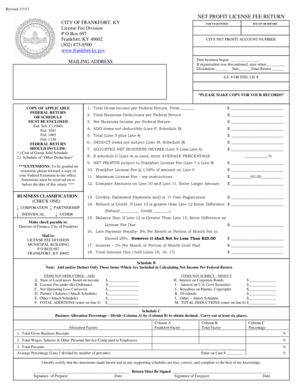

CITY NET PROFIT Frankfort Kentucky Frankfort Ky Form

Understanding the Kentucky Net Profit License Fee Return

The Kentucky Net Profit License Fee Return is a crucial document for businesses operating in Frankfort, Kentucky. This form is used to report the net profit of a corporation or business entity and calculate the associated license fee. The fee is based on the net profits earned during the fiscal year, making it essential for compliance with local tax regulations.

Steps to Complete the Kentucky Net Profit License Fee Return

Completing the Kentucky Net Profit License Fee Return involves several key steps:

- Gather financial documents, including income statements and expense reports.

- Calculate your total net profit by subtracting allowable business expenses from gross income.

- Determine the applicable license fee based on the net profit amount.

- Fill out the return form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

Required Documents for the Kentucky Net Profit License Fee Return

To successfully file the Kentucky Net Profit License Fee Return, certain documents are necessary:

- Income statements detailing revenue generated by the business.

- Expense reports outlining all business-related costs.

- Previous year’s tax returns for reference.

- Any additional documentation required by local authorities.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for compliance. The Kentucky Net Profit License Fee Return typically has specific due dates:

- Annual returns are usually due on the 15th day of the fourth month following the end of the fiscal year.

- Extensions may be available but must be requested before the original deadline.

Form Submission Methods

Businesses can submit the Kentucky Net Profit License Fee Return through various methods:

- Online submission via the Kentucky Department of Revenue website.

- Mailing a completed paper form to the appropriate local tax office.

- In-person submission at designated local government offices.

Penalties for Non-Compliance

Failure to file the Kentucky Net Profit License Fee Return can result in significant penalties:

- Late filing penalties may apply if the return is not submitted by the deadline.

- Interest may accrue on any unpaid fees, increasing the total amount owed.

- Continued non-compliance can lead to further legal action from local authorities.

Quick guide on how to complete city net profit frankfort kentucky frankfort ky

Complete CITY NET PROFIT Frankfort Kentucky Frankfort Ky effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage CITY NET PROFIT Frankfort Kentucky Frankfort Ky on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign CITY NET PROFIT Frankfort Kentucky Frankfort Ky without hassle

- Find CITY NET PROFIT Frankfort Kentucky Frankfort Ky and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign CITY NET PROFIT Frankfort Kentucky Frankfort Ky and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city net profit frankfort kentucky frankfort ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ky net profit license fee return?

The ky net profit license fee return is a tax form that businesses in Kentucky must file to report their net profits and pay the associated license fees. This return is essential for compliance with state regulations and helps ensure that your business remains in good standing.

-

How can airSlate SignNow assist with the ky net profit license fee return?

airSlate SignNow provides a streamlined solution for businesses to electronically sign and send documents related to the ky net profit license fee return. Our platform simplifies the process, making it easy to gather signatures and ensure timely submissions.

-

What are the pricing options for using airSlate SignNow for ky net profit license fee return?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your ky net profit license fee return without breaking the bank, allowing you to focus on your core business activities.

-

What features does airSlate SignNow offer for managing the ky net profit license fee return?

Our platform includes features such as customizable templates, secure document storage, and real-time tracking of signatures. These tools make it easier to manage your ky net profit license fee return efficiently and effectively.

-

Are there any benefits to using airSlate SignNow for the ky net profit license fee return?

Using airSlate SignNow for your ky net profit license fee return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution helps you save time and ensures that your documents are handled securely.

-

Can airSlate SignNow integrate with other software for the ky net profit license fee return?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your ky net profit license fee return. This integration helps streamline your workflow and ensures that all your financial documents are in one place.

-

Is airSlate SignNow user-friendly for filing the ky net profit license fee return?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and use. Whether you're familiar with e-signatures or not, our platform simplifies the process of filing your ky net profit license fee return.

Get more for CITY NET PROFIT Frankfort Kentucky Frankfort Ky

- Indiana unsecured installment payment promissory note for fixed rate indiana form

- Indiana installments fixed rate promissory note secured by residential real estate indiana form

- Indiana installments fixed rate promissory note secured by personal property indiana form

- Indiana note 497307105 form

- Notice of option for recording indiana form

- Life documents planning package including will power of attorney and living will indiana form

- General durable power of attorney for property and finances or financial effective upon disability indiana form

- Essential legal life documents for baby boomers indiana form

Find out other CITY NET PROFIT Frankfort Kentucky Frankfort Ky

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent