Credit Limit Form

What is the Credit Limit Form

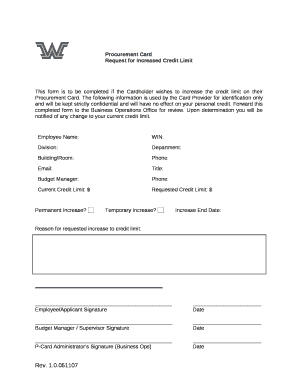

The credit limit form is a formal document used by individuals or businesses to request an increase in their existing credit limit from a financial institution. This form typically includes essential information such as the applicant's personal details, current credit limit, desired limit, and reasons for the request. It serves as a means for lenders to assess the applicant's creditworthiness and ability to manage higher credit levels.

Steps to Complete the Credit Limit Form

Completing the credit limit form involves several key steps:

- Gather Personal Information: Collect your full name, address, contact information, and Social Security number.

- Provide Financial Details: Include your current income, employment status, and any other relevant financial data.

- State Your Current Credit Limit: Clearly mention your existing credit limit and the amount you wish to increase it to.

- Explain Your Request: Offer a brief explanation of why you are requesting the increase, such as improved financial stability or increased expenses.

- Review and Submit: Double-check all information for accuracy before submitting the form to the lender.

Required Documents

When submitting a request to increase your credit limit, certain documents may be required to support your application. Commonly requested documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Bank statements to demonstrate financial stability.

- Identification documents, like a driver's license or passport.

Eligibility Criteria

Eligibility for a credit limit increase typically depends on several factors. These may include:

- Your credit score, which reflects your creditworthiness.

- Payment history with the lender, including timely payments.

- Your current income and overall financial health.

- Length of time you have had the credit account.

Form Submission Methods

The credit limit form can usually be submitted through various methods, depending on the lender's policies. Common submission methods include:

- Online: Many lenders allow you to complete and submit the form electronically through their website or mobile app.

- Mail: You may print the completed form and send it via postal service.

- In-Person: Some institutions may accept submissions at a local branch office.

Examples of Using the Credit Limit Form

There are various scenarios where individuals or businesses may utilize the credit limit form, including:

- A small business seeking to increase its credit line to manage seasonal inventory purchases.

- An individual requesting a higher limit to accommodate unexpected expenses, such as medical bills.

- A consumer aiming to improve their credit utilization ratio by increasing available credit.

Quick guide on how to complete credit limit form

Conveniently Prepare Credit Limit Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without hindrance. Manage Credit Limit Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign Credit Limit Form Effortlessly

- Find Credit Limit Form and then click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Credit Limit Form and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit limit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a request to increase credit limit template?

A request to increase credit limit template is a pre-designed document that helps users formally request an increase in their credit limit from their financial institution. This template streamlines the process, ensuring that all necessary information is included for a successful request.

-

How can I customize the request to increase credit limit template?

You can easily customize the request to increase credit limit template using airSlate SignNow's intuitive editing tools. Simply fill in your personal details, adjust the content as needed, and add any specific information that your lender may require.

-

Is there a cost associated with using the request to increase credit limit template?

Using the request to increase credit limit template is part of airSlate SignNow's subscription plans, which are designed to be cost-effective for businesses of all sizes. You can choose a plan that fits your needs and budget, ensuring you get the best value for your document management.

-

What are the benefits of using the request to increase credit limit template?

The request to increase credit limit template offers several benefits, including saving time, ensuring accuracy, and improving the chances of approval. By using a professional template, you present your request clearly and effectively, which can enhance your relationship with your lender.

-

Can I integrate the request to increase credit limit template with other tools?

Yes, airSlate SignNow allows you to integrate the request to increase credit limit template with various third-party applications. This integration capability enhances your workflow, enabling you to manage documents seamlessly across different platforms.

-

How does airSlate SignNow ensure the security of my request to increase credit limit template?

airSlate SignNow prioritizes the security of your documents, including the request to increase credit limit template. We use advanced encryption and secure cloud storage to protect your sensitive information, ensuring that only authorized users have access.

-

Can I track the status of my request after sending the request to increase credit limit template?

Absolutely! With airSlate SignNow, you can track the status of your request to increase credit limit template in real-time. This feature allows you to stay informed about the progress of your request and follow up if necessary.

Get more for Credit Limit Form

- En 13501 2 pdf download form

- Puzzling problem subtracting polynomials answer key form

- Sse vat declaration form

- Bi 529 form download

- Ethiopian embassy stockholm passport application form

- Bt super withdrawal request form

- Urdu ocr online form

- Evolutionary consequences of fertilization mode for reproductive form

Find out other Credit Limit Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT