Signed in SECTION 3 2020-2026

Understanding 32BJ Life Insurance

32BJ Life Insurance is a benefit provided to members of the 32BJ union, which primarily serves building service workers in the United States. This insurance offers financial protection for members and their families in the event of unexpected circumstances. The coverage typically includes various types of life insurance policies that can be tailored to meet individual needs and circumstances.

Eligibility Criteria for 32BJ Life Insurance

To qualify for 32BJ Life Insurance, individuals must be active members of the 32BJ union. Eligibility often depends on factors such as employment status, length of membership, and specific job classifications within the union. Members should review their specific union contract or reach out to union representatives for detailed eligibility requirements.

Steps to Complete the 32BJ Life Insurance Application

Applying for 32BJ Life Insurance involves several key steps:

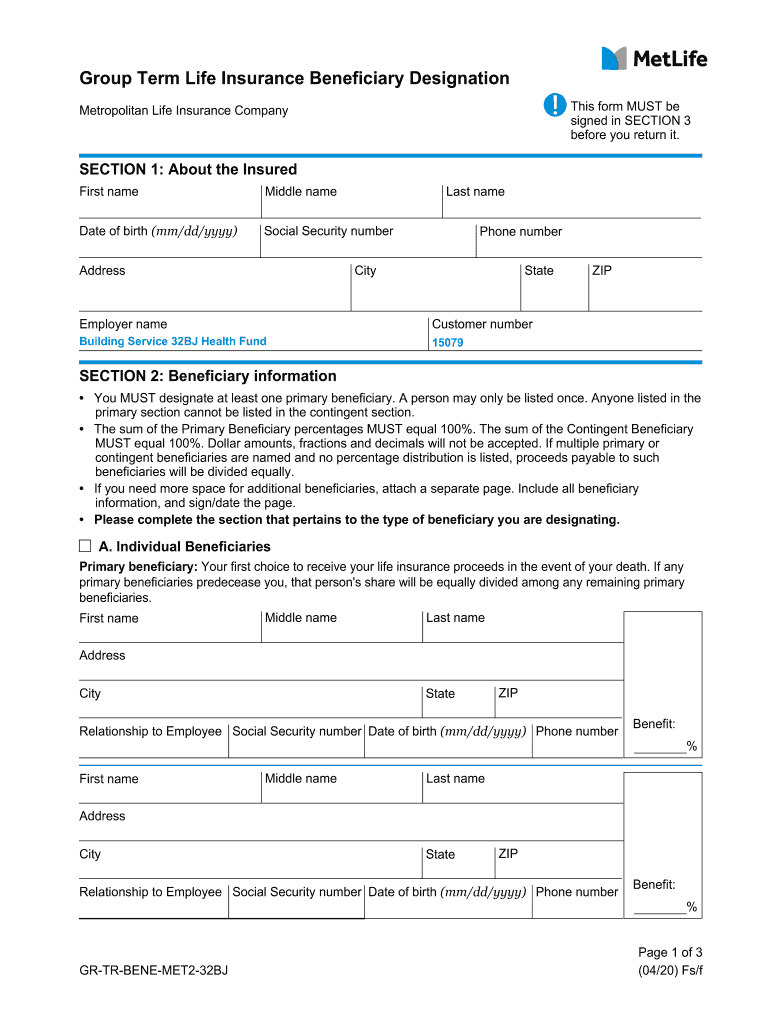

- Gather necessary personal information, including Social Security numbers and employment details.

- Complete the beneficiary profile individual form, which designates who will receive benefits in the event of the member's passing.

- Submit the completed application and any required documentation to the appropriate union office or insurance provider.

Required Documents for 32BJ Life Insurance

When applying for 32BJ Life Insurance, members must provide certain documents to ensure a smooth application process. These typically include:

- A completed beneficiary profile individual form.

- Proof of identity, such as a government-issued ID.

- Any previous insurance documentation, if applicable.

Form Submission Methods

Members can submit their 32BJ Life Insurance application through various methods. Common submission options include:

- Online submission through the union's designated portal.

- Mailing the completed forms to the union office.

- In-person submission at union meetings or events.

Key Elements of the 32BJ Life Insurance Policy

Understanding the key elements of the 32BJ Life Insurance policy is crucial for members. Important aspects include:

- The coverage amount, which is determined based on the member's position and contract.

- The types of policies available, including term and whole life insurance options.

- Provisions for updating beneficiary information as personal circumstances change.

Quick guide on how to complete signed in section 3

Effortlessly Complete Signed In SECTION 3 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow supplies all the resources you need to create, modify, and eSign your documents promptly without any hold-ups. Manage Signed In SECTION 3 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Signed In SECTION 3 seamlessly

- Locate Signed In SECTION 3 and click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize key sections of the forms or obscure sensitive information using the tools airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Modify and eSign Signed In SECTION 3 and ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct signed in section 3

Create this form in 5 minutes!

How to create an eSignature for the signed in section 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MetLife insurance beneficiary designation form?

The MetLife insurance beneficiary designation form is a document that allows policyholders to specify who will receive the benefits of their life insurance policy upon their passing. This form is crucial for ensuring that your intended beneficiaries receive the financial support they need. Completing the MetLife insurance beneficiary designation form accurately can help avoid potential disputes among heirs.

-

How do I complete the MetLife insurance beneficiary designation form?

To complete the MetLife insurance beneficiary designation form, you will need to provide your personal information, the details of your policy, and the names and relationships of your chosen beneficiaries. It's important to review the form carefully to ensure all information is correct. Once completed, submit the form to MetLife to ensure your designations are updated.

-

Can I change my beneficiaries on the MetLife insurance beneficiary designation form?

Yes, you can change your beneficiaries on the MetLife insurance beneficiary designation form at any time. It is advisable to review your designations periodically, especially after major life events such as marriage or the birth of a child. Simply fill out a new form and submit it to MetLife to update your beneficiary information.

-

What happens if I don't fill out the MetLife insurance beneficiary designation form?

If you do not fill out the MetLife insurance beneficiary designation form, the death benefit may be paid to your estate, which can lead to delays and potential disputes among heirs. This could result in your intended beneficiaries not receiving the funds as you wished. Therefore, it is essential to complete the form to ensure your wishes are honored.

-

Is there a fee associated with the MetLife insurance beneficiary designation form?

There is no fee to complete or submit the MetLife insurance beneficiary designation form. This service is provided to policyholders at no additional cost, allowing you to designate your beneficiaries easily. Ensuring your beneficiaries are correctly designated is a vital part of managing your life insurance policy.

-

How does the MetLife insurance beneficiary designation form benefit my loved ones?

The MetLife insurance beneficiary designation form ensures that your loved ones receive the financial support they need in the event of your passing. By clearly stating your beneficiaries, you can provide peace of mind knowing that your wishes will be honored. This can help alleviate financial burdens during a difficult time for your family.

-

Can I submit the MetLife insurance beneficiary designation form online?

Yes, you can submit the MetLife insurance beneficiary designation form online through the MetLife website or via airSlate SignNow. This convenient option allows you to complete and send your form quickly and securely. Utilizing digital solutions can streamline the process and ensure your designations are processed promptly.

Get more for Signed In SECTION 3

- Pokemon evolutions checklist form

- Pipeline pressure test record test information azcc

- Nasa certificate form

- Termo de responsabilidade sef form

- Sa100 form 2017

- Experian letter of agreement form

- Passport renewal mauritius form

- Activities in llandudno primary leap worksheets year 5 geography a contrasting locality primary resource exercise form

Find out other Signed In SECTION 3

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT