Protective Life Beneficiary Change Form 2019-2026

Understanding the usalliance financial Domestic Wire Transfer Form

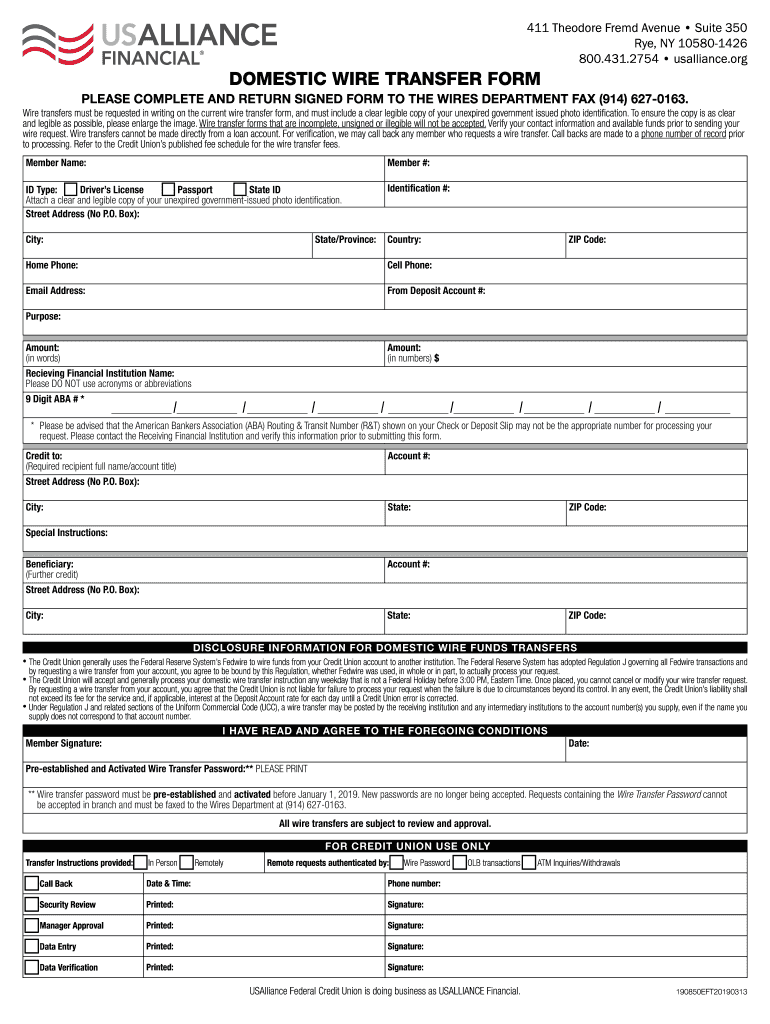

The usalliance financial Domestic Wire Transfer Form is a crucial document for individuals and businesses looking to send money electronically within the United States. This form facilitates the secure transfer of funds between banks and financial institutions, ensuring that transactions are processed efficiently. It is essential to complete this form accurately to avoid delays or errors in the transfer process.

Steps to Complete the usalliance financial Domestic Wire Transfer Form

Filling out the Domestic Wire Transfer Form involves several key steps:

- Provide your personal information, including your name, address, and account number.

- Enter the recipient's details, such as their name, bank name, and account number.

- Specify the amount you wish to transfer and any additional instructions.

- Review the information for accuracy before signing the form.

Ensuring that all details are correct is vital, as any mistakes can lead to complications in the transfer process.

Legal Use of the Domestic Wire Transfer Form

The Domestic Wire Transfer Form is legally binding once completed and signed. It is important to understand that this form complies with federal regulations governing electronic fund transfers. By using this form, you are authorizing your bank to process the transfer as specified. This legal framework protects both the sender and the recipient, ensuring that funds are transferred securely and in accordance with the law.

Key Elements of the Domestic Wire Transfer Form

Several critical components must be included in the Domestic Wire Transfer Form:

- Sender's Information: Name, address, and account number.

- Recipient's Information: Name, bank name, and account number.

- Transfer Amount: The total amount being sent.

- Authorization: The sender's signature to authorize the transaction.

Each of these elements plays a vital role in ensuring the transfer is processed correctly and legally.

