Sa900 2018

What is the SA900?

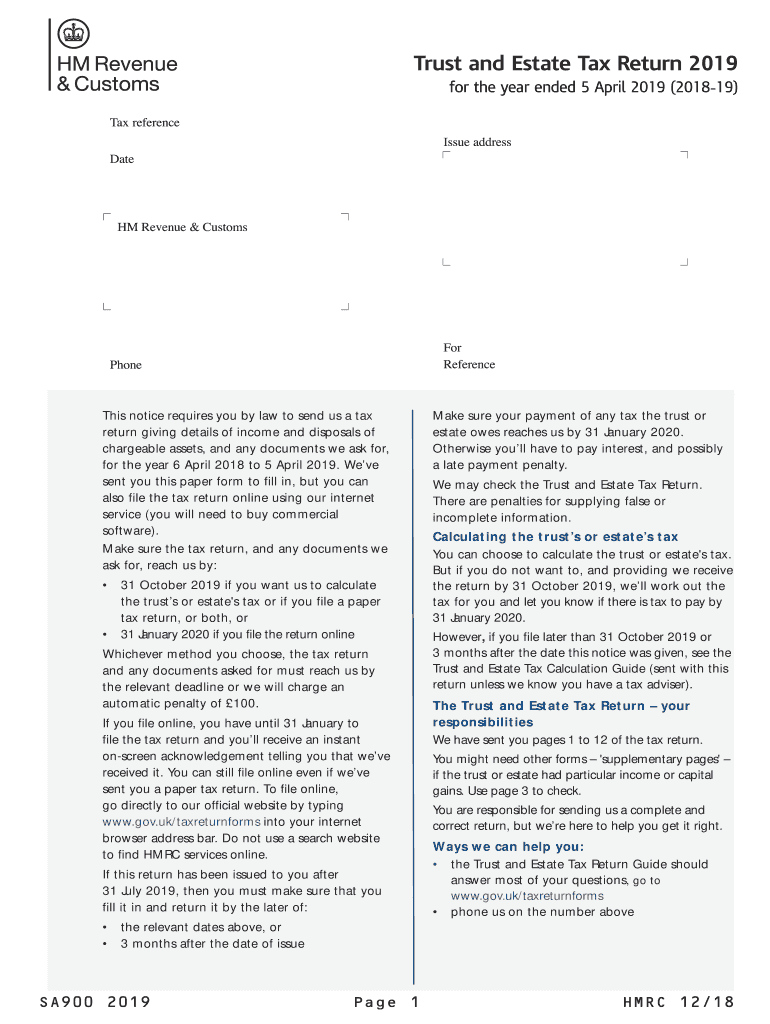

The SA900 is a specific form used for reporting trust income to HM Revenue and Customs (HMRC) in the United Kingdom. This form is primarily utilized by trustees of a trust to declare income generated by the trust during a tax year. The information provided on the SA900 helps HMRC assess the tax obligations of the trust and ensures compliance with tax regulations. Understanding the purpose and requirements of the SA900 is crucial for trustees to fulfill their legal obligations accurately.

Steps to Complete the SA900

Completing the SA900 involves several important steps to ensure accuracy and compliance. First, gather all necessary information regarding the trust, including its income sources and any expenses incurred. Next, fill out the form with precise details, ensuring that all sections are completed, including trustee information and income declarations. After completing the form, review it thoroughly to verify that all information is correct and complete. Finally, submit the SA900 to HMRC by the specified deadline to avoid penalties.

Legal Use of the SA900

The SA900 must be completed and submitted in accordance with UK tax laws. It serves as a legal document that provides HMRC with essential information about the trust's income and expenses. Failure to submit the SA900 or providing inaccurate information can result in penalties or legal repercussions. It is vital for trustees to understand the legal implications of the SA900 to ensure compliance and safeguard against potential issues.

