T2short 2019

What is the T2short

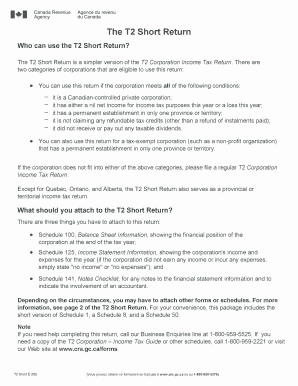

The T2short is a simplified version of the T2 corporate income tax return, designed for Canadian-controlled private corporations (CCPCs) with straightforward tax situations. This form allows eligible businesses to report their income, deductions, and tax credits in a more efficient manner. The T2short is particularly beneficial for small businesses, as it streamlines the filing process while ensuring compliance with Canadian tax laws.

How to use the T2short

To use the T2short, businesses must first determine their eligibility based on specific criteria, such as total income and the nature of their operations. Once confirmed, the corporation can fill out the form, providing necessary financial information, including total revenue, expenses, and applicable tax credits. It is essential to ensure that all figures are accurate to avoid potential penalties. After completing the form, it can be submitted electronically or via mail to the Canada Revenue Agency (CRA).

Steps to complete the T2short

Completing the T2short involves several key steps:

- Gather all financial records, including income statements and expense reports.

- Determine eligibility for the T2short based on income thresholds and business type.

- Fill out the form accurately, entering all required financial data.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the CRA's online platform or mail it to the appropriate address.

Legal use of the T2short

The T2short must be used in accordance with Canadian tax regulations. Corporations must ensure that they meet all eligibility requirements and file the form by the deadline to avoid penalties. Misuse of the form, such as submitting inaccurate information or failing to file, can lead to legal repercussions, including fines and increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the T2short are crucial for compliance. Corporations typically must file their T2short within six months of the end of their fiscal year. It is important to mark these dates on the calendar to ensure timely submission. Late filings can result in penalties and interest on any outstanding taxes owed, emphasizing the need for careful planning and adherence to deadlines.

Required Documents

To complete the T2short, several documents are necessary, including:

- Financial statements detailing income and expenses.

- Records of any tax credits claimed.

- Documentation supporting deductions, such as receipts and invoices.

- Previous tax returns for reference and accuracy.

Who Issues the Form

The T2short is issued by the Canada Revenue Agency (CRA), which is responsible for administering tax laws for the Government of Canada. The CRA provides guidance on how to complete the form and ensures that it aligns with current tax legislation. Businesses can access the T2short and related resources directly through the CRA's official website.

Quick guide on how to complete t2short

Effortlessly Prepare T2short on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage T2short on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign T2short with minimal effort

- Obtain T2short and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign T2short to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2short

Create this form in 5 minutes!

How to create an eSignature for the t2short

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t2short and how does it benefit my business?

t2short is an innovative feature of airSlate SignNow that streamlines the document signing process. By using t2short, businesses can enhance efficiency and reduce turnaround times for important documents. This feature is designed to simplify workflows, making it easier for teams to collaborate and finalize agreements quickly.

-

How much does airSlate SignNow with t2short cost?

The pricing for airSlate SignNow with t2short is competitive and designed to fit various business needs. We offer flexible plans that cater to different team sizes and usage levels. You can choose a plan that best suits your budget while still benefiting from the powerful features of t2short.

-

What features does t2short include?

t2short includes a range of features designed to enhance document management and eSigning. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities ensure that your documents are handled efficiently and securely, making t2short an essential tool for any business.

-

Can I integrate t2short with other software?

Yes, t2short seamlessly integrates with various software applications, enhancing your existing workflows. Whether you use CRM systems, project management tools, or other business applications, t2short can connect and streamline your processes. This integration capability makes it easier to manage documents across different platforms.

-

Is t2short suitable for small businesses?

Absolutely! t2short is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. With its straightforward interface and powerful features, small teams can efficiently manage their document signing needs without the complexity of larger systems. t2short empowers small businesses to operate more effectively.

-

How secure is the t2short eSigning process?

The t2short eSigning process is highly secure, utilizing advanced encryption and authentication methods. airSlate SignNow ensures that all documents signed through t2short are protected against unauthorized access. You can trust that your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using t2short for document management?

Using t2short for document management offers numerous benefits, including increased efficiency and reduced paper usage. By digitizing the signing process, businesses can save time and resources while improving collaboration. t2short also helps in maintaining a clear audit trail, ensuring compliance and accountability.

Get more for T2short

- Recruitment worksheet usgs usgs form

- Authority for release of information nsa

- Mobile food amp shower service request form national interagency nifc

- Sba 641 intake form

- Gsa 873a annual attendance record part time employees 2020 form

- Property pass form

- Standard form 186 federal write in absentee ballot fwab

- Optional form 873 annual attendance record clients 2020

Find out other T2short

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe