Nr73 Form 2017-2026

What is the Nr73 Form

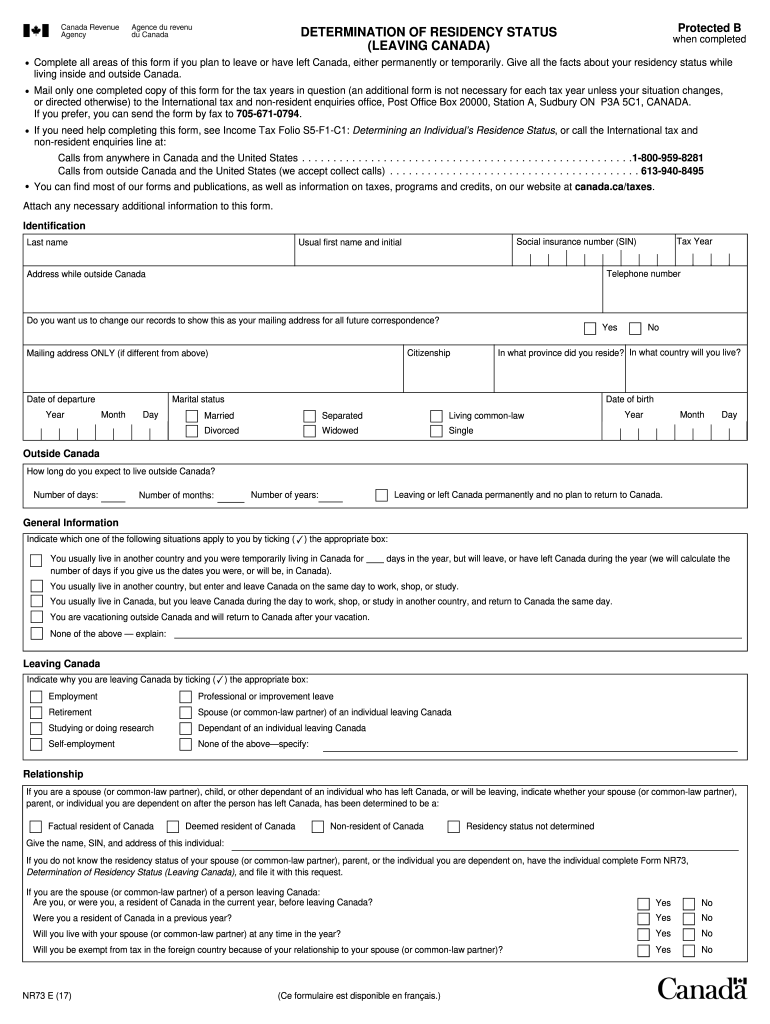

The Nr73 form is a document used by individuals who are leaving Canada and need to report their residency status to the Canada Revenue Agency (CRA). This form is particularly important for those who have been living in Canada and are transitioning to a new residency status, as it helps determine their tax obligations. The Nr73 form collects information about the individual's residency history, ties to Canada, and intentions regarding future residency. Understanding this form is crucial for ensuring compliance with Canadian tax laws.

How to use the Nr73 Form

Using the Nr73 form involves a few straightforward steps. First, individuals must accurately fill out the form, providing all required information regarding their residency status and any relevant ties to Canada. Next, it is essential to submit the completed form to the CRA, either online or by mail, depending on the individual's preference. The CRA uses the information provided to assess the residency status and determine any tax implications. It is advisable to keep a copy of the submitted form for personal records.

Steps to complete the Nr73 Form

Completing the Nr73 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, such as proof of residency, travel records, and any other relevant information.

- Fill out the form with accurate details, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the CRA through the preferred method—online or by mail.

Legal use of the Nr73 Form

The Nr73 form serves a legal purpose in the context of Canadian tax law. It is used to establish an individual's residency status, which has significant implications for tax liabilities. Proper use of the form ensures compliance with the Income Tax Act and helps avoid potential penalties for misreporting residency status. It is crucial to provide truthful and accurate information, as discrepancies can lead to legal consequences.

Required Documents

When completing the Nr73 form, individuals may need to provide several supporting documents to verify their residency status. Commonly required documents include:

- Proof of residency, such as utility bills or lease agreements.

- Travel records that indicate the duration of stay outside Canada.

- Identification documents, including passports or driver's licenses.

Having these documents ready can facilitate a smoother application process.