Required Documents

When completing the SA900, several documents may be required to support the information provided. These documents typically include:

- Trust deed or agreement

- Financial statements for the trust

- Records of income generated by the trust

- Receipts for any expenses claimed

Having these documents readily available will facilitate the completion of the SA900 and help ensure that all information is accurate and substantiated.

Form Submission Methods

The SA900 can be submitted to HMRC through various methods. Trustees can choose to file the form online using HMRC's digital services, which offers a streamlined process. Alternatively, the form can be printed and mailed to HMRC. It is essential to ensure that the submission method chosen complies with HMRC guidelines and that the form is submitted by the required deadline to avoid any penalties.

Penalties for Non-Compliance

Non-compliance with the SA900 filing requirements can lead to significant penalties. If the form is not submitted on time, HMRC may impose fines or interest on any unpaid taxes. Additionally, providing false information on the SA900 can result in legal action and further financial penalties. Trustees should be aware of these risks and take the necessary steps to ensure timely and accurate submission of the SA900.

Quick guide on how to complete trust and estate tax return 2019 use form sa9002019 to file a tax return for a trust or estate for the tax year ended 5 april

A brief guide on how to create your Sa900

Locating the appropriate template can present a challenge when you need to provide formal international documents. Even if you possess the necessary form, it may be cumbersome to swiftly fill it out according to all the stipulations if you opt for hard copies rather than handling everything digitally. airSlate SignNow is the online electronic signature tool that assists you in overcoming all these hurdles. It allows you to obtain your Sa900 and promptly complete and sign it on-site without having to reprint documents in the event of an error.

Here are the actions you need to undertake to prepare your Sa900 with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first blank field, input your information, and proceed with the Next function.

- Fill in the empty spaces with the Cross and Check features from the toolbar above.

- Choose the Highlight or Line options to mark the most crucial information.

- Click on Image and upload one if your Sa900 requires it.

- Utilize the right-side panel to add additional fields for yourself or others to complete if necessary.

- Review your entries and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Finish editing by clicking the Done button and selecting your file-sharing preferences.

Once your Sa900 is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders according to your liking. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct trust and estate tax return 2019 use form sa9002019 to file a tax return for a trust or estate for the tax year ended 5 april

FAQs

-

Why do I need a CA (Chartered accountant) to file my income tax return? How do I file the income tax return myself for the year 2019-20 in India?

When you fall ill then depend on your level of experience in medical feild you take medicine on your own otherwise you select medical practitioner depend upon level of problem. Even selecting proper doctor is also challenge and we need understand many medical terms for it.Same is here, filing return is clerical job but for proper reporting you required some knowledge of income tax and if the things are complicated then obviously you need CA. But again not only any CA. You have to find which category of experience required and his past performance etc etc

-

Can we file income tax return with out help of Chartered Accountants or Tax professionals?

Hi sir,Yes, You can very well file your income tax return without the help of CA.You can do it by using youtube or many other social media handles.Even you can visit the E-filing portal of Income tax India. You can get what you want.But let me tell you one thing.What if the notice is received after filing of your return? Like to whom you will call for solution of this notice?What if you have a refund but you will not get because of some simple mistake done by you?What if you have income which is taxable but you have not shown in the ITR filed by you?What if you have capital gain income or any small business income but you forgot to mention that in your return?What if you have income in 26AS but you have filed return without reconciling it with the actual income?It looks easy to file and i am damn sure that you will file it easily but you have to think what ifs also along with this.Thank you sir.Regards

-

How can I file the income tax returns Form 16 for the year of 2017–2018 and 2018–2019? Is there any chance, with a late fee?

No, you can’t file ITR for AY:2017–18 & 2018–19 as the due date for filing ITR is over i.e 31st March 2019.But you can apply for condonation of delay in filing ITR with reasons to CIT. Once the condonation is accepted you can file but it is a complex process.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can an NRI file a tax return for AY 2018–2019 with an ITR1 form, as there is no column on the ITR1 form to mark residential status?

