WPB City of West Palm Beach Departments 2016-2026

Key elements of the tax rental application form

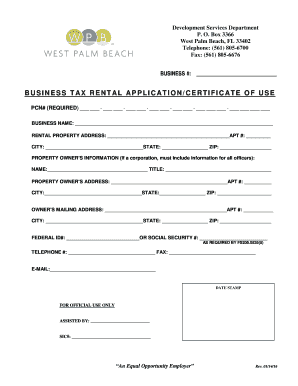

The tax rental application form is essential for businesses operating in West Palm Beach. It typically includes several key elements that must be accurately filled out to ensure compliance with local regulations. Important sections often include:

- Business Information: This section requires details such as the business name, address, and contact information.

- Owner Information: Applicants must provide personal details of the business owner, including name, address, and social security number or tax identification number.

- Property Details: This includes the physical address of the rental property, type of rental, and the number of units available.

- Tax Identification: Businesses must provide their tax identification number to ensure proper tax reporting.

- Signature: A signature from the business owner or authorized representative is necessary to validate the application.

Steps to complete the tax rental application form

Completing the tax rental application form involves several straightforward steps to ensure all required information is accurately submitted. Here are the steps to follow:

- Gather Required Information: Collect all necessary documents, including identification and proof of business registration.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all information is accurate and up to date.

- Review the Application: Double-check all entries for accuracy, including names, addresses, and identification numbers.

- Sign the Form: Ensure that the application is signed by the appropriate individual, confirming the accuracy of the information provided.

- Submit the Application: Choose your submission method, whether online, by mail, or in person, and ensure it is sent to the correct department.

Required documents for the tax rental application

When submitting the tax rental application form, certain documents are typically required to support the application. These documents may include:

- Proof of Business Registration: This could be a copy of the business license or registration documents.

- Identification: Personal identification for the business owner, such as a driver's license or passport.

- Tax Identification Number: A document that verifies the business's tax identification number.

- Lease Agreement: If applicable, a copy of the lease agreement for the rental property may be required.

- Financial Statements: Some applications may require recent financial statements to assess business viability.

Form submission methods for the tax rental application

Businesses have several options for submitting the tax rental application form, each with its own advantages. The common submission methods include:

- Online Submission: Many jurisdictions allow for electronic submission through their official websites, providing a quick and efficient way to submit forms.

- Mail Submission: Applications can be printed and mailed to the appropriate department, ensuring that all documents are included.

- In-Person Submission: Applicants may also choose to submit the form in person at designated offices, allowing for immediate confirmation of receipt.

Eligibility criteria for the tax rental application

Understanding the eligibility criteria for the tax rental application is crucial for a successful submission. Generally, the following criteria must be met:

- Business Type: The applicant must operate a legitimate business that meets local zoning regulations.

- Property Ownership: The applicant must either own the rental property or have a legal agreement allowing them to rent it.

- Tax Compliance: The business must be in good standing with local tax authorities, with no outstanding tax obligations.

- Application Timeliness: Applications should be submitted within the designated timeframe to avoid penalties.

Legal use of the tax rental application form

The tax rental application form serves a legal purpose in the context of business operations in West Palm Beach. It is important to understand the legal implications associated with this form:

- Compliance with Local Laws: Completing the form correctly ensures that businesses comply with local tax regulations and avoid potential fines.

- Record Keeping: The submitted form becomes part of the official business records, which may be reviewed during audits or inspections.

- Tax Liability: Accurate information on the form helps determine the appropriate tax liability for the business, ensuring fair taxation.

- Legal Protection: Properly completing and submitting the application can protect the business from legal challenges related to tax compliance.

Quick guide on how to complete wpb city of west palm beach departments

Control WPB City Of West Palm Beach Departments from any location at any time

Your daily business activities may require additional attention when managing state-specific business documentation. Reclaim your office time and reduce the costs associated with paper-based processes with airSlate SignNow. airSlate SignNow provides you with a variety of pre-uploaded business documents, including WPB City Of West Palm Beach Departments, that you can utilize and share with your business associates. Organize your WPB City Of West Palm Beach Departments effortlessly with powerful editing and eSignature functionalities and send it directly to your intended recipients.

Steps to obtain WPB City Of West Palm Beach Departments in just a few clicks:

- Choose a form pertinent to your state.

- Click on Learn More to access the document and verify its accuracy.

- Select Get Form to begin processing it.