Penalties for Non-Compliance

Failing to submit the Nr73 form or providing inaccurate information can result in serious penalties. The Canada Revenue Agency may impose fines or interest on any unpaid taxes due to misreported residency status. In some cases, individuals may face legal action for tax evasion. It is essential to understand the implications of non-compliance and to ensure that the Nr73 form is completed and submitted accurately and on time.

Quick guide on how to complete form 73 for revenue canada 2017 2019

A concise guide on how to create your Nr73 Form

Finding the suitable template can be a hurdle when you need to present official international papers. Even if you have the necessary form, it may be tedious to promptly prepare it according to all the specifications if you resort to printed copies rather than managing everything digitally. airSlate SignNow is the web-based eSignature platform that assists you in navigating through this process. It allows you to select your Nr73 Form and swiftly complete and sign it on-site without the need to reprint documents whenever you make an error.

Here are the steps you need to take to create your Nr73 Form with airSlate SignNow:

- Click the Get Form button to upload your document to our editor immediately.

- Begin with the first empty field, enter details, and proceed using the Next tool.

- Complete the empty boxes utilizing the Cross and Check tools from the panel above.

- Select the Highlight or Line options to emphasize the most crucial information.

- Click on Image and upload one if your Nr73 Form requires it.

- Utilize the right-side panel to add more fields for you or others to complete if needed.

- Review your entries and validate the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing the form by clicking the Done button and selecting your file-sharing preferences.

Once your Nr73 Form is ready, you can distribute it as you prefer - send it to recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders based on your preferences. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct form 73 for revenue canada 2017 2019

FAQs

-

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

-

How do I fill out the IELTS ATRF form for Ryerson University, Canada?

Sorry, cannot help you on this one. I have no idea what the acronyms represent and I graduated in 1971 so forms were paper and filed with the department head. Your best bet would be to go to the RU site and search for these items there.

Create this form in 5 minutes!

How to create an eSignature for the form 73 for revenue canada 2017 2019

How to create an electronic signature for the Form 73 For Revenue Canada 2017 2019 online

How to make an electronic signature for your Form 73 For Revenue Canada 2017 2019 in Google Chrome

How to make an electronic signature for putting it on the Form 73 For Revenue Canada 2017 2019 in Gmail

How to generate an electronic signature for the Form 73 For Revenue Canada 2017 2019 straight from your smartphone

How to generate an eSignature for the Form 73 For Revenue Canada 2017 2019 on iOS devices

How to create an electronic signature for the Form 73 For Revenue Canada 2017 2019 on Android OS

People also ask

-

What is the nr73 residency leaving agency and how does it work?

The nr73 residency leaving agency helps individuals manage their residency transitions effectively. By offering a streamlined process, it simplifies the paperwork and documentation required for leaving a residency. With features like eSign capabilities, users can submit their documents quickly and securely.

-

What are the pricing options available for the nr73 residency leaving agency?

The nr73 residency leaving agency offers flexible pricing tailored to different needs. Users can choose from monthly or annual subscription models to fit their budget. Additionally, airSlate SignNow frequently provides discounts for longer commitments, making it a cost-effective solution.

-

How does airSlate SignNow enhance the functionality of the nr73 residency leaving agency?

airSlate SignNow enhances the nr73 residency leaving agency by providing a user-friendly interface for document signing and management. It includes features such as real-time tracking and reminders, ensuring that all necessary documents are signed and submitted on time. This leads to a smoother and more efficient residency transition.

-

Are there any integrations available with the nr73 residency leaving agency?

Yes, the nr73 residency leaving agency easily integrates with a variety of applications, enhancing its utility. It syncs seamlessly with popular tools like Google Drive, Dropbox, and various CRM systems. This integration capability ensures that your workflow remains uninterrupted and organized.

-

What benefits does the nr73 residency leaving agency offer to its users?

The nr73 residency leaving agency provides numerous benefits, including increased efficiency and reduced stress during residency transitions. By automating document signing and management, it saves users signNow time. This allows individuals to focus on other important aspects of their relocation.

-

Can I try the nr73 residency leaving agency before committing to a subscription?

Absolutely! The nr73 residency leaving agency offers a free trial period. This allows prospective customers to experience the features and benefits of the service firsthand before making a commitment. It's a great way to ensure it meets your specific needs.

-

Is the nr73 residency leaving agency compliant with legal standards?

Yes, the nr73 residency leaving agency adheres to all necessary legal standards for electronic signatures. This compliance ensures that all documents signed through airSlate SignNow are legally binding and secure. Users can trust that their documentation is handled in accordance with the law.

Get more for Nr73 Form

Find out other Nr73 Form

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form