Yes, there is no column in the ITR 1 For Mark The residential status, therefore, you should furnishred the Form No.2.

-

Can I form a UK limited company in March 2015 and start trading after 6 April 2015 without needing to send an annual return for the previous tax year (5 April 2014 to 5 April 2015)?

You dont write 'tax returns' for your business based on the personal income tax dates (April) you write them based on your companies own financial year end dates.Have a look here:https://www.gov.uk/prepare-file-...You must send your return 9 months after the end of your financial year - I.e. 21 months after you start your company. That's for companies house and paying tax -- you actually have another 3 months before you need to report to HMRC. It has nothing to do with the personal 'tax year'.The only things you need to report based on April deadlines is employee payments (PAYE) and your own personal tax return -- which you either won't have to do (because you won't have been paid anything) or will have to do anyway for another reason (already earned over £100k one year in the past etc.)Basically - rather than worrying about the tax and filing for the first year, worry about making some money!

-

Can I file income tax for FY 2015 in 2019 in India? I am a salaried employee and have only my salary as the lone source of income which is TDS. I just missed filing the return. Is it possible for me to file the return now in 2019?

As the last date of filing of return has expired, the return can only be filed by making an application u/s 119(2)(b).Due dates of filing return-The ITR for a Financial year has to be filed by an individual on or before 31st July of the next year (i.e Assessment year) . For example return for FY 14–15 can be filed by 31st July 2016.Belated Return -Prior to amendment of Finance Act 2016, a belated return could be filed till one year from the end of AY. But pursuant to amendment made by Finance Act 2016, belated return can be filed till the end of the Assessment year i.e for FY 16–17 belated return can be filed till 31st March 2018 .Return u/s 119(2)(b)The provision of Section 119(2)(b) empower the income tax authorities to accept the income tax return even if the time limit has expired in case of genuine reason of delay and genuine hardship to the assessee. An an application is to be made to appropriate authority before six year's from end of relevant assessment year.The procedure for application under Section 119(2)(b) is as follows -Login to the income tax e filing website using your id and passwordGo to e-file option and click on income tax returnSelect the AY and ITR nameSelect section 119(2)(b) as the reference section and file your returnsReturn must be filed under section 139(4) instead of section 139(1)However it has to be noted that the relief under section can be claimed only if the appropriate authority is of the view that the delay is on account of genuine reason and will cause hardship to the assessee.

-

If an LLC is formed in January 2018, can foreign members of the LLC apply for their ITIN numbers before 2019? How would they do that when the W-7 form (probably) has to be sent in together with a tax return?

Hi Yes they can apply now. The EIN and LLC agreement listing them as member needs to be included. They would check the reason for an exception to filing a tax return.All ITINs take 7 to 11 weeks to be issued for international applicants.The ID documents need to be included. These can be the original documents which the IRS will return or you can use a CAA like myself to assist.

-

I’m on a H1B visa, single and have been in the U.S. for less than 5 years. Are the forms 1040A and 1040EZ the only ones that I need to fill for my tax return? Should I just use a software like TurboTax or hire an accountant?

It’s tax time.Taxation of immigrants by the United States is signNowly affected by the immigration status of such immigrants. Although the immigration laws of the United States refer to aliens as immigrants, nonimmigrants, and undocumented (illegal) aliens, the tax laws of the United States refer only to “resident aliens” and “nonresident aliens”.In general, the controlling principle is that resident aliens are taxed in the same manner as U.S. citizens on their worldwide income, and nonresident aliens are taxed according to special rules contained in certain parts of the Internal Revenue Code.Holders of nonimmigrant visas or temporary visas may or may not have to report income and pay taxes to the United States Government. Holders of nonimmigrant visas only become tax residents if they spend at least 183 days of the current year within the United States. If you have spent more than 183 days of the current year in the U.S., you are considered a “resident alien.”A nonresident alien/nonimmigrant visa holder (with certain narrowly defined exceptions) is subject to federal income tax only on income which is derived from sources within the United States and or income that is effectively connected with a U.S. trade or business.Nonresident aliens who are required to file an income tax return must use:Form 1040NR, U.S. Nonresident Alien Income Tax Return or,Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, if qualified.Resident aliens who are required to file an income tax return must use:Form 1040, U.S. Individual Income Tax Return,Form 1040A, U.S. Individual Income Tax Return, orForm 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents.According to TurboTax, its software does not support the filing of Form 1040NR. However, it has a partnership with Sprintax that does support such filings. I would recommend that you also consult with a certified public accountant because depending on your circumstances, s/he may be able to identify other IRS forms and or deductions that may be applicable to you.For more information on the intersection of US taxation and immigration, go here.For more information on immigration, please visit here.

Create this form in 5 minutes!

How to create an eSignature for the trust and estate tax return 2019 use form sa9002019 to file a tax return for a trust or estate for the tax year ended 5 april

How to create an electronic signature for your Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April online

How to make an eSignature for the Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April in Google Chrome

How to create an electronic signature for signing the Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April in Gmail

How to generate an eSignature for the Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April right from your smart phone

How to create an eSignature for the Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April on iOS devices

How to create an electronic signature for the Trust And Estate Tax Return 2019 Use Form Sa9002019 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April on Android OS

People also ask

-

What is the SA900 HMRC form and who needs to use it?

The SA900 HMRC form is a tax return specifically designed for partnerships in the UK. Businesses that operate as partnerships must complete this form to report their income and calculate their tax liability. Properly filling out the SA900 HMRC form is essential for compliance with tax regulations.

-

How can airSlate SignNow help with the SA900 HMRC form?

With airSlate SignNow, you can easily eSign and send the SA900 HMRC form electronically, streamlining the submission process. Our platform allows multiple users to collaborate on the document, ensuring that all necessary stakeholders can review and sign it in a timely manner. This reduces the risk of delays and improves compliance.

-

Is airSlate SignNow suitable for businesses looking to file the SA900 HMRC form?

Yes, airSlate SignNow is an ideal solution for businesses needing to file the SA900 HMRC form. The platform is user-friendly and designed to simplify the document signing process, making it easier for businesses to manage tax-related documents efficiently. Plus, it provides a secure environment to keep your sensitive information safe.

-

What are the pricing options available for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring it is cost-effective while managing your SA900 HMRC form and other documents. You can choose a monthly or annual subscription based on your usage. Additionally, we provide a free trial, so you can explore the features before committing.

-

Does airSlate SignNow integrate with other tools for easier management of the SA900 HMRC form?

Absolutely! airSlate SignNow integrates with various productivity and accounting tools, allowing for seamless management of the SA900 HMRC form. This integration ensures that all your data is synchronized across platforms, enhancing workflow efficiency and ensuring that critical documents are readily accessible.

-

What features does airSlate SignNow offer for drafting the SA900 HMRC form?

airSlate SignNow provides a range of features to help you draft the SA900 HMRC form, including templates, collaborative editing, and eSignature capabilities. These features facilitate smooth collaboration between partners and ensure that the completed form meets all HMRC requirements. You can also store and retrieve past forms for future reference.

-

How secure is my information when using airSlate SignNow for the SA900 HMRC form?

Security is a top priority at airSlate SignNow. When you use our platform to handle your SA900 HMRC form, your data is protected by advanced encryption and secure servers. We comply with industry standards to ensure that sensitive information remains confidential and secure throughout the signing process.

Get more for Sa900

- Community service log proviso mathematics science academy pmsa pths209 form

- Bsa annual charter agreement form

- Noc affidavit format 330744355

- Nj superior court answer form

- Tennessee valley authority schedule of rates and charges form

- Triwest authorization to disclose form

- Scroll down to complete form it 370 pf tax ny gov

- Evaluation of the maine historic rehabilitation tax credit form

Find out other Sa900

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online