Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM 2017

What is the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

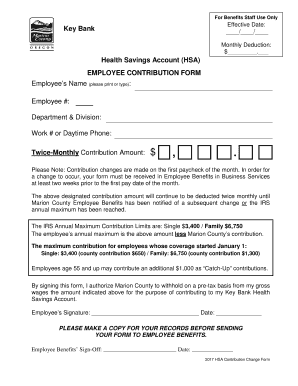

The Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM is a document used by employees to designate their contributions to a Health Savings Account (HSA). HSAs are tax-advantaged accounts that allow individuals to save for medical expenses. This form typically includes essential information such as the employee's name, Social Security number, and the amount they wish to contribute. By completing this form, employees can ensure that their contributions are accurately processed and recorded by their employer.

How to use the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

Using the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM involves several straightforward steps. First, employees should obtain the form from their employer or HR department. Next, they need to fill in their personal information, including their name and Social Security number. After that, they should specify the contribution amount they wish to make. Once completed, the form should be submitted to the employer for processing. It is important to keep a copy for personal records.

Steps to complete the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

Completing the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM involves the following steps:

- Obtain the form from your employer or HR department.

- Fill in your personal details, including your full name and Social Security number.

- Indicate the amount you wish to contribute to your HSA.

- Review the form for accuracy and completeness.

- Submit the form to your employer or HR department.

Key elements of the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

The key elements of the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM include:

- Employee Information: This section requires personal details such as name and Social Security number.

- Contribution Amount: Employees must specify how much they wish to contribute to their HSA.

- Employer Information: Some forms may require details about the employer or plan sponsor.

- Signature: A signature may be required to validate the form and authorize the contributions.

Legal use of the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

The Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM is legally binding once signed by the employee. It authorizes the employer to deduct the specified contribution amount from the employee's paycheck and deposit it into their HSA. Compliance with IRS regulations is essential, as contributions must not exceed annual limits set by the IRS. Employers are responsible for ensuring that contributions are processed correctly and reported for tax purposes.

IRS Guidelines

The IRS provides specific guidelines regarding Health Savings Accounts, including contribution limits and eligibility criteria. For the tax year, the maximum contribution limits are adjusted annually. Employees should consult the IRS guidelines to ensure their contributions comply with these limits. Additionally, it is important to understand the tax benefits associated with HSAs, such as tax-deductible contributions and tax-free withdrawals for qualified medical expenses.

Quick guide on how to complete health savings account hsa employee contribution form

Effortlessly Prepare Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM on Any Device

Digital document management has become a favored choice among companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly with no delays. Manage Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM with Ease

- Find Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the document or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct health savings account hsa employee contribution form

Create this form in 5 minutes!

How to create an eSignature for the health savings account hsa employee contribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM?

The Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM is a document that allows employees to specify their contributions to their Health Savings Account. This form is essential for managing contributions and ensuring compliance with IRS regulations regarding HSAs.

-

How can I access the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM?

You can easily access the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM through our airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and download or fill out the form directly online.

-

What are the benefits of using the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM?

Using the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM streamlines the contribution process for both employees and employers. It helps in tracking contributions accurately, ensuring that employees maximize their tax benefits while maintaining compliance with HSA regulations.

-

Is there a cost associated with the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM?

The Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM is available at no additional cost when you use the airSlate SignNow platform. Our solution is designed to be cost-effective, allowing businesses to manage their HSA contributions without incurring extra fees.

-

Can the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM be integrated with other software?

Yes, the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM can be easily integrated with various HR and payroll software. This integration ensures seamless data transfer and helps maintain accurate records of employee contributions.

-

How does the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM ensure compliance?

The Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM is designed to comply with IRS regulations. By using this form, employers can ensure that employee contributions are accurately recorded and reported, minimizing the risk of compliance issues.

-

What features does the airSlate SignNow platform offer for the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM?

The airSlate SignNow platform offers features such as electronic signatures, document tracking, and customizable templates for the Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM. These features enhance efficiency and simplify the contribution process for both employees and employers.

Get more for Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

Find out other Health Savings Account HSA EMPLOYEE CONTRIBUTION FORM

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast