Trust and Estate Tax Return Use Form SA900 to File a Tax Return for a Trust or Estate for the Tax Year Ended 5 April 2020

Understanding the Trust and Estate Tax Return

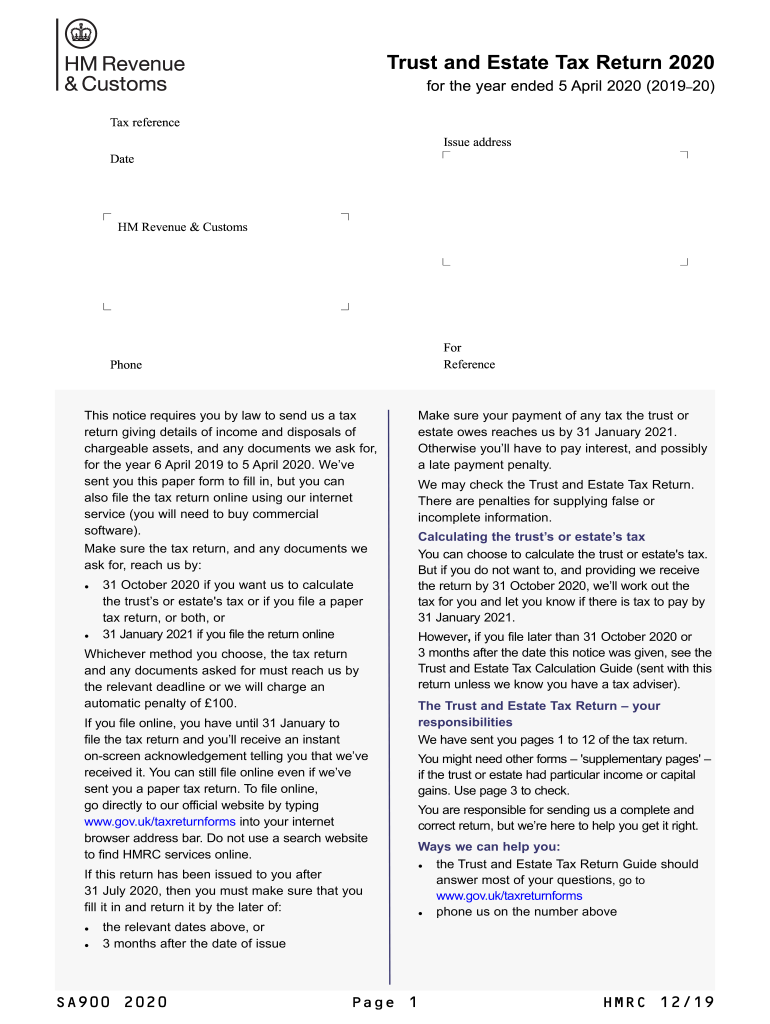

The SA900 tax return is specifically designed for trusts and estates in the United Kingdom. It is essential for reporting income and gains to HM Revenue and Customs (HMRC) for the tax year ending on April 5. This form is used by trustees or personal representatives of deceased estates to ensure compliance with tax obligations. Understanding its purpose is crucial for managing the financial responsibilities associated with trusts and estates.

Steps to Complete the Trust and Estate Tax Return

Filling out the SA900 tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to the trust or estate, including income sources and expenses. Next, complete the form by entering the relevant details in the specified sections, such as income, deductions, and distributions. It is important to double-check all entries for accuracy. Once completed, submit the form to HMRC by the specified deadline to avoid penalties.

Required Documents for the Trust and Estate Tax Return

To successfully complete the SA900 tax return, certain documents are required. These typically include financial statements for the trust or estate, records of income received, and any relevant tax documents. Additionally, documentation supporting deductions and expenses should be included to substantiate claims made on the return. Having these documents organized will streamline the filing process and ensure compliance with HMRC requirements.

Filing Deadlines and Important Dates

Timely submission of the SA900 tax return is critical to avoid penalties. The filing deadline for the tax return is usually set for January 31 following the end of the tax year on April 5. It is advisable to mark this date on your calendar to ensure that all necessary documentation is prepared and submitted on time. Late submissions may result in financial penalties and interest charges on any unpaid tax.

Legal Use of the Trust and Estate Tax Return

The SA900 tax return is legally binding and must be completed accurately to meet tax obligations. It is essential for trustees and personal representatives to understand the legal implications of the information provided on the form. Filing the return correctly ensures compliance with tax laws and regulations, protecting the interests of the beneficiaries and the estate itself.

Digital vs. Paper Version of the Trust and Estate Tax Return

When completing the SA900 tax return, individuals have the option to file either digitally or using a paper form. The digital version offers advantages such as faster processing times and easier tracking of submissions. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen method, ensuring that the form is filled out accurately is paramount for compliance.

Quick guide on how to complete trust and estate tax return 2020 use form sa9002020 to file a tax return for a trust or estate for the tax year ended 5 april

Complete Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools required to create, modify, and electronically sign your documents promptly without any holdups. Handle Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April without hassle

- Locate Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April and then click Get Form to initiate.

- Employ the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct trust and estate tax return 2020 use form sa9002020 to file a tax return for a trust or estate for the tax year ended 5 april

Create this form in 5 minutes!

How to create an eSignature for the trust and estate tax return 2020 use form sa9002020 to file a tax return for a trust or estate for the tax year ended 5 april

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is an SA900 tax return?

The SA900 tax return is a specific document required for partnerships and limited liability partnerships in the UK to report their income and gains. Completing the SA900 tax return accurately is essential for compliance with HMRC regulations. Using airSlate SignNow can streamline the eSigning and submission process, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow help with the SA900 tax return process?

airSlate SignNow offers a user-friendly platform to digitally sign and manage documents, such as the SA900 tax return. This service minimizes the hassle of paper documents by providing secure electronic signatures and storage. As a result, businesses can expedite the filing process while maintaining compliance with tax regulations.

-

What features does airSlate SignNow offer for handling tax documents like the SA900?

airSlate SignNow provides features such as document templates, customizable workflows, and integration with cloud storage. These tools simplify the creation and management of tax documents, including the SA900 tax return. Additionally, advanced security measures ensure that your sensitive tax information is protected during the signing process.

-

Is airSlate SignNow cost-effective for filing the SA900 tax return?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the SA900 tax return. The service eliminates the need for expensive paper document management solutions by offering competitive pricing plans. Companies can save time and resources while ensuring compliance with their tax obligations, making it a beneficial investment.

-

Can airSlate SignNow integrate with other accounting software for filing the SA900 tax return?

Absolutely! airSlate SignNow offers integration capabilities with various accounting software, which can enhance the process of filing the SA900 tax return. This integration allows for seamless data transfer, reducing the chances of errors and improving efficiency. By using both tools together, businesses can streamline their tax preparation workflow.

-

What security measures does airSlate SignNow have for handling the SA900 tax return?

airSlate SignNow employs robust security measures, including end-to-end encryption and secure storage, to protect sensitive information such as the SA900 tax return. This ensures that your business’s financial data is kept safe from unauthorized access. The platform also complies with global data protection regulations, offering peace of mind during the signing process.

-

How can I get started with airSlate SignNow for my SA900 tax return?

Getting started with airSlate SignNow is easy. Simply sign up for an account on their website, choose a pricing plan that fits your needs, and start uploading your documents like the SA900 tax return. The intuitive interface and helpful resources available will guide you through the setup process efficiently.

Get more for Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April

- Makeup artist waiver form fill and sign printable template online

- Pediatric intake form template fill online printable fillable

- Adult psychological assessment intake doc form

- Editable first aid kit monthly checklist template form

- Suspect profile template form

- Spay or neuter surgery for pets miami dade county form

- Toronto police civilian personal history form

- Generic email account information change

Find out other Trust And Estate Tax Return Use Form SA900 To File A Tax Return For A Trust Or Estate For The Tax Year Ended 5 April

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe