Mv349 1 Form 2015

What is the Mv349 1 Form

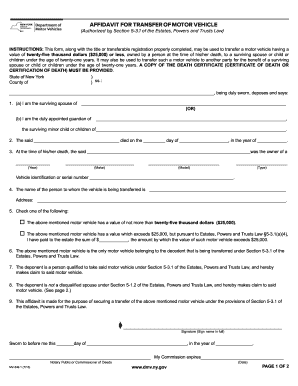

The Mv349 1 Form is a specific document used in the United States for the registration and transfer of motor vehicles. This form is essential for individuals and businesses engaged in buying, selling, or transferring ownership of vehicles. It captures vital information about the vehicle, including its identification number, make, model, and year, as well as details about the buyer and seller. Proper completion of this form ensures compliance with state regulations and facilitates a smooth transition of vehicle ownership.

How to use the Mv349 1 Form

To use the Mv349 1 Form effectively, start by gathering all necessary information about the vehicle and the parties involved in the transaction. This includes the vehicle's title, identification number, and odometer reading. Both the buyer and seller must complete their respective sections of the form, ensuring all fields are filled accurately. Once completed, the form should be signed by both parties to validate the transaction. It is advisable to keep a copy of the signed form for personal records.

Steps to complete the Mv349 1 Form

Completing the Mv349 1 Form involves a series of straightforward steps:

- Gather necessary documents, including the vehicle title and identification.

- Fill in the vehicle details, including make, model, year, and VIN.

- Provide the buyer's and seller's information, including names and addresses.

- Record the odometer reading at the time of sale.

- Sign and date the form to validate the transaction.

- Make copies for both parties for their records.

Legal use of the Mv349 1 Form

The legal use of the Mv349 1 Form is crucial for ensuring that vehicle ownership is transferred in accordance with state laws. This form serves as a legal document that proves the sale or transfer of the vehicle, protecting both the buyer and seller. It is important to ensure that the form is filled out completely and accurately, as any discrepancies can lead to legal complications or disputes over ownership. Additionally, retaining a copy of the completed form can provide evidence of the transaction if needed in the future.

State-specific rules for the Mv349 1 Form

Each state in the U.S. may have specific rules and requirements regarding the Mv349 1 Form. These can include variations in the form itself, additional information that must be provided, or specific filing procedures. It is essential for users to familiarize themselves with their state's regulations to ensure compliance. Checking with the local Department of Motor Vehicles (DMV) or equivalent authority can provide clarity on any state-specific requirements that must be met when using the Mv349 1 Form.

Form Submission Methods

The Mv349 1 Form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s DMV website.

- Mailing the completed form to the appropriate DMV office.

- In-person submission at a local DMV office.

Each method may have different processing times and requirements, so it is advisable to check the specific guidelines provided by the state DMV.

Quick guide on how to complete mv349 1 2015 form

Simplify your life by completing Mv349 1 Form with airSlate SignNow

Whether you need to title a new vehicle, apply for a driver’s license, transfer ownership, or handle any other task associated with motor vehicles, navigating such RMV forms as Mv349 1 Form is a necessary hassle.

There are various methods to obtain them: by mail, at the RMV service center, or by downloading them online from your local RMV website and printing them. Each of these options can be time-consuming. If you’re seeking a quicker way to fill them out and endorse them with a legally-binding eSignature, airSlate SignNow is the optimal solution.

How to complete Mv349 1 Form effortlessly

- Click on Show details to view a brief summary of the document you are interested in.

- Select Get document to begin and open the document.

- Follow the green tag indicating the required fields if applicable to you.

- Utilize the top toolbar and employ our professional functionality set to adjust, annotate, and enhance your document's appearance.

- Add text, your initials, shapes, images, and other elements.

- Click Sign in within the same toolbar to create a legally-binding eSignature.

- Review the document content to ensure it’s devoid of mistakes and inconsistencies.

- Select Done to finalize document processing.

Utilizing our platform to complete your Mv349 1 Form and other related forms will save you considerable time and hassle. Enhance your RMV document execution process from the very beginning!

Create this form in 5 minutes or less

Find and fill out the correct mv349 1 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the mv349 1 2015 form

How to make an eSignature for your Mv349 1 2015 Form in the online mode

How to create an electronic signature for the Mv349 1 2015 Form in Chrome

How to create an electronic signature for signing the Mv349 1 2015 Form in Gmail

How to make an eSignature for the Mv349 1 2015 Form straight from your smartphone

How to create an electronic signature for the Mv349 1 2015 Form on iOS devices

How to create an electronic signature for the Mv349 1 2015 Form on Android devices

People also ask

-

What is the Mv349 1 Form and how is it used?

The Mv349 1 Form is a crucial document used for vehicle registration and title transfer in certain jurisdictions. It streamlines the process of documenting vehicle ownership and ensures compliance with local regulations. By utilizing the Mv349 1 Form, businesses and individuals can facilitate smoother transactions related to vehicle ownership.

-

How can airSlate SignNow help with the Mv349 1 Form?

airSlate SignNow provides an efficient platform to electronically sign and send the Mv349 1 Form. With our user-friendly interface, you can easily fill out the form, obtain signatures, and store it securely online, making the entire process faster and more reliable. This eliminates the hassle of printing and mailing documents.

-

Is there a cost associated with using airSlate SignNow for the Mv349 1 Form?

Yes, while airSlate SignNow offers competitive pricing options, the cost may vary based on your specific needs and the number of users. We provide a range of plans that cater to different business sizes, allowing you to choose the best option for processing documents like the Mv349 1 Form. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the Mv349 1 Form?

airSlate SignNow offers a variety of features to enhance your experience with the Mv349 1 Form, including customizable templates, real-time tracking, and secure cloud storage. These features ensure that you can manage the signing process efficiently while maintaining compliance and security. Additionally, bulk sending capabilities allow for easy handling of multiple forms.

-

Can I integrate airSlate SignNow with other software for the Mv349 1 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage the Mv349 1 Form alongside your existing workflows. Integrations with CRM systems, document management tools, and cloud storage services enhance productivity and streamline document handling processes.

-

What are the benefits of using airSlate SignNow for the Mv349 1 Form?

Using airSlate SignNow for the Mv349 1 Form offers numerous benefits including increased efficiency, reduced turnaround time, and enhanced security. By digitizing the signing process, you can eliminate paperwork and ensure that your documents are always accessible. This not only saves time but also reduces the risk of errors associated with manual handling.

-

How secure is the airSlate SignNow platform for handling the Mv349 1 Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption methods and complies with industry standards to protect your Mv349 1 Form and other sensitive documents. You can confidently store and send your forms, knowing they are safeguarded against unauthorized access.

Get more for Mv349 1 Form

- Bws honolulu test forms for bfpa

- Manulife gp5232 form

- Af form 1299

- Ibew local 617 re sign bformb submit this bformb by pressing bb

- Application for direct trustee to trustee transfer non taxable rs5531 n to request the direct transfer of a deceased nyslrs form

- Penn yan substitute teacher preference form

- Title insurance agency application tennessee form

- Nonprofit lease agreement template form

Find out other Mv349 1 Form

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free