Form Submission Methods for the Domestic Wire Transfer

The completed Domestic Wire Transfer Form can typically be submitted in several ways:

- Online: Many banks offer online banking services that allow users to submit wire transfer requests electronically.

- By Mail: You can send the completed form through postal mail to your bank's processing center.

- In-Person: Visiting your local bank branch to submit the form directly can also be an option.

Choosing the right submission method can depend on your urgency and convenience.

Eligibility Criteria for Using the Domestic Wire Transfer Form

To use the Domestic Wire Transfer Form, individuals must meet specific eligibility criteria:

- Must have an active account with usalliance financial or a participating bank.

- Must be the account holder or an authorized user on the account.

- Must provide valid identification if required by the bank.

Meeting these criteria ensures that the transfer process is secure and compliant with banking regulations.

Quick guide on how to complete domestic wire transfer form usalliance financial

The simplest method to locate and sign Protective Life Beneficiary Change Form

Across the spectrum of your entire organization, ineffective procedures related to document approval can take up a signNow amount of productive hours. Signing documents like Protective Life Beneficiary Change Form is an integral aspect of operations in any organization, which is why the effectiveness of each agreement's lifecycle has a substantial impact on the company's overall productivity. With airSlate SignNow, signing your Protective Life Beneficiary Change Form can be as straightforward and swift as possible. You will discover with this platform the latest version of nearly any form. Even better, you can sign it instantly without the need for additional software on your computer or printing any physical copies.

Steps to obtain and sign your Protective Life Beneficiary Change Form

- Explore our library by category or use the search bar to locate the document you require.

- Check the form preview by selecting Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any relevant details using the toolbar.

- Once finished, click the Sign tool to affix your signature to the Protective Life Beneficiary Change Form.

- Choose the signature option that suits you best: Draw, Create initials, or insert an image of your handwritten signature.

- Click Done to complete your editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything you need to handle your paperwork efficiently. You can find, complete, edit, and even send your Protective Life Beneficiary Change Form in one tab without any trouble. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct domestic wire transfer form usalliance financial

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How much does a domestic wire transfer actually cost to the bank?

The US does not have a central real-time settlement switch to which all banks are connected. The closest analog the US has is a 40-year old technology that is called the ACH (Automated Clearing House) which still is a 3-day process, using batch filing for transfers between banks.With over 8,000+ financial branches, the reason that the US has never bothered to implement a real-time switch can easily be seen by the amount of money that banks make by keeping your money overnight (float). Billions of US dollars are earned by the banks on a yearly basis by having this inordinate delay built into the system. Considering that the US processed over US$ 33 Trillion in 2011 via ACH payments, you can calculate (using your preferred model) how much money they made with that transaction volume. Everyone who is processing ACH payments is making money. Essentially, it is the bank that is setting the rate to move that transfer across. Sure, they can do it for tens of cents, but if they can get away with charging you $15 for it, why not.There is no incentive for the banks to move to a real-time settlement system, until and unless they figure out a way to earn the money they are earning through ACH right now. There has been a lot of talk about a faster settlement system, but even if that comes into play, there is no guarantee that everyone will hop onto it and it is most likely that the banks involved will impose higher fees to have the funds channeled through faster. If there is one thing for certain, in the US, speed comes at a price.As a postscript, an excellent read on this is Dwolla's effort to implement a real-time settlement switch: ACH goes real time with FiSync. Free for banks and credit unions.

-

How long does a domestic wire transfer take to clear?

In the US, a Fed Funds Wire Transfer should take a couple of hours during normal business hours. Now Fed Funds are bank guaranteed funds, so you cannot walk into a bank, give them a check for $10,000 and ask them to wire it someplace. The money in the sending account must be “good” funds. There is a fee for sending funds via Fed wire, and there is a cut-off time, so you can’t initiate a transfer at 4:45 either. An alternative, particularly if these transfers are going to reoccur, is an ACH, or Automated Clearing House transfer. These should be free and clear overnight. You need the receiving parties account number and bank routing number to do this. If by domestic, you mean someplace other than the US, I can’t help you.

-

How long does it take for a US bank to trace a lost domestic wire transfer?

I am unaware of any analysis of this, and pretty certain it will be largely dependent on the operational setup of the banks involved in the origination and receiving of payments. I also do not know many enough about the US payments methods (Fedwire and ACH) but some points to consider:Every payments has a unique IDPayment messages have very specific fields that enable each bank to process the payment. Aside from the curreny, amount, and date, there is also the banks involved in the payment chain. This is in an sequence on the payment message to allow automated (aka STP) handling of payments.As a domestic payment, there almost certainly only two banks involved in that specific payment: the originator of the payment (sender) and the agent bank (receiver)Consequently, there cannot be lost wires.The department that receives the request to investigate may not have access to the relevant information or tools, and this will add the time.The usual method of getting another bank (the receiving bank) to investigate, is for the ordering bank to issue an authenticated free format swift message, usually MT199 or MT299.The originating bank should be able to readily identify the unique ID and reference, and provide this to the receiving bank, which is all they need to trace which account the money went in to. The time this takes is dependent on the SLA’s within each bank, and the competence of the team handling the query.My experience with US banks is that this can be identified in the same day for competent setups, but this is for wholesale banking payments, which may or may not differ with retail payments.

-

Are there any banks in India that allow their customers to make international wire transfers via Netbanking without having to go to the branch and fill a form?

If yours is a savings account, yes. A lot of private banks have that option. I've used AXIS Bank to send out wire transfers and it works fine. It is important to note that you can only send transfers to close relatives.P.S. If you're an Indian business or a freelancer, do check out Zilra (that we built) to receive payments from your customers around the world. You can find pricing information here - Zilra

Create this form in 5 minutes!

How to create an eSignature for the domestic wire transfer form usalliance financial

How to make an electronic signature for your Domestic Wire Transfer Form Usalliance Financial online

How to make an eSignature for your Domestic Wire Transfer Form Usalliance Financial in Chrome

How to create an electronic signature for signing the Domestic Wire Transfer Form Usalliance Financial in Gmail

How to create an eSignature for the Domestic Wire Transfer Form Usalliance Financial from your smartphone

How to create an electronic signature for the Domestic Wire Transfer Form Usalliance Financial on iOS devices

How to make an electronic signature for the Domestic Wire Transfer Form Usalliance Financial on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to USAlliance Financial?

airSlate SignNow is a powerful tool that enables businesses to send and eSign documents efficiently. For customers of USAlliance Financial, this means they can streamline their document management processes, ensuring fast and secure transactions.

-

How much does airSlate SignNow cost for USAlliance Financial clients?

Pricing for airSlate SignNow is designed to be affordable for all businesses, including those associated with USAlliance Financial. Different plans are available, allowing users to choose the one that best fits their needs, with options for increased functionality as required.

-

What features does airSlate SignNow offer for USAlliance Financial users?

airSlate SignNow offers a variety of features tailored for USAlliance Financial users, including document templates, custom branding, automated workflows, and secure eSigning. These features help enhance productivity while ensuring compliance with industry standards.

-

Is airSlate SignNow secure for USAlliance Financial documents?

Yes, airSlate SignNow prioritizes security, making it a safe solution for handling sensitive documents related to USAlliance Financial. Features such as SSL encryption, document tracking, and advanced authentication methods work together to protect your information.

-

Can airSlate SignNow integrate with USAlliance Financial’s existing systems?

Absolutely! airSlate SignNow is designed to seamlessly integrate with various platforms commonly used by USAlliance Financial clients. This allows for a smoother workflow and minimizes disruption while utilizing the features of both systems.

-

What benefits does airSlate SignNow provide to clients of USAlliance Financial?

Clients of USAlliance Financial benefit from airSlate SignNow's ease of use, speed, and cost-effectiveness. By reducing the time spent on document signing and management, businesses can focus on more important tasks, increasing overall efficiency.

-

How can I get help or support with airSlate SignNow as a USAlliance Financial user?

As a USAlliance Financial user, you can access dedicated support for airSlate SignNow through various channels, including live chat, email, and a comprehensive knowledge base. Whether you need technical assistance or guidance on best practices, help is readily available.

Get more for Protective Life Beneficiary Change Form

- Sales incentive tracking form for spiffs doc trggroup

- Age declaration form

- Industry registration form

- Animal bite reporting form colorado gov colorado

- Kuykendall dermatology new patient health information

- Matching rational functions to their graphs worksheet form

- Circuit court for notice courts state md form

- Work for hire copyright agreement template form

Find out other Protective Life Beneficiary Change Form

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later