- WPB City Of West Palm Beach Departments will instantly appear within the editor. No additional steps are necessary.

- Utilize airSlate SignNow’s sophisticated editing features to complete or modify the form.

- Opt for the Sign feature to create your signature and eSign your document.

- When finished, click on Done, save your modifications, and access your document.

- Share the form via email or SMS, or employ a link-to-fill option with your collaborators or allow them to download the document.

airSlate SignNow signNowly conserves your time managing WPB City Of West Palm Beach Departments and enables you to find essential documents in one place. A comprehensive collection of forms is categorized and tailored to address critical business processes necessary for your organization. The advanced editor reduces the likelihood of errors, as you can easily amend mistakes and review your documents on any device before sending them out. Start your free trial now to discover all the advantages of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

Find and fill out the correct wpb city of west palm beach departments

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Can you name a cheap MRI center in West Palm Beach, Florida? I need to get a basic MRI done, insurance high deductible so all costs are out of pocket.

Do what insurance companies do on a larger scale.Go in person to the MRI center closest to you with a prescription for the MRI that you need. Ask to speak with the manager and explain that you want to pay cash for the study. You should get a discounted cash price and you should be able to negotiate it down further. Schedule that scan.Then take that price to another MRI center and see if they can do better than that. If you're paying cash, then let free market principles help you.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the wpb city of west palm beach departments

How to generate an electronic signature for your Wpb City Of West Palm Beach Departments in the online mode

How to generate an eSignature for your Wpb City Of West Palm Beach Departments in Google Chrome

How to make an electronic signature for signing the Wpb City Of West Palm Beach Departments in Gmail

How to make an electronic signature for the Wpb City Of West Palm Beach Departments right from your smart phone

How to create an eSignature for the Wpb City Of West Palm Beach Departments on iOS devices

How to create an electronic signature for the Wpb City Of West Palm Beach Departments on Android

People also ask

-

What is the wpb business application and how does it work?

The wpb business application provided by airSlate SignNow is a comprehensive solution designed for businesses to efficiently manage document signing and workflows. It simplifies the process of sending, signing, and storing essential documents securely online, enabling teams to collaborate seamlessly. With its user-friendly interface, even those with minimal tech experience can utilize its features effectively.

-

How much does the wpb business application cost?

The cost of the wpb business application varies depending on the scale of your business and the specific features you require. airSlate SignNow offers flexible pricing plans that cater to different business sizes, ensuring you get value for your expenditure. To get an accurate quote, it's best to contact the sales team or visit the pricing page.

-

What features are included in the wpb business application?

The wpb business application includes key features such as customizable templates, real-time tracking of document status, and advanced security measures. Additionally, it supports in-person signing and offers integration with popular apps to enhance your business operations. This makes it a versatile tool that can adapt to various business needs.

-

How can the wpb business application benefit my business?

By using the wpb business application, your business can streamline its document management processes, resulting in faster turnaround times and enhanced productivity. The platform also reduces paper usage, helping you to save costs and contribute to environmental sustainability. Furthermore, it provides a professional image to clients through seamless digital interactions.

-

Can the wpb business application be integrated with other software?

Yes, the wpb business application seamlessly integrates with various third-party applications such as CRM systems, project management tools, and cloud storage services. This allows you to optimize your existing workflows and maintain a cohesive operational ecosystem. Integration is simple, ensuring that you can connect tools without disrupting your processes.

-

Is the wpb business application secure for storing sensitive documents?

Absolutely, the wpb business application prioritizes security with features such as data encryption, secure access controls, and compliance with industry standards. Your sensitive documents are protected throughout the signing process, providing peace of mind. Regular updates ensure that security measures remain effective against evolving threats.

-

Can I try the wpb business application before committing?

Yes, airSlate SignNow offers a free trial for the wpb business application, allowing you to explore its features and assess its suitability for your needs. This trial period gives you an opportunity to experience the benefits firsthand without making an immediate financial commitment. Sign up on the website to start your free trial.

Get more for WPB City Of West Palm Beach Departments

- Penske truck rental moving truck rentals form

- Waiver quitclaim form

- Notice of exclusion from calpers membership form

- Form 8857 rev december internal revenue service

- Ein confirmation letter pdf fill online printable form

- Rockview university ru zambia online application forms

- Form 5532 gender designation change request form missouri dor mo

- Form 430 1 mcps

Find out other WPB City Of West Palm Beach Departments

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF