesota national guard form

- Application for seals and certificates minnesota department of doli state mn form

- Name of applicant please print applicants form

- Recreational camping area manufactured home park service doli state mn form

- Retraining plan form workers compensation division

- Minnesota dept of transportation business impacts report appendix c business outreach summary dot state mn form

Find out other Instructions For Rollover Contribution John Hancock Retirement

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF