Ct 3m 2023

Understanding the CT 3M Form

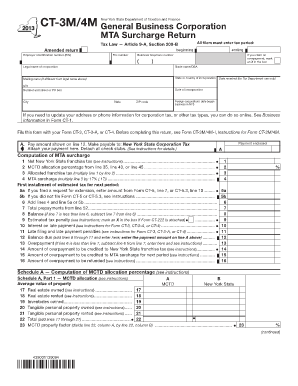

The CT 3M form is a tax document used primarily by businesses in the United States to report their income, deductions, and credits. This form is essential for corporations and partnerships, providing a comprehensive overview of their financial activities for the tax year. By accurately completing the CT 3M, businesses can ensure compliance with federal tax regulations while optimizing their tax liabilities.

Steps to Complete the CT 3M Form

Completing the CT 3M form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the identification section, providing details about the business entity, such as name, address, and Employer Identification Number (EIN).

- Report total income, including all revenue streams, and account for any deductions applicable to the business.

- Calculate credits and taxes owed based on the information provided.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal Use of the CT 3M Form

The CT 3M form serves a legal purpose in the tax reporting process. It is crucial for businesses to file this form accurately to avoid potential legal issues with the Internal Revenue Service (IRS). Failing to file or providing incorrect information can lead to penalties, audits, or other legal repercussions. Therefore, understanding the legal implications of the CT 3M is vital for compliance.

Filing Deadlines for the CT 3M Form

Businesses must adhere to specific filing deadlines for the CT 3M form. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes to these deadlines to ensure timely submission and avoid penalties.

Required Documents for the CT 3M Form

To complete the CT 3M form accurately, several documents are required:

- Income statements detailing all revenue generated during the tax year.

- Expense reports that outline all business-related expenditures.

- Previous tax returns for reference and consistency.

- Any supporting documentation for deductions and credits claimed.

Examples of Using the CT 3M Form

The CT 3M form is commonly used by various types of businesses. For instance, a small LLC may use the form to report its annual income and expenses, while a larger corporation may utilize it to account for multiple revenue streams and complex deductions. Each example highlights the form's flexibility and importance in ensuring accurate tax reporting across different business structures.

Quick guide on how to complete ct 3m

Complete Ct 3m effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Ct 3m on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Ct 3m without effort

- Locate Ct 3m and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you choose. Modify and eSign Ct 3m to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3m

Create this form in 5 minutes!

How to create an eSignature for the ct 3m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 3m in relation to airSlate SignNow?

CT 3M refers to a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How does airSlate SignNow's ct 3m feature improve document signing?

The ct 3m feature in airSlate SignNow simplifies the document signing process by providing a user-friendly interface and automated workflows. This ensures that users can quickly send documents for eSignature, reducing turnaround time and improving overall productivity.

-

What are the pricing options for airSlate SignNow with ct 3m?

airSlate SignNow offers various pricing plans that include access to the ct 3m feature. These plans are designed to cater to businesses of all sizes, ensuring that you can find a cost-effective solution that meets your needs without compromising on functionality.

-

Can I integrate airSlate SignNow's ct 3m with other applications?

Yes, airSlate SignNow's ct 3m feature supports integrations with a variety of applications, enhancing your workflow. This allows you to connect with tools you already use, making it easier to manage documents and eSignatures seamlessly.

-

What benefits does ct 3m provide for businesses?

The ct 3m feature in airSlate SignNow offers numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. By utilizing this feature, businesses can enhance their document management processes and focus on core activities.

-

Is airSlate SignNow's ct 3m secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security, and the ct 3m feature is designed to protect sensitive documents. With advanced encryption and compliance with industry standards, you can trust that your documents are safe during the signing process.

-

How can I get started with airSlate SignNow's ct 3m feature?

Getting started with airSlate SignNow's ct 3m feature is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and you can begin sending and signing documents right away, leveraging the full capabilities of ct 3m.

Get more for Ct 3m

- Nj self exclusion removal list form

- H cop form

- A 901 application form

- New jersey state parole board internship program application form

- New jersey internship state parole board form

- Nevada state contractors board corporate indemnification agreement form

- Nevada indemnification form

- Aa sign in sheetdoc douglascountynv form

Find out other Ct 3m

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA