Form MO PTE General Information 2023-2026

Overview of Nebraska 1040N Instructions

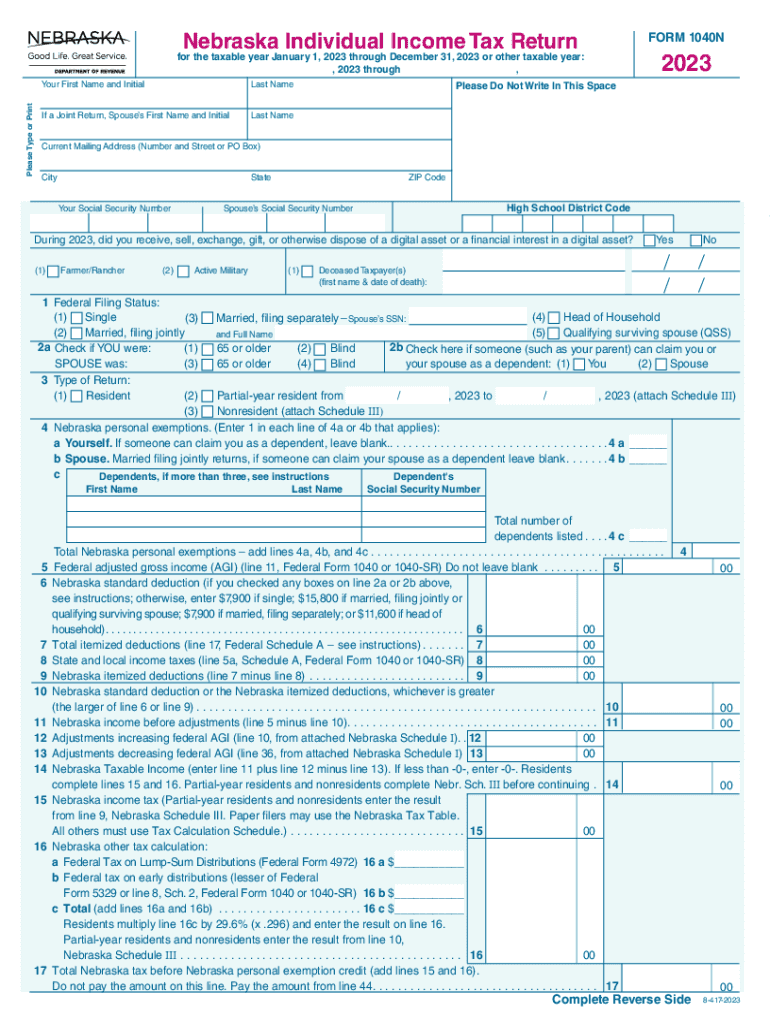

The Nebraska 1040N form is essential for individuals filing their state income tax returns. It is specifically designed for residents of Nebraska who need to report their income, calculate their tax liability, and claim any applicable credits or deductions. Understanding the instructions associated with the 1040N form is crucial for ensuring compliance with state tax laws and for accurately completing your tax return.

Steps to Complete the Nebraska 1040N Form

Completing the Nebraska 1040N form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number, ensuring accuracy to avoid delays.

- Report your total income, including wages, interest, and dividends, in the designated sections of the form.

- Calculate your Nebraska taxable income by subtracting any deductions or exemptions you qualify for.

- Determine your tax liability based on the Nebraska tax rates applicable to your income level.

- Complete any additional schedules or forms required for specific credits or deductions.

- Review your completed form for accuracy before submitting it.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential for avoiding penalties. The Nebraska 1040N form is typically due on April fifteenth of each year. If this date falls on a weekend or holiday, the due date may be extended to the next business day. Additionally, if you require more time to complete your return, you may file for an extension, which allows for an additional six months to submit your form, although any taxes owed must still be paid by the original due date.

Required Documents for Filing

To successfully file your Nebraska 1040N form, you will need several documents:

- Your W-2 forms from all employers.

- Any 1099 forms for additional income sources.

- Records of any tax deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents organized and accessible will streamline the filing process and help ensure that you do not miss any important information.

Form Submission Methods

You can submit your Nebraska 1040N form through various methods:

- Online: Use the Nebraska Department of Revenue’s e-filing system for a quick and secure submission.

- Mail: Print your completed form and send it to the appropriate address listed in the instructions.

- In-Person: Visit your local Nebraska Department of Revenue office to submit your form directly.

Choosing the right submission method can help you manage your filing experience effectively.

Key Elements of the Nebraska 1040N Form

Understanding the key elements of the Nebraska 1040N form is vital for accurate completion. These elements include:

- Personal Information: Essential details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Sections to report various types of income, such as wages and interest.

- Deductions and Exemptions: Areas to claim any allowable deductions that reduce taxable income.

- Tax Calculation: A section to compute the total tax owed based on your taxable income.

Each of these components plays a critical role in determining your overall tax liability and ensuring compliance with Nebraska tax regulations.

Quick guide on how to complete form mo pte general information

Complete Form MO PTE General Information seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form MO PTE General Information on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form MO PTE General Information effortlessly

- Find Form MO PTE General Information and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misdirected files, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow caters to your requirements in document management with just a few clicks from any device you prefer. Alter and eSign Form MO PTE General Information and ensure exceptional communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo pte general information

Create this form in 5 minutes!

How to create an eSignature for the form mo pte general information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska 1040N instructions form?

The Nebraska 1040N instructions form provides detailed guidance on how to complete your Nebraska state income tax return. It includes information on eligibility, deductions, and credits available to taxpayers. Understanding this form is crucial for accurate tax filing in Nebraska.

-

How can airSlate SignNow help with the Nebraska 1040N instructions form?

airSlate SignNow simplifies the process of completing and eSigning the Nebraska 1040N instructions form. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. With our user-friendly interface, you can easily manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Nebraska 1040N instructions form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to features that streamline the completion of the Nebraska 1040N instructions form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Nebraska 1040N instructions form?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage for the Nebraska 1040N instructions form. These tools enhance efficiency and ensure that your tax documents are organized and easily accessible. Our platform is designed to simplify your tax filing process.

-

Can I integrate airSlate SignNow with other software for the Nebraska 1040N instructions form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when handling the Nebraska 1040N instructions form. This integration helps you manage your documents more effectively and enhances collaboration with your team.

-

What are the benefits of using airSlate SignNow for tax documents like the Nebraska 1040N instructions form?

Using airSlate SignNow for tax documents like the Nebraska 1040N instructions form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making tax filing a hassle-free experience. You can focus on what matters most while we handle the paperwork.

-

How do I get started with airSlate SignNow for the Nebraska 1040N instructions form?

Getting started with airSlate SignNow for the Nebraska 1040N instructions form is easy. Simply sign up for an account, choose a pricing plan, and start creating or uploading your tax documents. Our intuitive platform guides you through the process, making it simple to eSign and manage your forms.

Get more for Form MO PTE General Information

- Warning of default on residential lease iowa form

- Landlord tenant closing statement to reconcile security deposit iowa form

- Name change notification package for brides court ordered name change divorced marriage for iowa iowa form

- Name change notification form iowa

- Commercial building or space lease iowa form

- Ia package form

- Iowa guardian form

- Bankruptcy forms 7

Find out other Form MO PTE General Information

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form