Initial Resolution Buncombe 2012A LOBs Edits to V 3 2 DOC Buncombecounty Form

Understanding the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

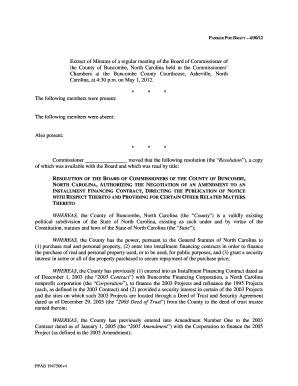

The Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty is a formal document that outlines the intent of Buncombe County to issue limited obligation bonds (LOBs). This resolution serves as a foundational legal instrument that details the purpose of the bond issuance, including funding for specific projects or services. It is essential for ensuring compliance with local and state regulations governing public financing and debt issuance.

Steps to Complete the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

Completing the Initial Resolution involves several key steps. First, it is important to gather all necessary information regarding the proposed bond issuance, including the amount, purpose, and projected timeline. Next, stakeholders should review the document to ensure all relevant details are accurately captured. Once the resolution is drafted, it must be presented to the appropriate governing body for approval. Following approval, the resolution should be filed with the appropriate county office to ensure it is officially recorded.

Legal Use of the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

The legal use of the Initial Resolution is critical for the legitimacy of the bond issuance process. This document must comply with state laws governing public finance, including any specific requirements set forth by the North Carolina Local Government Commission. Proper execution of the resolution ensures that the bonds issued are legally binding and that the funds raised can be utilized for the intended public purposes.

Obtaining the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

To obtain the Initial Resolution, interested parties should contact the Buncombe County finance department or the office responsible for public finance. These offices can provide the necessary documentation and guidance on how to access the resolution. Additionally, it may be available through public records requests, ensuring transparency and accessibility for residents and stakeholders.

Key Elements of the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

Key elements of the Initial Resolution include the title of the bond issue, the total amount to be raised, the purpose of the bonds, and the repayment plan. It also outlines any covenants or commitments made by the county regarding the use of proceeds and adherence to legal requirements. Understanding these elements is crucial for stakeholders involved in the financing process.

Examples of Using the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

Examples of using the Initial Resolution can vary widely, from funding infrastructure improvements to supporting community development projects. For instance, a resolution may be utilized to finance the construction of a new public facility or to enhance existing services. Each application must align with the legal framework established by state law and the specific goals of Buncombe County.

Quick guide on how to complete initial resolution buncombe 2012a lobs edits to v 3 2 doc buncombecounty

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Work on [SKS] from any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

Steps to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or censor sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and assure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the initial resolution buncombe 2012a lobs edits to v 3 2 doc buncombecounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

The Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty is a crucial document that outlines specific edits and resolutions related to local government operations. It serves as a formal record for decision-making processes and is essential for compliance and transparency in Buncombe County.

-

How can airSlate SignNow help with the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty. Our user-friendly interface ensures that you can manage your documents efficiently, reducing the time spent on administrative tasks.

-

What are the pricing options for using airSlate SignNow for the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for managing the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

With airSlate SignNow, you gain access to features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are designed to enhance your experience when handling the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty, making the process efficient and reliable.

-

Are there any integrations available for airSlate SignNow when working with the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty alongside your existing tools. This integration capability enhances productivity and ensures that all your documents are easily accessible.

-

What benefits does airSlate SignNow provide for businesses dealing with the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

Using airSlate SignNow for the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security for your documents. Our platform empowers businesses to focus on their core activities while we handle the document management.

-

Is airSlate SignNow secure for handling the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including the Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty, are protected with advanced encryption and compliance with industry standards. You can trust us to keep your sensitive information safe.

Get more for Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

- Vca family and oahu veterinary specialty centerstaff form

- Upload accountnow com form

- Tax return use form sa100 to file a tax return report your income and to claim tax reliefs and any repayment due youll need 733402847

- I g u a local 3 form

- Cpl application rivington form

- Musc letterhead form

- My mercy birth plan mercy your life is our lifes work form

- Log in to your account or register fsafeds form

Find out other Initial Resolution Buncombe 2012A LOBs Edits To V 3 2 DOC Buncombecounty

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure